- United States

- /

- Hospitality

- /

- NYSE:YUMC

How Investors May Respond To Yum China Holdings (YUMC) Accelerating Store Growth and Boosting Capital Returns

Reviewed by Sasha Jovanovic

- Yum China Holdings unveiled its RGM 3.0 strategy and a new three-year financial outlook at its 2025 Investor Day, outlining ambitious plans to reach 20,000 stores by 2026 and more than 30,000 by 2030, with a focus on expanding KFC and Pizza Hut across China and increasing capital returns to shareholders.

- A unique aspect of the announcement is the company's commitment to return approximately 100% of free cash flow to shareholders after minority dividends beginning in 2027, signaling a strong focus on shareholder value alongside rapid business expansion.

- We'll explore how Yum China's target of doubling Pizza Hut operating profit in China by 2029 alters its long-term investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Yum China Holdings Investment Narrative Recap

To be a shareholder in Yum China Holdings, you need to believe in the company’s ability to scale its network rapidly across China while navigating strong competitive and cost pressures. The new RGM 3.0 strategy announcement, with its updated long-term growth and capital return targets, does not change the most important short-term catalyst, the pace and profitability of store expansion, nor does it materially alter the ongoing risk of eroding margins in a fiercely competitive market.

Among Yum China’s recent news, the commitment to return approximately 100% of free cash flow to shareholders starting in 2027 stands out. This aligns with the company’s goal to maintain investor appeal even as it pursues aggressive expansion and faces industry-wide cost inflation, keeping capital returns front of mind as a supporting catalyst for sentiment.

In contrast, investors should also keep in mind the potential longer-term effects of an increasing shift towards smaller-ticket orders and expansion in lower-tier cities, as these trends can affect average check sizes and overall revenue momentum…

Read the full narrative on Yum China Holdings (it's free!)

Yum China Holdings' narrative projects $14.0 billion in revenue and $1.2 billion in earnings by 2028. This requires 7.0% yearly revenue growth and an earnings increase of about $281 million from current earnings of $919.0 million.

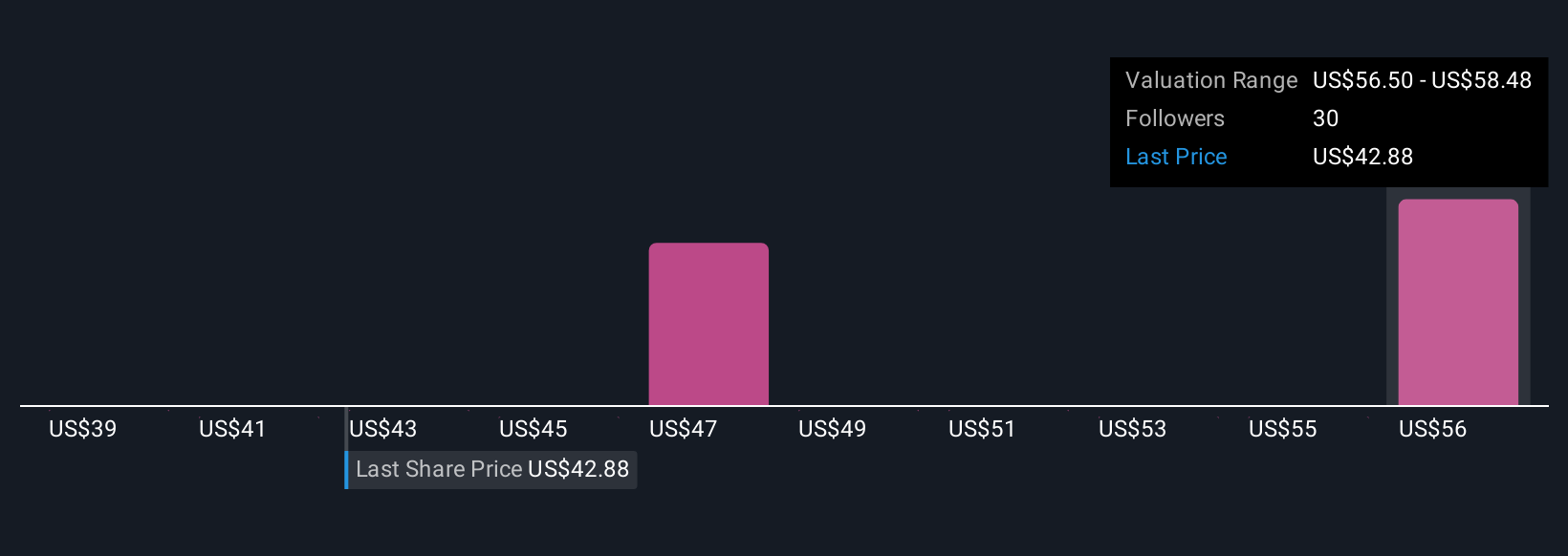

Uncover how Yum China Holdings' forecasts yield a $57.99 fair value, a 22% upside to its current price.

Exploring Other Perspectives

Seven fair value estimates from the Simply Wall St Community for Yum China range from US$31.51 to US$65.20 per share. While many see value, the recurring risk of competition and pressures on store margins continues to fuel debate about sustainable profit growth.

Explore 7 other fair value estimates on Yum China Holdings - why the stock might be worth as much as 37% more than the current price!

Build Your Own Yum China Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Yum China Holdings research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Yum China Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Yum China Holdings' overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YUMC

Yum China Holdings

Owns, operates, and franchises restaurants in the People’s Republic of China.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives