- United States

- /

- Consumer Services

- /

- NYSE:STON

Imagine Owning StoneMor (NYSE:STON) And Taking A 96% Loss Square On The Chin

Long term investing is the way to go, but that doesn't mean you should hold every stock forever. We really hate to see fellow investors lose their hard-earned money. Anyone who held StoneMor Inc. (NYSE:STON) for five years would be nursing their metaphorical wounds since the share price dropped 96% in that time. We also note that the stock has performed poorly over the last year, with the share price down 73%. Unhappily, the share price slid 1.9% in the last week.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

View our latest analysis for StoneMor

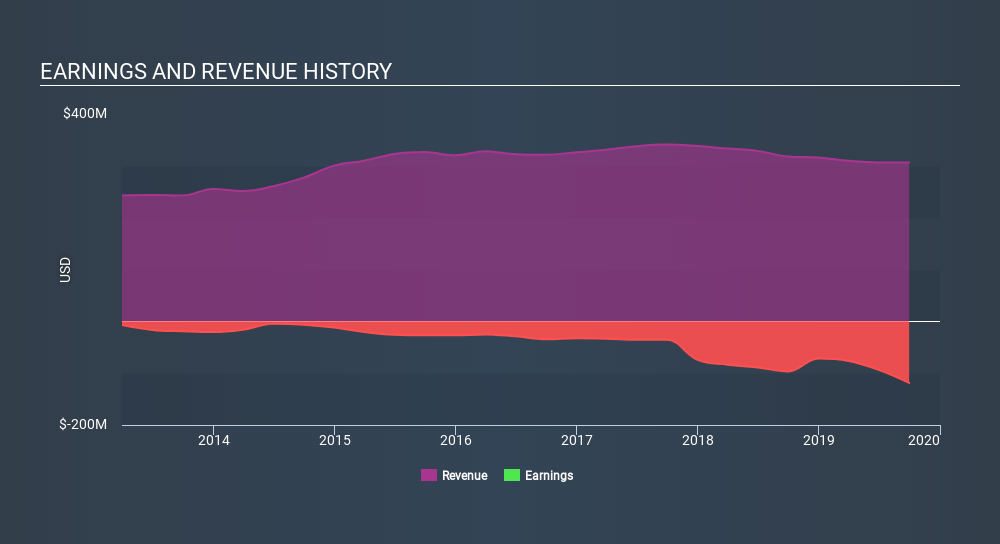

Given that StoneMor didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last half decade, StoneMor saw its revenue increase by 0.7% per year. That's far from impressive given all the money it is losing. It's not so sure that share price crash of 48% per year is completely deserved, but the market is doubtless disappointed. We'd be pretty cautious about this one, although the sell-off may be too severe. We'd recommend focussing any further research on the likelihood of profitability in the foreseeable future, given the muted revenue growth.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at StoneMor's financial health with this free report on its balance sheet.

A Different Perspective

StoneMor shareholders are down 73% for the year, but the market itself is up 10%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 46% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand StoneMor better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for StoneMor (of which 2 are potentially serious!) you should know about.

Of course StoneMor may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:STON

StoneMor

StoneMor Inc. owns and operates cemeteries and funeral homes in the United States.

Slightly overvalued with worrying balance sheet.

Similar Companies

Market Insights

Community Narratives