- United States

- /

- Consumer Services

- /

- NYSE:UTI

Universal Technical Institute (UTI): Valuation Check After Hyundai’s IONIQ 5 EV Donation and EV Training Push

Reviewed by Simply Wall St

Hyundai Motor America’s donation of 18 IONIQ 5 EVs to Universal Technical Institute (UTI) is not just a classroom upgrade; it is a fresh data point for investors watching how UTI monetizes the EV skills gap.

See our latest analysis for Universal Technical Institute.

The Hyundai partnership and UTI’s upcoming investor-facing events, including a non-deal roadshow and conference appearances later this month, arrive as the stock trades at about $26.60, with a 1-year total shareholder return of 4.64 percent and a powerful 3-year total shareholder return above 300 percent. This suggests long-term momentum remains intact even after a softer recent 90-day share price return.

If this EV training push has you thinking more broadly about education and mobility trends, you might also want to explore auto manufacturers as another way to spot potential beneficiaries of the shift in automotive technology.

With shares still sitting well below consensus targets despite a tripling over three years, the question now is whether UTI’s EV pivot leaves room for another leg higher or if the market has already priced in its next chapter of growth.

Most Popular Narrative Narrative: 29.3% Undervalued

With the most followed narrative pointing to value near $37.60 versus a $26.60 close, the gap hinges on how investors see UTI’s expansion math.

The recently lifted growth restrictions on Concorde Career Colleges now allow for accelerated program launches and the addition of multiple new campuses a year ahead of plan, positioning the company for faster-than-anticipated revenue growth and increased market share starting as early as 2026.

Want to see the full playbook behind that growth push? The narrative leans on rising revenue, slimmer margins, and a future earnings multiple that might surprise you.

Result: Fair Value of $37.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained regulatory pressure and weaker than expected enrollment from rapid campus expansion could quickly undermine the optimistic growth and valuation assumptions embedded in this thesis.

Find out about the key risks to this Universal Technical Institute narrative.

Another View: Multiples Flash a Caution Sign

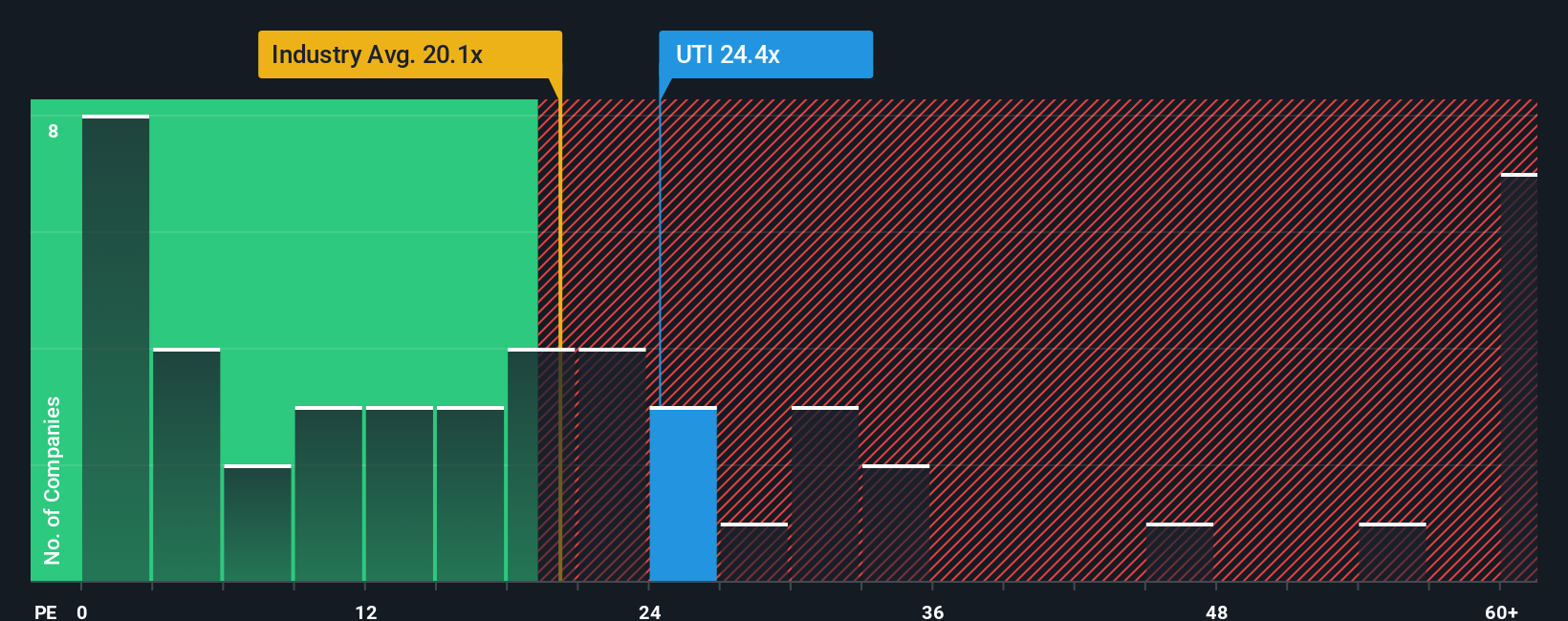

While the consensus narrative points to upside, the price tag tells a different story. UTI trades on about 23 times earnings, richer than both the Consumer Services industry at 16.6 times and peers at 22.2 times, and well above a fair ratio of 9.4 times, suggesting meaningful valuation risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Universal Technical Institute Narrative

If you are not convinced by these views or prefer to dive into the numbers yourself, you can build a custom thesis in minutes, starting with Do it your way.

A great starting point for your Universal Technical Institute research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Ready for your next move beyond Universal Technical Institute? Put Simply Wall Street’s screener to work now so you are not watching the best opportunities from the sidelines.

- Target reliable cash generators by reviewing these 13 dividend stocks with yields > 3% that can strengthen your portfolio’s income stream while markets stay unpredictable.

- Capitalize on structural tech shifts by focusing on these 24 AI penny stocks positioned to benefit from surging demand for automation and intelligent software.

- Lock in potential bargains early by zeroing in on these 918 undervalued stocks based on cash flows that still trade at attractive discounts to their intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UTI

Universal Technical Institute

Provides transportation, skilled trades, and healthcare education programs in the United States.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion