- United States

- /

- Hospitality

- /

- OTCPK:LKNC.Y

Does Luckin Coffee's (LKNC.Y) Revenue Surge Reveal a Sustainable Edge in China’s Coffee Market?

Reviewed by Sasha Jovanovic

- Luckin Coffee Inc. recently announced its third-quarter and nine-month earnings for 2025, highlighting revenue increases to CNY15.29 billion and CNY36.51 billion, respectively, alongside higher net income for the nine-month period compared to the previous year.

- This performance points to Luckin Coffee's continued business expansion and operational gains, amid a highly competitive Chinese coffee market.

- We'll examine how this strong nine-month revenue growth informs Luckin Coffee's evolving investment story and future market position.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Luckin Coffee Investment Narrative Recap

To be a shareholder in Luckin Coffee, you need to believe in the company’s ability to sustain rapid growth through its aggressive store rollout and digital-driven customer engagement within China’s fiercely contested coffee market. The recent third-quarter results affirm strong revenue momentum but show relatively flat profitability quarter-over-quarter, suggesting the sharp pace of expansion remains a double-edged sword; for now, these results do not materially shift the largest near-term catalyst, continued user and store growth, or the key risk of overexpansion and margin pressure.

Among recent announcements, Luckin’s planned expansion into Malaysia via a strategic partnership is especially relevant, as it shows the company’s intent to replicate its China growth strategy internationally. While this move could eventually support new customer acquisition and brand presence beyond China, short-term financial impact appears limited and the main catalysts for now remain domestic: maintaining store productivity and driving transaction growth.

However, investors should be aware that even with surging revenue, persistent store expansion poses questions about longer term sales per location and...

Read the full narrative on Luckin Coffee (it's free!)

Luckin Coffee's narrative projects CN¥73.6 billion revenue and CN¥6.9 billion earnings by 2028. This requires 21.5% yearly revenue growth and a CN¥3 billion earnings increase from the current earnings of CN¥3.9 billion.

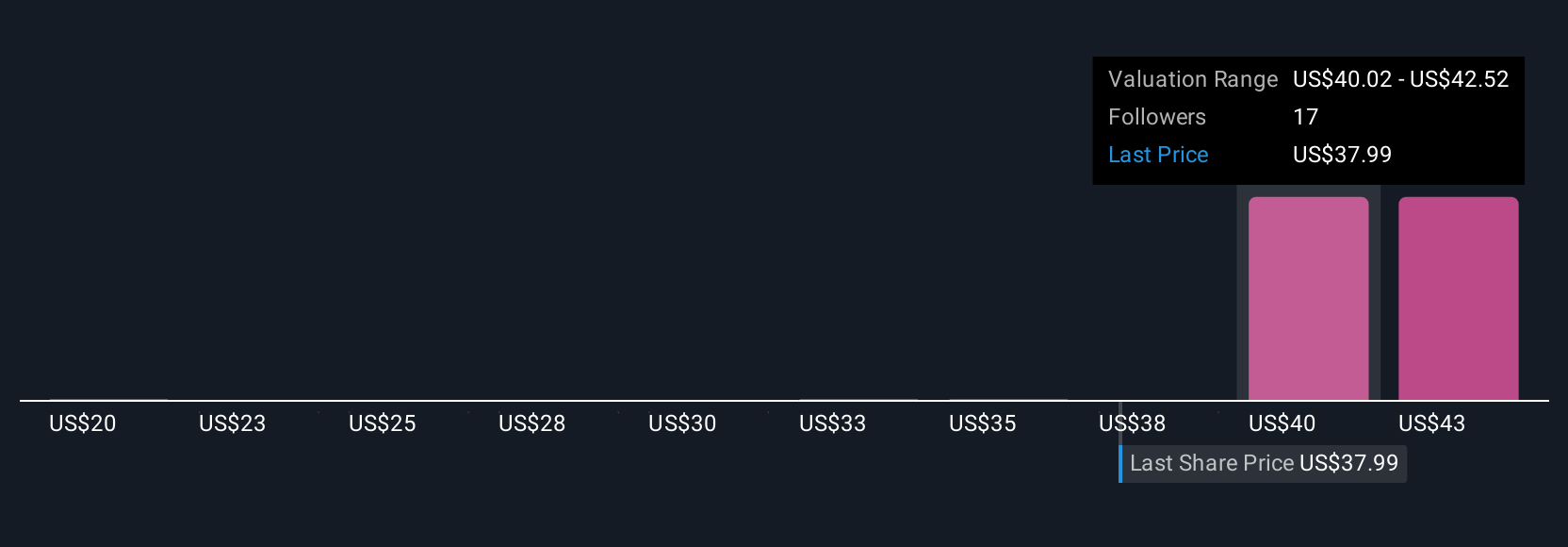

Uncover how Luckin Coffee's forecasts yield a $48.24 fair value, a 31% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community estimates for Luckin Coffee’s fair value range from CNY29.95 to CNY71.48, with nine perspectives highlighting wide differences in investor outlook. Consider how ongoing store expansion, while fueling revenue growth, raises important questions about long-term profitability drivers.

Explore 9 other fair value estimates on Luckin Coffee - why the stock might be worth 19% less than the current price!

Build Your Own Luckin Coffee Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Luckin Coffee research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Luckin Coffee research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Luckin Coffee's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:LKNC.Y

Luckin Coffee

Offers retail services of freshly brewed drinks, and pre-made food and beverage items in the People's Republic of China.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success