- United States

- /

- Hospitality

- /

- NYSE:VAC

Will Board Moves and Insider Buying at Marriott Vacations (VAC) Signal a Shift in Leadership Credibility?

Reviewed by Sasha Jovanovic

- Marriott Vacations Worldwide recently underwent major leadership changes, with John E. Geller, Jr. stepping down from his CEO and President roles at the Board’s request, and Matthew E. Avril appointed as Interim CEO and President, while Director William Mccarten made a significant insider purchase and the company completed a US$470 million securitization of vacation ownership loans.

- These developments highlight active board involvement and renewed focus on financial strength as the company faces operational challenges and shifts in executive leadership.

- We’ll explore how the combination of an interim CEO appointment and insider share purchases may reshape the company’s investment outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Marriott Vacations Worldwide Investment Narrative Recap

Marriott Vacations Worldwide investors are betting on the long-term appeal of vacation ownership and the company’s ability to drive recurring revenue growth by expanding its first-time buyer base, modernizing marketing strategies, and maintaining high occupancy among affluent customers. The latest leadership changes, including the appointment of an interim CEO and insider share purchases, create new uncertainty but do not materially alter the most important short-term catalyst: maintaining the pace of new owner sales. The biggest risk remains persisting softness in owner upgrades and contract sales, signaling possible demand headwinds.

One of the most relevant recent announcements is the $470 million securitization of vacation ownership loans, which boosts the company’s liquidity and financial resilience. This move, while potentially increasing financial flexibility, occurs against a backdrop of operational and leadership transitions that could affect management’s ability to accelerate revenue growth through modernization and first-time buyer initiatives in the near term.

However, investors should also be aware that ongoing operational challenges could limit progress if...

Read the full narrative on Marriott Vacations Worldwide (it's free!)

Marriott Vacations Worldwide's narrative projects $6.3 billion revenue and $355.3 million earnings by 2028. This requires 22.9% yearly revenue growth and a $96.3 million earnings increase from $259.0 million currently.

Uncover how Marriott Vacations Worldwide's forecasts yield a $68.00 fair value, a 34% upside to its current price.

Exploring Other Perspectives

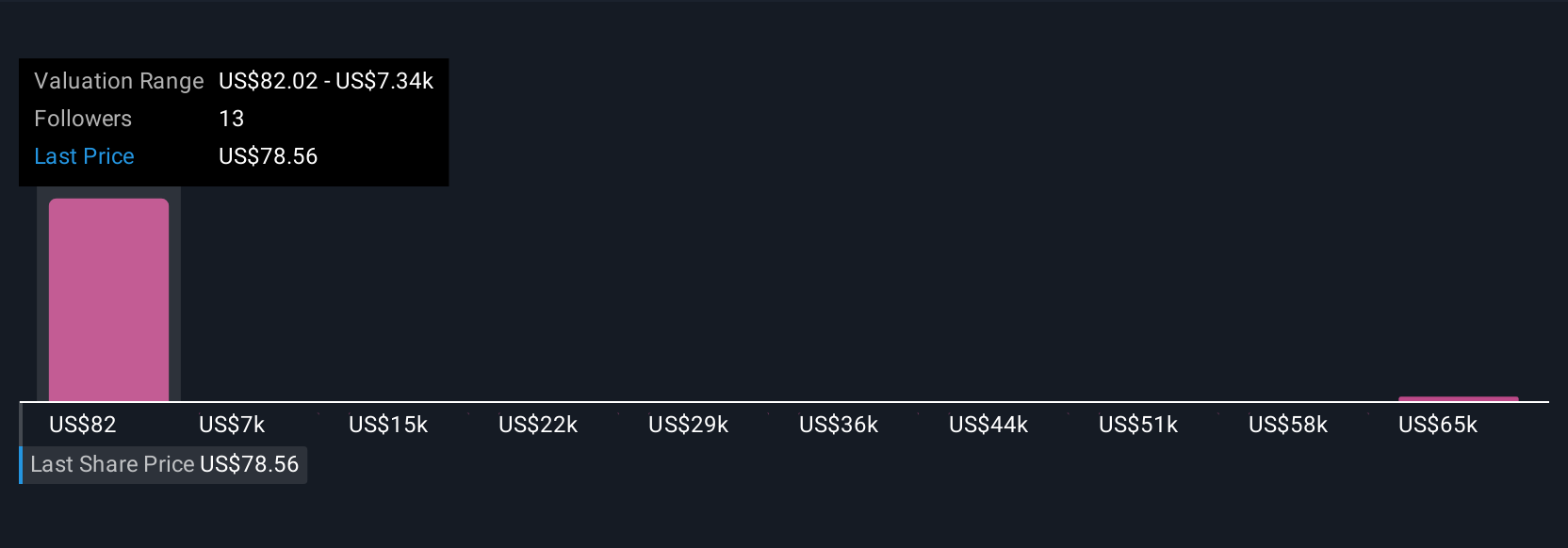

Fair value estimates from the Simply Wall St Community span from US$68 to US$72,680 across six user perspectives. While many see upside potential in first-time buyer growth, there is wide disagreement on future outcomes, so it’s worth reviewing how owner sales trends and management changes might influence the company’s future performance.

Explore 6 other fair value estimates on Marriott Vacations Worldwide - why the stock might be a potential multi-bagger!

Build Your Own Marriott Vacations Worldwide Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Marriott Vacations Worldwide research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Marriott Vacations Worldwide research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Marriott Vacations Worldwide's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VAC

Marriott Vacations Worldwide

A vacation company, engages in the vacation ownership, exchange, rental, and resort and property management businesses in the United States and internationally.

Undervalued with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success