- United States

- /

- Consumer Services

- /

- NYSE:TMX

ServiceMaster Global Holdings (NYSE:SERV) Has A Pretty Healthy Balance Sheet

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that ServiceMaster Global Holdings, Inc. (NYSE:SERV) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for ServiceMaster Global Holdings

What Is ServiceMaster Global Holdings's Net Debt?

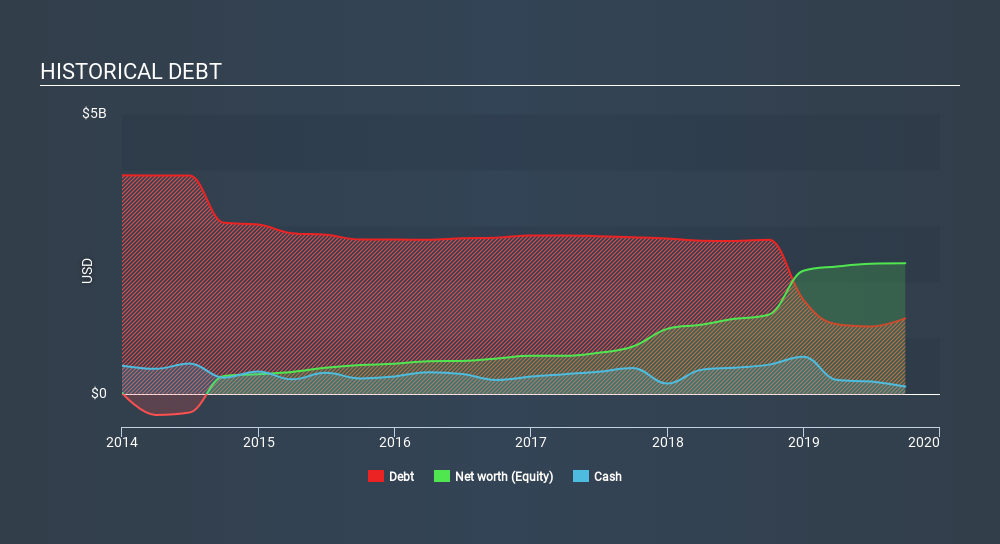

You can click the graphic below for the historical numbers, but it shows that as of September 2019 ServiceMaster Global Holdings had US$1.36b of debt, an increase on US$2.8k, over one year. On the flip side, it has US$140.0m in cash leading to net debt of about US$1.22b.

How Healthy Is ServiceMaster Global Holdings's Balance Sheet?

We can see from the most recent balance sheet that ServiceMaster Global Holdings had liabilities of US$504.0m falling due within a year, and liabilities of US$2.18b due beyond that. Offsetting this, it had US$140.0m in cash and US$214.0m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$2.33b.

ServiceMaster Global Holdings has a market capitalization of US$5.13b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

ServiceMaster Global Holdings has a debt to EBITDA ratio of 3.1 and its EBIT covered its interest expense 3.5 times. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. However, it should be some comfort for shareholders to recall that ServiceMaster Global Holdings actually grew its EBIT by a hefty 419%, over the last 12 months. If that earnings trend continues it will make its debt load much more manageable in the future. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 2 warning signs for ServiceMaster Global Holdings (of which 1 is major) which any shareholder or potential investor should be aware of.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Happily for any shareholders, ServiceMaster Global Holdings actually produced more free cash flow than EBIT over the last three years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

ServiceMaster Global Holdings's conversion of EBIT to free cash flow suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. But, on a more sombre note, we are a little concerned by its interest cover. Looking at all the aforementioned factors together, it strikes us that ServiceMaster Global Holdings can handle its debt fairly comfortably. Of course, while this leverage can enhance returns on equity, it does bring more risk, so it's worth keeping an eye on this one. We'd be motivated to research the stock further if we found out that ServiceMaster Global Holdings insiders have bought shares recently. If you would too, then you're in luck, since today we're sharing our list of reported insider transactions for free.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:TMX

Terminix Global Holdings

Terminix Global Holdings, Inc. provides residential and commercial termite and pest management services.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)