- United States

- /

- Hospitality

- /

- NYSE:VIK

How Debt Refinancing and Fleet Expansion at Viking Holdings (VIK) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Viking Holdings recently announced plans to refinance existing debt by pricing US$1.7 billion in senior notes due 2033, expanded its river cruise fleet with two new ships, and received analyst coverage from Wells Fargo, who highlighted both growth efforts and competitive headwinds.

- The combination of fleet expansion, large-scale debt refinancing, and analyst attention points to a period of operational change and heightened scrutiny regarding Viking’s long-term outlook in a competitive and evolving cruise market.

- We’ll explore how Viking’s decision to add new river ships to its fleet impacts the wider investment narrative for the company.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Viking Holdings Investment Narrative Recap

For investors to remain confident in Viking Holdings, they must believe that the company can capitalize on strong travel demand and sustained premium pricing, even as competition increases and margin pressures persist. Recent announcements, specifically the addition of new river ships and plans to refinance US$1.7 billion in debt, support operational expansion and financial flexibility, but they do not change the central short-term catalyst of maintaining robust passenger bookings. The biggest risk that remains is heightened competition, especially as major cruise operators enter the river segment; the impact of this risk has not been materially altered by the latest news.

Among the latest developments, Viking’s fleet expansion, marked by the delivery of Viking Honir and Viking Thoth, stands out as most relevant. This move further consolidates the company’s position in core European and Egyptian river markets, directly aligning with its efforts to solidify leadership and meet advanced bookings, which are critical short-term performance indicators amid a growing field of rivals.

But despite growing capacity and financial maneuvers, the rising presence of large competitors in the premium river cruise segment is a risk that...

Read the full narrative on Viking Holdings (it's free!)

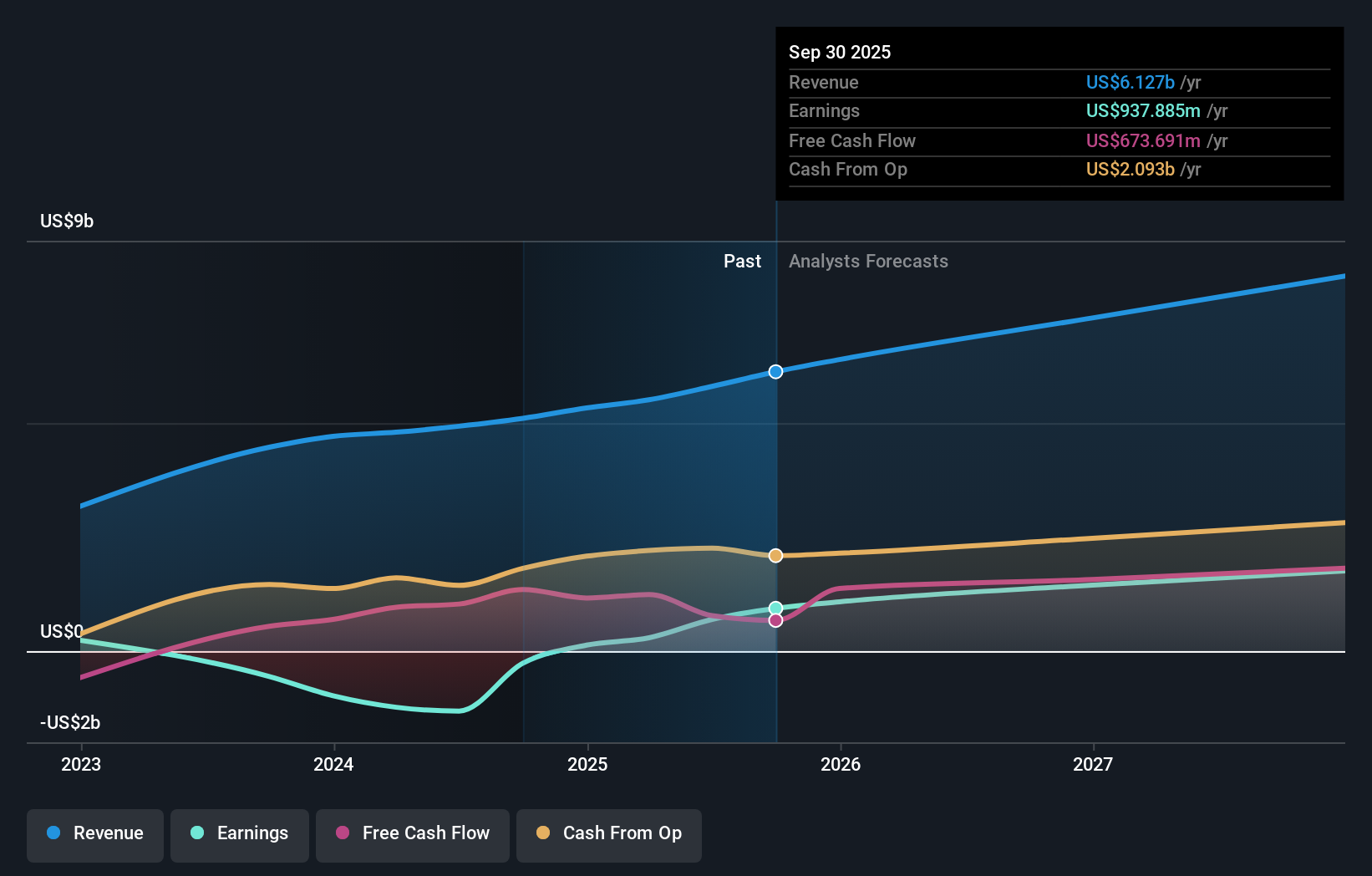

Viking Holdings' narrative projects $8.5 billion revenue and $2.0 billion earnings by 2028. This requires 13.6% yearly revenue growth and a $1.31 billion earnings increase from $694.2 million.

Uncover how Viking Holdings' forecasts yield a $66.35 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range widely, from US$34.20 to US$80.21, based on five independent perspectives. With bookings already strong and capacity expanding, you can see why opinions on Viking’s future performance differ so much, explore several viewpoints to compare your own expectations.

Explore 5 other fair value estimates on Viking Holdings - why the stock might be worth 41% less than the current price!

Build Your Own Viking Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Viking Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Viking Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Viking Holdings' overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VIK

Viking Holdings

Engages in the passenger shipping and other forms of passenger transport in North America, the United Kingdom, and internationally.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives