- United States

- /

- Hospitality

- /

- OTCPK:LKNC.Y

Assessing Luckin Coffee (OTCPK:LKNC.Y) Valuation Following Recent Modest Share Price Dip

Reviewed by Simply Wall St

See our latest analysis for Luckin Coffee.

Luckin Coffee's share price has cooled off a bit in the past month, but the bigger story is its momentum. With a 47.1% share price return so far this year and an impressive 61.3% total shareholder return for the past 12 months, Luckin continues building on strong long-term gains seen over three- and five-year periods as well.

If the market’s appetite for turnaround stories like Luckin has you interested, now is the perfect time to discover fast growing stocks with high insider ownership

With shares trading roughly 18% below analyst price targets and showing years of durable growth, investors must decide whether Luckin Coffee is undervalued right now or if the company's future potential is already fully accounted for.

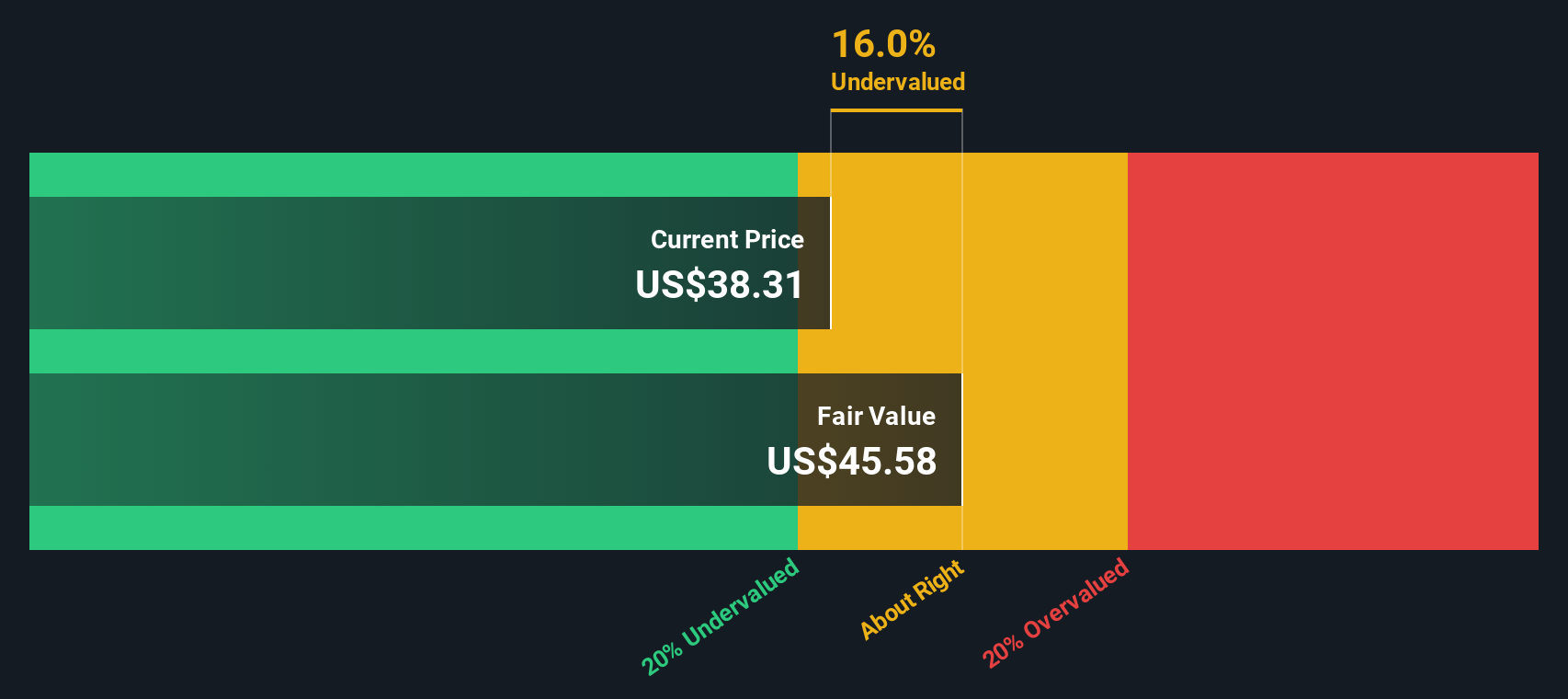

Most Popular Narrative: 15.5% Undervalued

Luckin Coffee's narrative-driven fair value sits well above the latest close, hinting the share price still trails underlying business potential. This gap sets the stage for what could be a pivotal driver.

Ongoing investments in proprietary supply chain infrastructure, such as the commissioning of the new Xiamen roasting facility and integration of existing plants, are expected to enhance vertical integration, lower cost of materials as a percent of revenues, and drive expansion of gross and net margins over the long term.

Curious how a relentless push into operational efficiency and digital strategy transforms into a bold valuation? The narrative hinges on aggressive expansion, innovative customer engagement, and carefully modeled margin shifts, all driven by long-term growth assumptions that could surprise even seasoned investors. Unpack the bigger financial picture behind Luckin’s premium pricing and see what data really underpins this view.

Result: Fair Value of $46.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition and the risk of overexpansion could challenge Luckin's growth story. These factors may put pressure on margins and test the durability of its current momentum.Find out about the key risks to this Luckin Coffee narrative.

Another View: Our DCF Model Challenges the Narrative

While narrative-led valuation signals Luckin Coffee is still below its potential, our DCF model tells a different story. It estimates a fair value of $36.34, which is below the current share price. Could market optimism be running ahead of fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Luckin Coffee for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 842 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Luckin Coffee Narrative

If you have a different perspective, or want to dig into the numbers yourself, you can craft your own Luckin Coffee story in just minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Luckin Coffee.

Looking for More Smart Investment Ideas?

Don’t let your next opportunity slip past you. Leverage the Simply Wall Street Screener to spot stocks on the move in today’s market.

- Tap into high-growth trends in artificial intelligence by checking out these 26 AI penny stocks, which are at the front line of technological change, automation, and efficiency gains.

- Boost your search for overlooked bargains by reviewing these 842 undervalued stocks based on cash flows, which feature solid fundamentals and attractive price points right now.

- Accelerate your income strategy and see what sets apart these 18 dividend stocks with yields > 3%, which consistently reward shareholders with strong yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:LKNC.Y

Luckin Coffee

Offers retail services of freshly brewed drinks, and pre-made food and beverage items in the People's Republic of China.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives