- United States

- /

- Consumer Services

- /

- NYSE:STUB

Should Investors Rethink StubHub After Its 23% Drop and Live Event Trends in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do next with StubHub Holdings stock? You are not alone. Investors have been watching its every move, looking for signals on whether the digital ticketing platform presents real value or just more volatility. Over the past week, the stock slipped by 1.3%, and so far this year, it is down a hefty 23.0%. That kind of drop can inspire both caution and opportunity, depending on what you see in the numbers and how you read between the lines.

There has definitely been some market chatter around StubHub. Shifts in consumer demand for live events and ongoing competition in the ticketing space have led to changing investor sentiment. While some market watchers point to growth potential as live entertainment returns, others are wary of competitive pressures, which could explain that sharp year-to-date decline. With so much uncertainty, understanding valuation becomes even more important.

Here is something to keep in mind: according to six core valuation checks, StubHub Holdings is currently considered undervalued in none of them, giving it a value score of 0 out of 6. Of course, that does not mean the full story is told. In the next sections, we will break down these valuation methods, show how they apply to StubHub, and reveal an even more insightful way to gauge the company’s real worth at the end of the article.

StubHub Holdings scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: StubHub Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's value. This approach helps investors determine what a business is truly worth based on its ability to generate cash going forward.

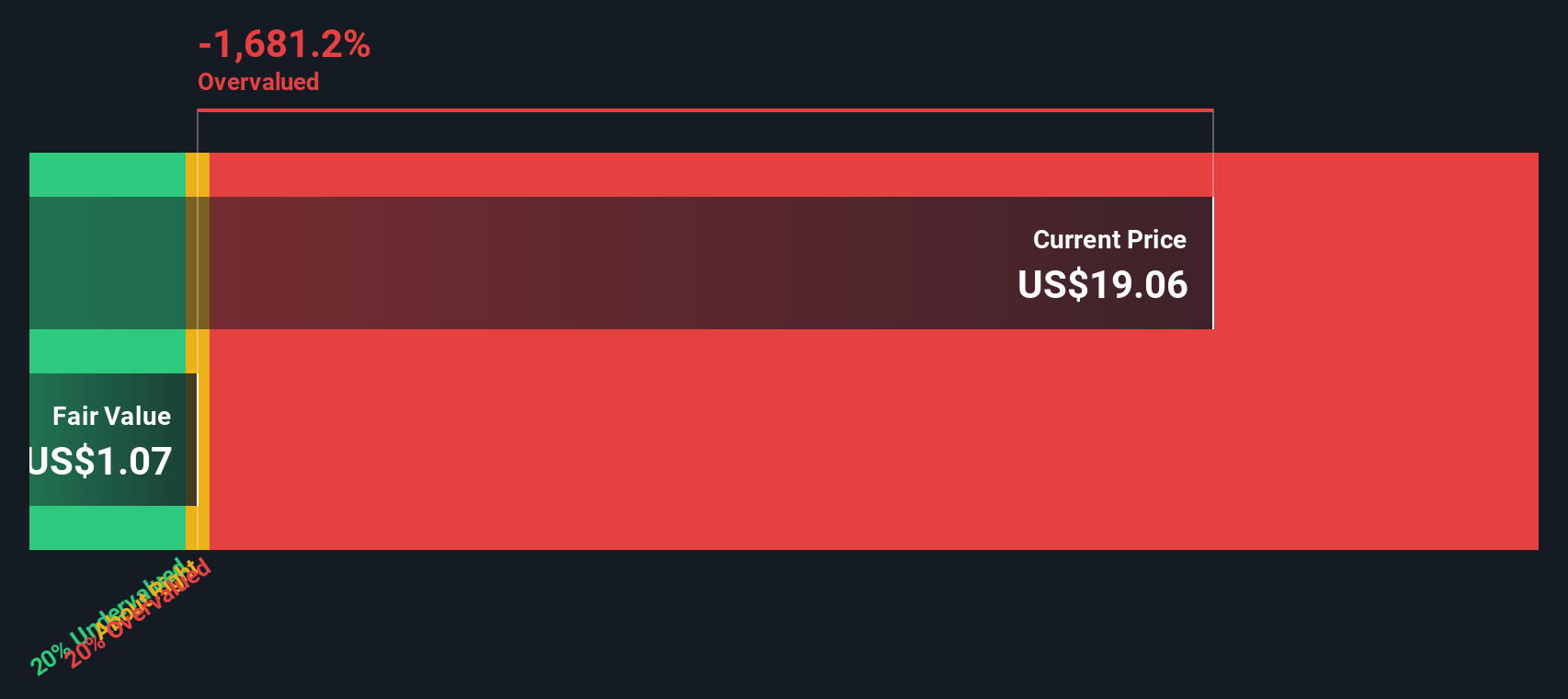

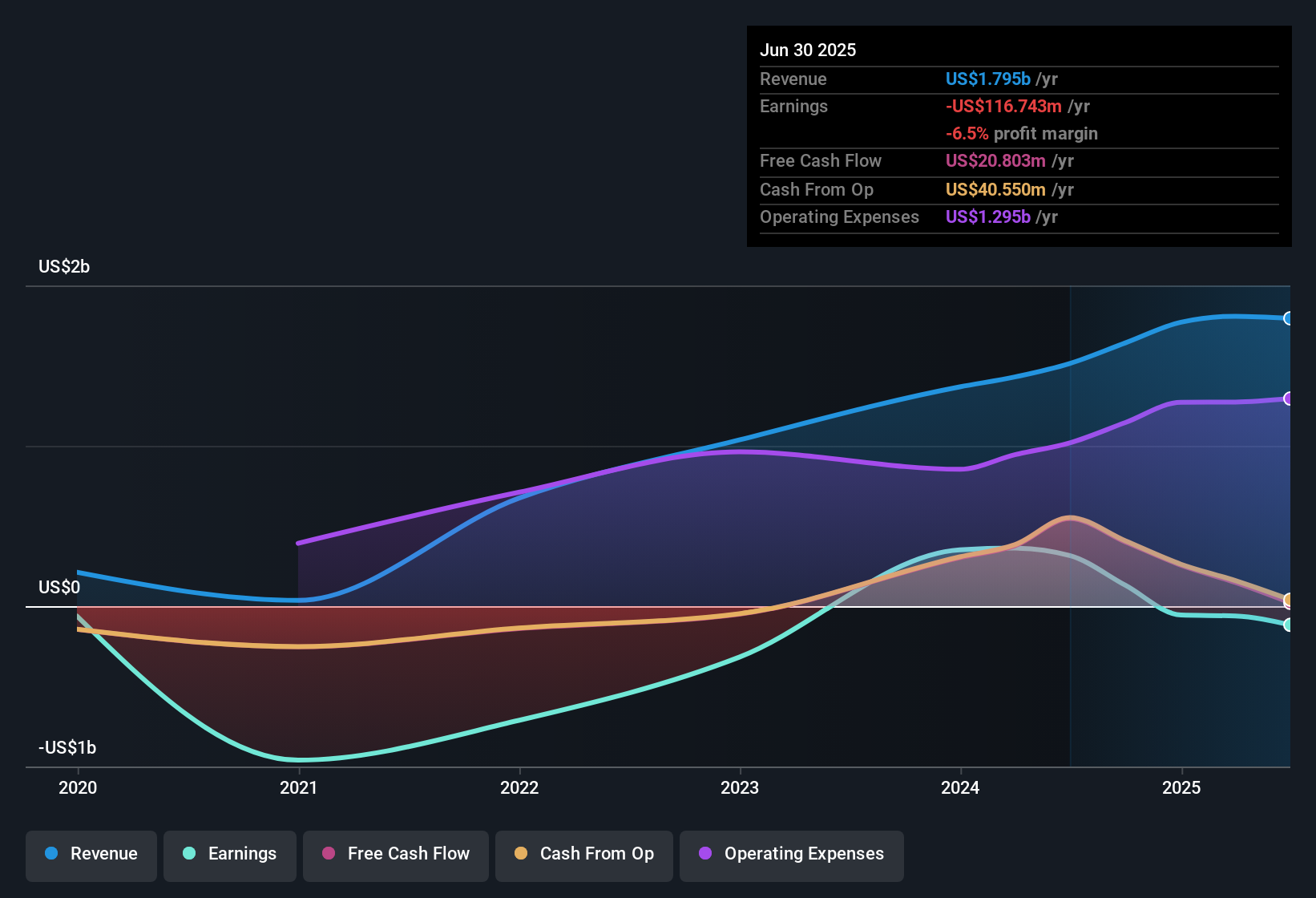

For StubHub Holdings, the DCF analysis uses the 2 Stage Free Cash Flow to Equity model. The company’s most recent twelve-month free cash flow stands at $28.29 million. Analysts provide detailed estimates for the first five years, while projections out to year ten are extrapolated by Simply Wall St. According to these forecasts, StubHub’s free cash flow is expected to decrease slightly in the next several years, starting at $24.62 million in 2026 and reaching $22.54 million by 2035 (all figures in $ millions).

Based on this model, the estimated intrinsic value per share is $1.04. With the stock currently trading at a price that puts it 1,526.3% above this value, StubHub Holdings appears significantly overvalued on a DCF basis.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests StubHub Holdings may be overvalued by 1526.3%. Find undervalued stocks or create your own screener to find better value opportunities.

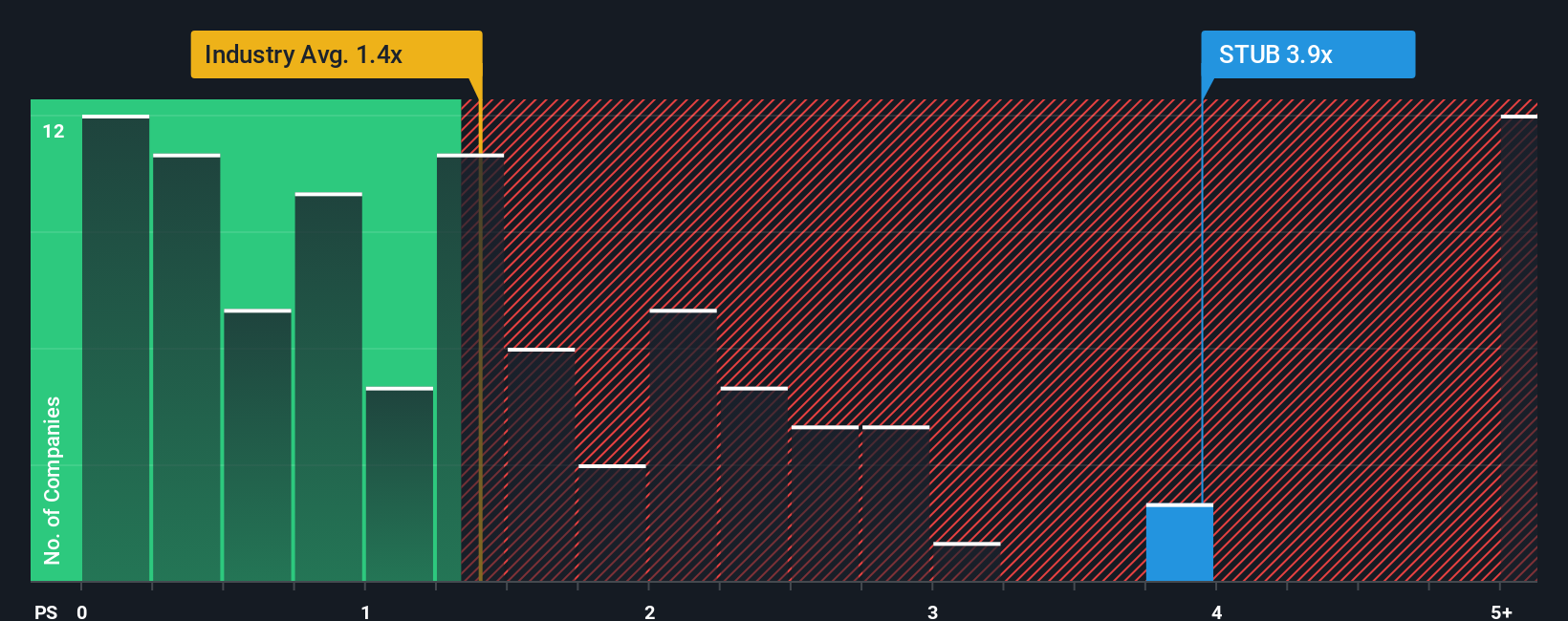

Approach 2: StubHub Holdings Price vs Sales

The Price-to-Sales (P/S) ratio is often chosen as the preferred valuation metric for companies like StubHub Holdings, especially when earnings are not consistently positive. This is because sales figures tend to be more stable and less prone to accounting adjustments, making the P/S ratio a practical benchmark for understanding valuation in the context of future growth and operating risk.

What qualifies as a "fair" P/S ratio can shift depending on investor expectations for growth, the degree of business risk, and overall market sentiment. Higher expected growth or lower risk usually justifies a higher P/S multiple, whereas slower growth or elevated uncertainty can pull that ratio downward.

StubHub Holdings currently trades at a P/S ratio of 3.47x. This is above both its industry average of 1.64x and the average for its direct peers at 2.13x. While these benchmarks offer context, Simply Wall St’s “Fair Ratio” goes a step further. This proprietary metric models what a justified P/S multiple should be for StubHub based on a spectrum of company-specific factors, such as growth forecasts, margins, scale, and risk profile, rather than just relying on historical peer averages.

Since Simply Wall St’s Fair Ratio is not available for StubHub but given that its P/S ratio is significantly above both peer and industry benchmarks, current trading levels suggest the stock is more likely overvalued on this basis.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your StubHub Holdings Narrative

Earlier, we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is simply your story about a company, where you set your own expectations for StubHub Holdings’ future revenue, profits, and margins, and then see the fair value that results from your view. Narratives connect the dots between what you believe will happen, how those beliefs translate into financial forecasts, and what price the business is really worth.

This approach is easy and accessible on Simply Wall St’s Community page, used by millions of investors. Narratives empower you to compare your fair value to the current market price, helping you know when it might be time to buy, hold, or sell. In addition, Narratives stay up to date and reflect the latest news, earnings reports, or other market developments, so your investment outlook is never out of date.

For example, some investors see StubHub Holdings’ fair value as much higher based on strong recovery in live events. Others project a lower fair value due to tough competition and margin pressure. Narratives let you combine your own perspective with real numbers, making your decisions more personal, flexible, and responsive to what is happening now.

Do you think there's more to the story for StubHub Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STUB

StubHub Holdings

Operates ticketing marketplace for live event tickets worldwide.

Mediocre balance sheet with minimal risk.

Market Insights

Community Narratives