- United States

- /

- Hospitality

- /

- NYSE:TNL

Will Travel + Leisure’s (TNL) $500 Million Refinancing Reshape Its Earnings Stability Strategy?

Reviewed by Simply Wall St

- Earlier this month, Travel + Leisure Co. entered into a fourth supplemental indenture to issue US$500 million of 6.125% senior secured notes due 2033, using proceeds to redeem 6.60% notes maturing in October 2025, repay revolving credit lines, cover offering expenses, and potentially for additional debt reduction and general corporate needs.

- This refinancing effort reflects a deliberate move to reduce future interest expenses and strengthen the company’s capital structure while preserving financial flexibility.

- We’ll look at how this refinancing and debt reduction may affect Travel + Leisure’s ongoing efforts to maintain earnings stability and operational efficiency.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Travel + Leisure Investment Narrative Recap

Being a shareholder in Travel + Leisure Co. means believing in the sustained demand for vacation ownership and travel experiences, supported by recurring revenue and efforts to broaden the customer base. The recent refinancing, while not a dramatic shift, marginally lowers financing costs and enhances flexibility, but it does not fundamentally change the company’s reliance on its core Vacation Ownership segment, the most important revenue driver and, at the same time, a concentration risk if trends turn against the model.

Among recent announcements, Travel + Leisure’s steady quarterly dividend increases, including the latest declared US$0.56 per share, stand out as most relevant to this refinancing, as these moves emphasize the company’s focus on shareholder returns and ongoing cash flow management. With refinancing aimed at reducing interest payments and the continued return of capital through dividends, the company’s ability to maintain stable earnings and meet shareholder payout expectations will remain closely watched.

By contrast, investors should be mindful of how continued industry consolidation or evolving travel preferences might impact future growth and...

Read the full narrative on Travel + Leisure (it's free!)

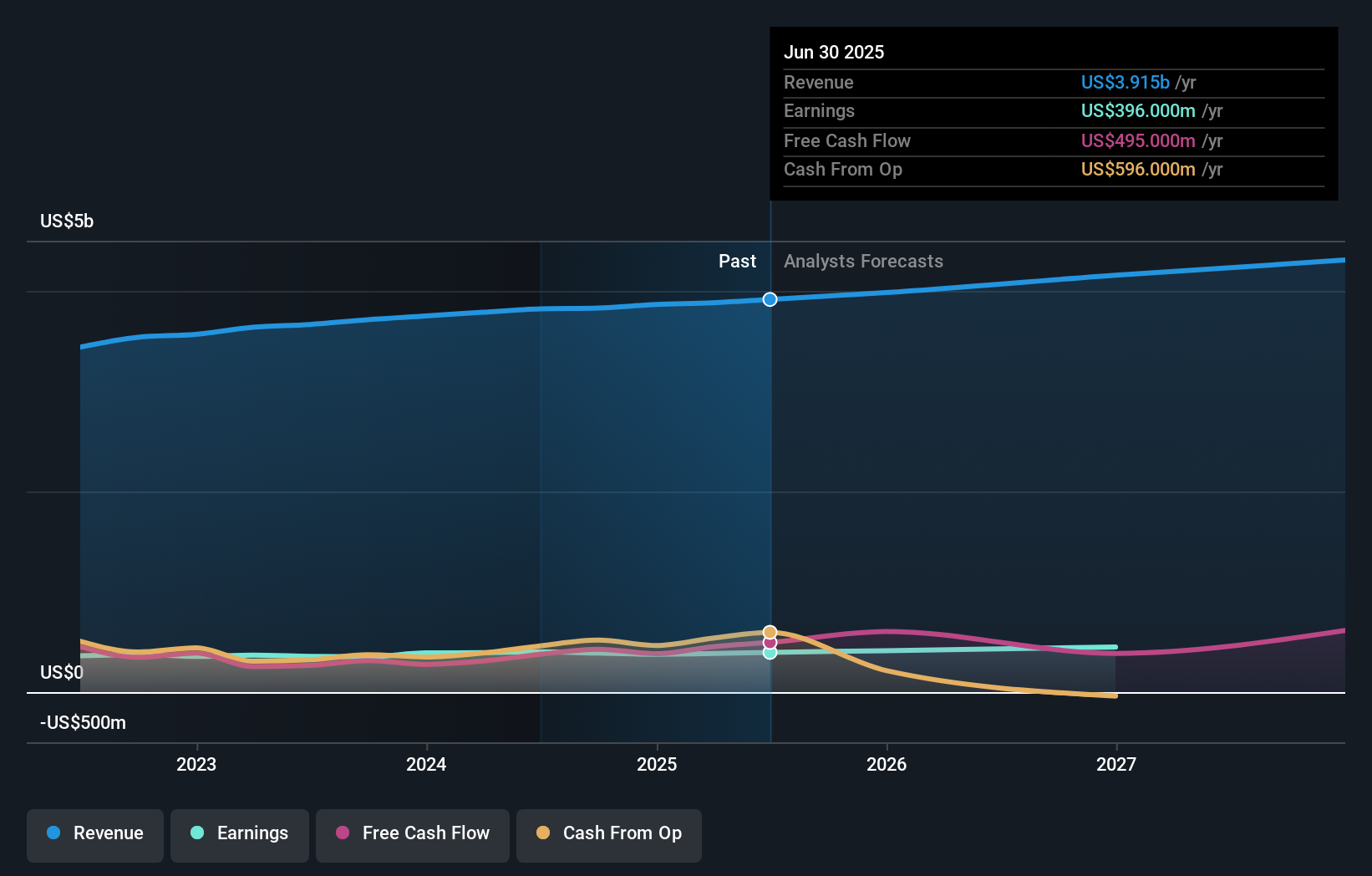

Travel + Leisure's narrative projects $4.4 billion in revenue and $506.9 million in earnings by 2028. This requires 3.9% yearly revenue growth and a $110.9 million earnings increase from the current $396.0 million.

Uncover how Travel + Leisure's forecasts yield a $67.67 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offered fair value estimates for Travel + Leisure ranging from US$43.13 to an outlier of US$61,186.95 across four analyses. Given the company’s high reliance on its Vacation Ownership segment, your outlook may hinge on whether you see this focus as a strength or a vulnerability, explore how these viewpoints could affect your view of the company’s long-term trajectory.

Explore 4 other fair value estimates on Travel + Leisure - why the stock might be worth 32% less than the current price!

Build Your Own Travel + Leisure Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Travel + Leisure research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Travel + Leisure research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Travel + Leisure's overall financial health at a glance.

No Opportunity In Travel + Leisure?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 23 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Travel + Leisure might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TNL

Travel + Leisure

Provides hospitality services and travel products in the United States and internationally.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives