- United States

- /

- Hospitality

- /

- NYSE:SHCO

Assessing Soho House & Co (SHCO) Valuation After a Strong Year of Share Price Growth

Reviewed by Simply Wall St

See our latest analysis for Soho House & Co.

Momentum looks to be building for Soho House & Co, with the share price showing strong upward movement over the past year. After some recent volatility, the stock is still trading near recent highs, and its 1-year total shareholder return tops 70%. This is a clear signal that investors are warming to its growth story.

If Soho House’s strong run has you thinking bigger, it could be the perfect moment to see what else is trending by exploring fast growing stocks with high insider ownership.

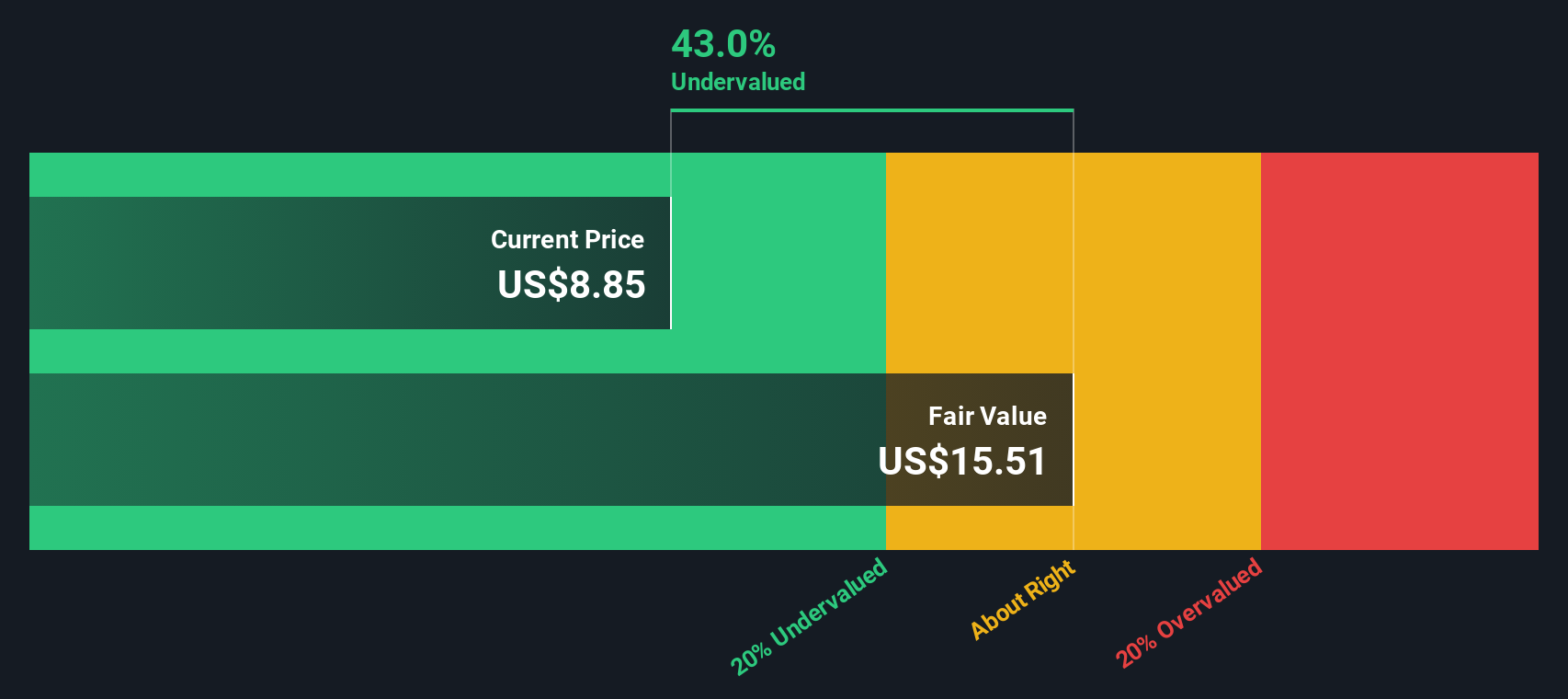

With shares up sharply in recent months, the key question is whether Soho House & Co remains undervalued based on its future prospects, or if the current price already reflects all the anticipated growth ahead.

Most Popular Narrative: Fairly Valued

With Soho House & Co shares closing at $8.82 and the most closely followed narrative setting fair value at $9.00, there is near alignment between market price and expectations. The narrative's fair value is only 2% above the last close, prompting a closer look at the story driving this perspective.

New initiatives such as the launch of an industry-leading ERP system are designed to streamline finance operations, procurement, and staffing across their global presence. This is expected to lead to cost efficiencies and improved earnings in the future.

Want to find out why analysts are so optimistic about Soho House’s path to profitability? The key to this valuation lies in bold operational upgrades and a finely tuned membership strategy. Curious about the specific quantitative forecasts that shape this narrative? Unlock the full breakdown and see what’s driving the fair value calculation.

Result: Fair Value of $9.00 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, financial misstatements and uncertainty around strategic decisions could challenge Soho House & Co's growth outlook. This may keep investors attentive in the months ahead.

Find out about the key risks to this Soho House & Co narrative.

Another View: SWS DCF Model Provides a Different Angle

While the market price is in line with analyst consensus, our DCF model offers a different perspective. According to this approach, Soho House & Co shares are trading above their fair value, with a fair value estimate of $7.33. This suggests the stock may be overvalued if you rely on future cash flows instead of growth stories. Which method gives the most accurate insight for investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Soho House & Co for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Soho House & Co Narrative

If you think your perspective might differ, or if you’re inclined to dig deeper on your own, you can shape your own analysis in just minutes with Do it your way.

A great starting point for your Soho House & Co research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't let opportunity pass you by. The investing landscape is full of untapped potential, and these tailored lists make it easy to spot your next big winner.

- Uncover rapid growth stories by targeting innovation leaders using these 25 AI penny stocks. Ride the tech momentum that's capturing the market's attention.

- Boost your portfolio income and increase resilience when you select from these 16 dividend stocks with yields > 3%, which offers consistently strong yields above 3%.

- Catch the buzz surrounding digital finance and secure your stake by checking out these 82 cryptocurrency and blockchain stocks, featuring blockchain trailblazers and cryptocurrency plays.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SHCO

Soho House & Co

Operates a global membership platform of physical and digital spaces that connects a group of members in the United Kingdom, the Americas, Europe, and internationally.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives