- United States

- /

- Hospitality

- /

- NYSE:VIK

Viking Holdings (VIK): Evaluating Valuation After Strong Earnings and Fleet Expansion Signal Growth Momentum

Reviewed by Simply Wall St

Viking Holdings (NYSE:VIK) just posted quarterly earnings that beat forecasts, with record adjusted EBITDA and revenue gains year over year. The company also expanded its fleet past 100 ships and secured most of its 2025 cruise bookings.

See our latest analysis for Viking Holdings.

Viking Holdings’ strong quarterly results and fleet expansion have energized its stock, with a notable year-to-date share price return of over 40% and a one-year total shareholder return of nearly 37%. Recent gains follow upbeat earnings, expanded future booking visibility, and strategic moves such as adding new vessels and refinancing debt. These developments point to growing investor optimism and momentum building around the company’s long-term growth story.

If this wave of record bookings and expansion piques your interest, now is a good time to see what other fast-growing, high-insider-ownership companies are trending — discover fast growing stocks with high insider ownership

Given this run of impressive results and surging share price, the big question now is whether Viking Holdings is undervalued today or if the market has already priced in much of that anticipated growth. Could there still be a compelling buying opportunity?

Most Popular Narrative: 7% Undervalued

The leading narrative places Viking Holdings’ fair value estimate at $66.35, modestly above the last close price of $61.50, hinting at some upside according to consensus projections. This outlook sets the tone for a deeper discussion around the expectations driving this value.

Broad-based capacity expansion into new geographies like India, Egypt, and China, as well as continued penetration of the U.S. market, positions Viking to capitalize on global population aging and growing affluence among travelers seeking premium, culturally enriching experiences, supporting significant long-term revenue growth.

Want to know the story behind this premium valuation? One powerful variable in this narrative is a rapid profit ramp plus future multiples that set a bold precedent for hospitality. The projected path to these numbers relies on assumptions that might surprise you. Curious what’s behind the optimism? Unlock the details that shape this price target.

Result: Fair Value of $66.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a shift in travel demand among older consumers or rising costs from stricter environmental rules could quickly change the growth outlook for Viking Holdings.

Find out about the key risks to this Viking Holdings narrative.

Another View: What Multiples Say

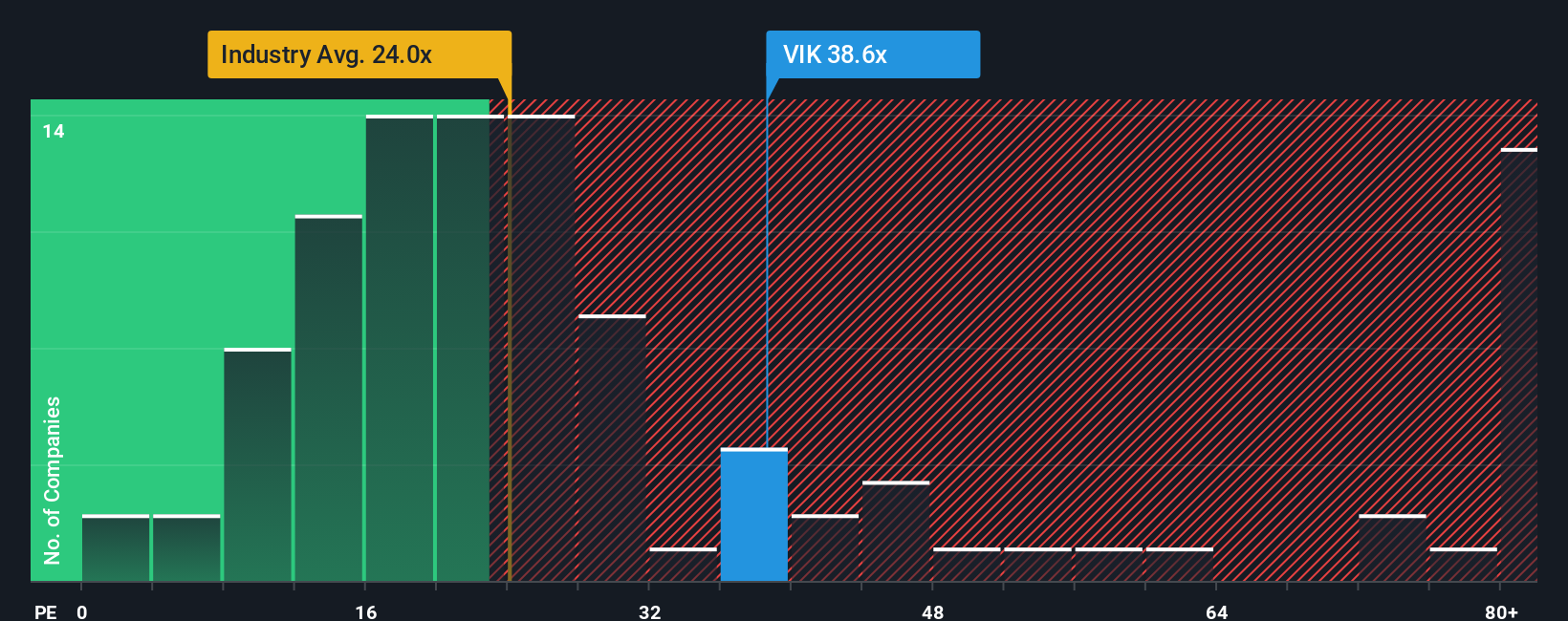

While consensus projections point to Viking Holdings being undervalued, a quick look at today’s price-to-earnings ratio raises eyebrows. The stock trades at 39.1x, which is far above the US Hospitality industry average of 20.8x and the peer average of 17.3x. Even when compared to the fair ratio of 31x, Viking appears pricey, suggesting less margin for error if growth slows. Could the market be too optimistic, or are investors justified in paying this premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Viking Holdings Narrative

If you want to dig deeper or challenge the consensus, you can easily review the numbers and craft your own perspective in just a few minutes. Do it your way

A great starting point for your Viking Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know that true opportunities come from staying ahead of the crowd. Don’t miss the chance to see what else could supercharge your portfolio right now.

- Tap into the next breakout trend by checking out these 26 quantum computing stocks, which is pushing boundaries in computing and innovation.

- Strengthen your passive income with these 15 dividend stocks with yields > 3%, featuring companies offering robust yields above 3%.

- Ride the wave of intelligent automation and growth through these 26 AI penny stocks, which are leading advancements in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VIK

Viking Holdings

Engages in the passenger shipping and other forms of passenger transport in North America, the United Kingdom, and internationally.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives