- United States

- /

- Hospitality

- /

- OTCPK:LKNC.Y

Should Investors Reconsider Luckin Coffee After 68% Price Surge and Rapid Store Expansion?

Reviewed by Bailey Pemberton

- Thinking of diving into Luckin Coffee stock and pondering whether it is a bargain or overhyped? You are not alone, as investors everywhere are curious about its true value.

- The share price has been on quite a ride, boasting a huge 694.8% gain over five years and up 68.4% in the past year. However, it dipped 8.4% over the last month.

- Recently, headlines have focused on Luckin’s rapid store expansion and partnerships that aim to capture more of the Chinese coffee market. Additionally, continued buzz around brand collaborations and product innovations has fueled investor excitement, adding energy to the growing narrative behind recent price moves.

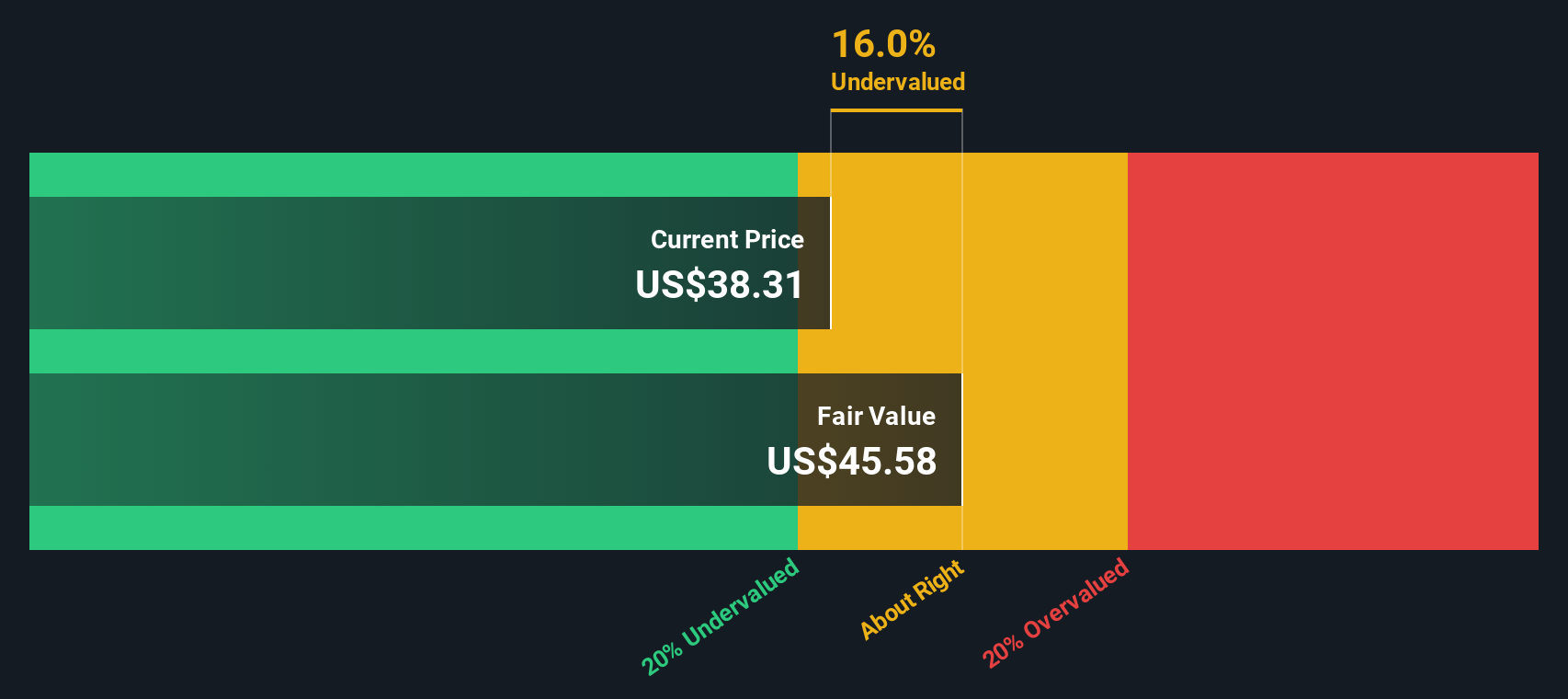

- On our valuation check, Luckin Coffee scores 3 out of 6. This means it looks undervalued by half of our tested metrics. Next, we will unpack how these valuation scores are determined and, by the end, reveal a smarter approach to understanding what the company might truly be worth.

Approach 1: Luckin Coffee Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's worth by projecting how much cash it will generate in the future, then discounting those values back to their value today. This approach aims to cut through market hype by focusing on underlying financial performance.

For Luckin Coffee, recent data shows the company generated about CN¥4.39 Billion in free cash flow over the last twelve months. Analyst forecasts extend to 2027, projecting free cash flow to rise to roughly CN¥4.48 Billion. After that, additional years are extrapolated, bringing expected free cash flow for 2035 up to approximately CN¥5.29 Billion. These long-term projections are based on current performance and expectations for stable growth in the Chinese coffee market.

According to this DCF model, the estimated intrinsic value of Luckin Coffee is $29.39 per share. At current prices, this suggests the stock is around 25.2% overvalued based on its projected cash flows.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Luckin Coffee may be overvalued by 25.2%. Discover 909 undervalued stocks or create your own screener to find better value opportunities.

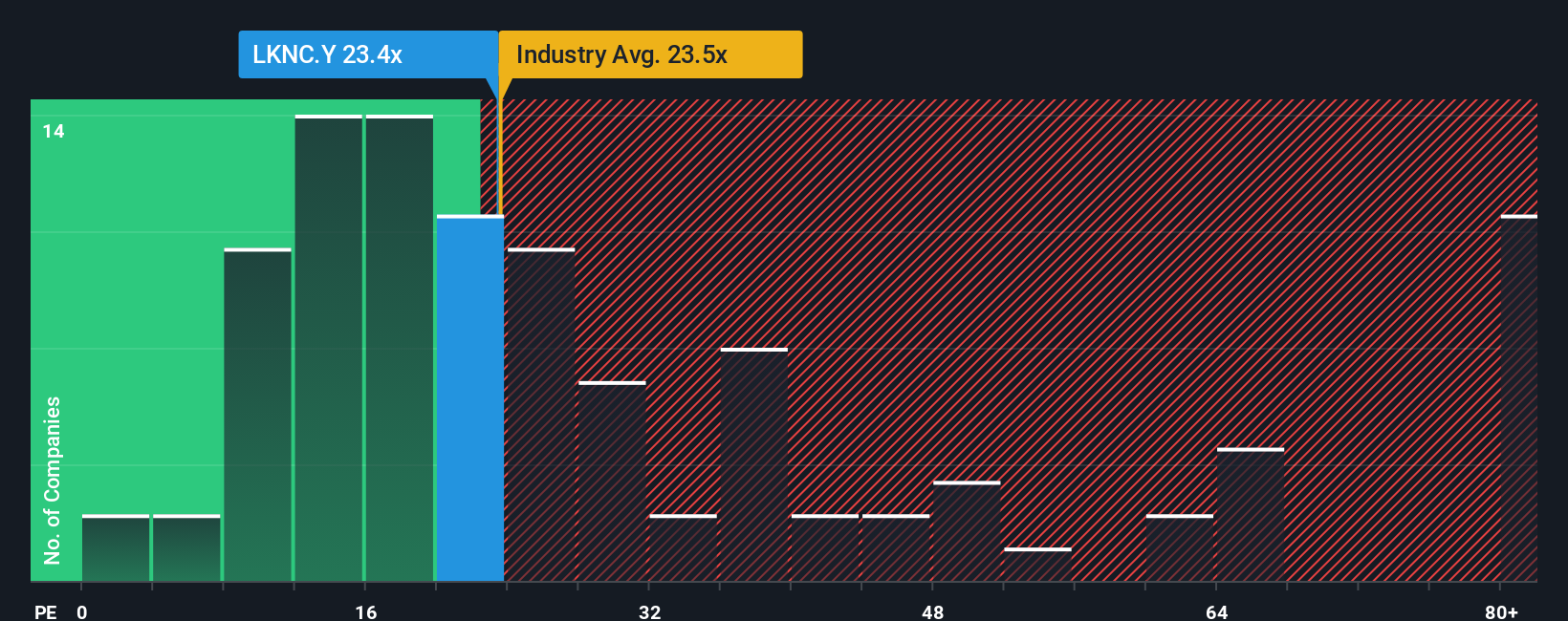

Approach 2: Luckin Coffee Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies because it relates a company’s stock price to its earnings. A reasonable PE ratio can help investors understand whether a stock is expensive or attractively priced compared to its profitability.

Growth expectations and perceived risk are key factors in setting a “normal” or “fair” PE ratio. Higher growth potential or lower risk generally justify higher PE multiples, while slower growth or elevated risks often result in lower ones.

Currently, Luckin Coffee trades at a PE ratio of 21.46x. Compared to the hospitality industry average of 20.74x and the average of its closest peers at 48.66x, Luckin sits just slightly above the industry norm but well below high-flying rivals.

Simply Wall St’s proprietary “Fair Ratio” model aims to provide a more precise benchmark by capturing specifics such as Luckin’s earnings growth outlook, profit margin, market cap, and unique industry factors. This tailored approach is generally more informative than simply checking peer or industry averages, which can miss company-specific strengths or risks.

Luckin Coffee’s calculated Fair Ratio is 28.80x, noticeably above its current PE of 21.46x. This suggests that, based on company specifics and the broader context, the shares could be undervalued at today’s price.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1423 companies where insiders are betting big on explosive growth.

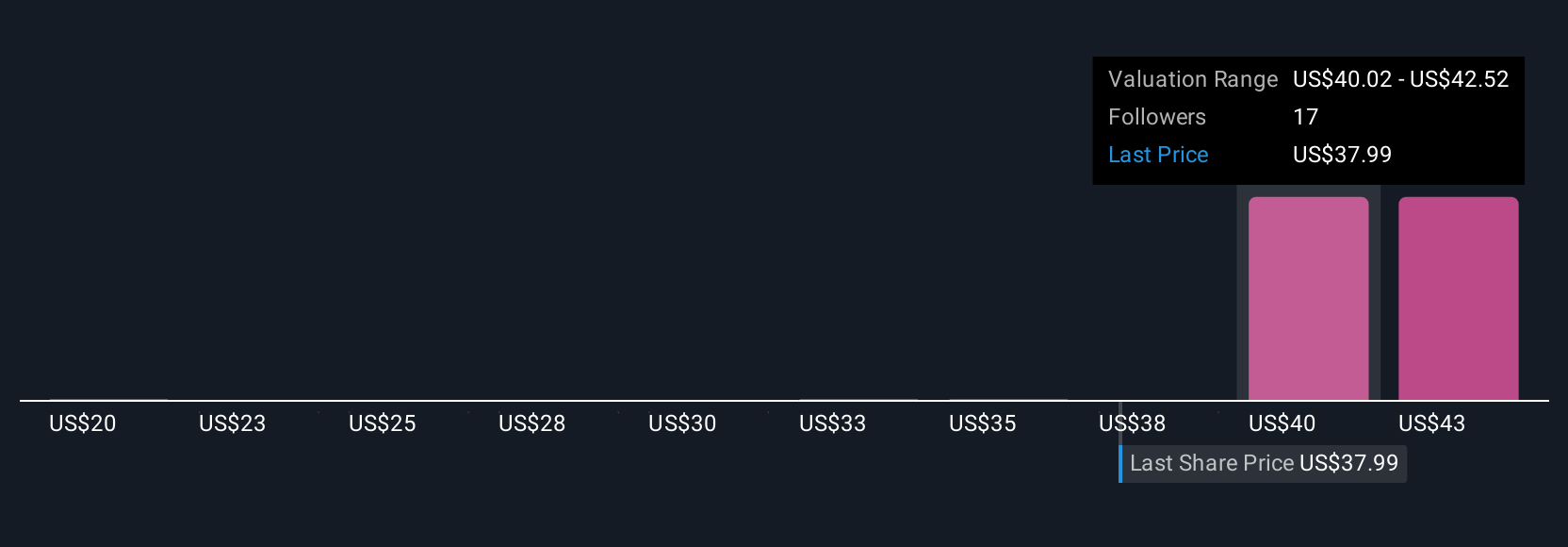

Upgrade Your Decision Making: Choose your Luckin Coffee Narrative

Earlier, we mentioned there is an even better way to understand valuation. Let’s introduce you to Narratives, a smarter, more dynamic approach now available on Simply Wall St’s Community page.

A Narrative is your own story behind the numbers: you set your assumptions for Luckin Coffee’s future revenue, earnings, and margins based on what you believe will happen, and those expectations generate a personal Fair Value for the stock.

This approach ties together a company’s story and outlook, your financial forecasts, and a tailored estimate of fair value in one place, so you can decide with greater confidence when a share is overvalued or undervalued compared to the current price.

Narratives are both simple and powerful, designed to be accessible for all investors, and they update automatically when news or earnings are announced, so your analysis is always current.

For example, some investors believe Luckin’s rapid store expansion and digital focus could sustain high growth, giving them a higher Fair Value (as optimistic as $48.24 per share). Others may weigh competitive pressures and margin risks more heavily, setting a much lower estimate (bearish views are as low as $45.61 per share).

No matter your perspective, Narratives help you see how your assumptions stack up, compare with others, and make decisions based on more than just ratios or headlines.

Do you think there's more to the story for Luckin Coffee? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:LKNC.Y

Luckin Coffee

Offers retail services of freshly brewed drinks, and pre-made food and beverage items in the People's Republic of China.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives