- United States

- /

- Hospitality

- /

- NYSE:VAC

Will Investor Optimism for VAC’s Earnings Signal a Shift in Marriott Vacations' Long-Term Strategy?

Reviewed by Sasha Jovanovic

- Marriott Vacations Worldwide recently announced it is expected to report quarterly earnings on November 5, with analysts projecting a year-over-year earnings decline but higher revenues for the period.

- A positive Earnings ESP of +0.80% and a track record of outpacing consensus estimates for the past four quarters have contributed to rising optimism among investors ahead of the results.

- We will now examine how expectations of a potential earnings beat may affect Marriott Vacations Worldwide's broader investment case.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Marriott Vacations Worldwide Investment Narrative Recap

To own Marriott Vacations Worldwide, an investor needs confidence in the long-term resilience of leisure travel, continued engagement from affluent customers, and the company’s ability to convert first-time buyers into repeat owners. The upcoming quarterly earnings announcement is the key short-term catalyst, and given the company's history of outpacing analyst estimates, expectations of a positive earnings surprise are running high. However, while a potential beat may lift sentiment, it is not likely to materially reduce the most immediate risk: greater credit losses from higher defaults in emerging markets, which could weigh on profit margins.

Among recent company actions, the reiteration of contract sales guidance for 2025 is most relevant to this earnings update. With contract sales expected between US$1,740 million and US$1,830 million, management signals confidence in future revenue despite near-term headwinds, supporting optimism around upcoming results as well as longer-term earnings visibility.

On the other hand, as emerging market defaults and rising loan loss provisions could spell larger hurdles for margins, investors should be aware of...

Read the full narrative on Marriott Vacations Worldwide (it's free!)

Marriott Vacations Worldwide's narrative projects $6.3 billion in revenue and $355.3 million in earnings by 2028. This requires 22.9% yearly revenue growth and an earnings increase of $96 million from the current $259.0 million.

Uncover how Marriott Vacations Worldwide's forecasts yield a $91.90 fair value, a 39% upside to its current price.

Exploring Other Perspectives

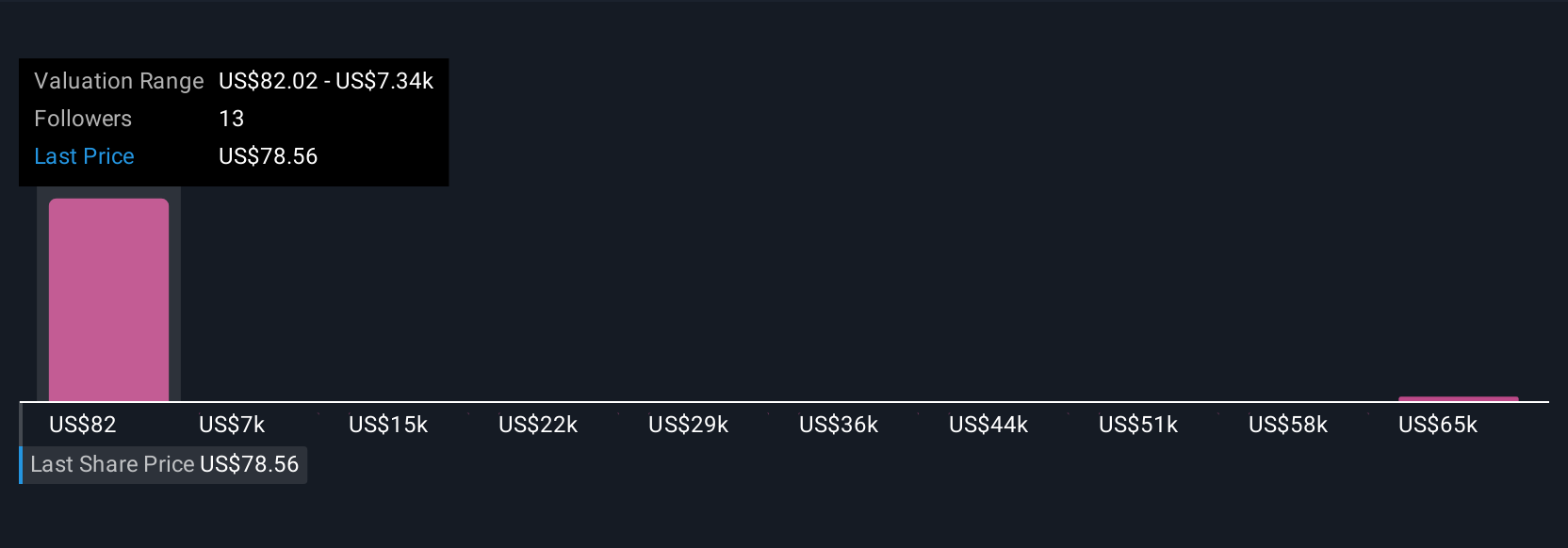

Simply Wall St Community fair value estimates for Marriott Vacations Worldwide range widely from US$82 up to US$72,681, with six unique perspectives. As you consider these varied opinions, recall that persistent credit risk in newer markets could have outsized effects on the company’s financial position.

Explore 6 other fair value estimates on Marriott Vacations Worldwide - why the stock might be a potential multi-bagger!

Build Your Own Marriott Vacations Worldwide Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Marriott Vacations Worldwide research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Marriott Vacations Worldwide research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Marriott Vacations Worldwide's overall financial health at a glance.

No Opportunity In Marriott Vacations Worldwide?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VAC

Marriott Vacations Worldwide

A vacation company, engages in the vacation ownership, exchange, rental, and resort and property management businesses in the United States and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives