- United States

- /

- Hospitality

- /

- NYSE:SHAK

Shake Shack (SHAK): Evaluating Valuation Following Recent Share Price Decline

Reviewed by Simply Wall St

Shake Shack (SHAK) shares have seen some ups and downs lately, with the stock posting a nearly 10% decline over the past month. Investors are keeping an eye on what might be driving this shift, weighing recent performance against the company’s longer-term growth trajectory.

See our latest analysis for Shake Shack.

Shake Shack’s recent downward momentum marks a shift from what had been a strong multiyear run. The one-year total shareholder return is down over 31%, even as its three-year total return remains up an impressive 73%. The latest decline suggests investors are re-evaluating its growth prospects following a period of rapid expansion and changing market sentiment.

If Shake Shack’s wild ride has you wondering what else is out there, now’s the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With Shake Shack trading notably below analyst targets but facing recent declines, the big question now is whether the current price reflects a real bargain or if the market has already taken all future growth potential into account.

Most Popular Narrative: 26.8% Undervalued

Shake Shack’s fair value is pegged far above its last close, creating a wide gap for investors to dissect. The most widely-followed narrative contends the stock’s true worth goes well beyond current market pessimism, underpinned by its multi-year growth investments.

Menu innovation, digital upgrades, and targeted marketing are fueling stronger sales growth, brand equity, and improved guest experiences, boosting margins and long-term earnings power. Strategic expansion into urban, international, and experiential formats, alongside operational improvements and sustainability efforts, positions Shake Shack for sustained, system-wide revenue and margin gains.

Curious why the experts are willing to price in a future usually reserved for the market’s hottest disruptors? The secret sauce here is an unprecedented financial ramp-up with big earnings, aggressive growth, and a profit margin leap rarely seen in food service. The numbers behind that fair value might surprise you.

Result: Fair Value of $114.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost inflation and slowing customer traffic could quickly challenge even the most optimistic growth outlook for Shake Shack going forward.

Find out about the key risks to this Shake Shack narrative.

Another View: Is the Premium Justified?

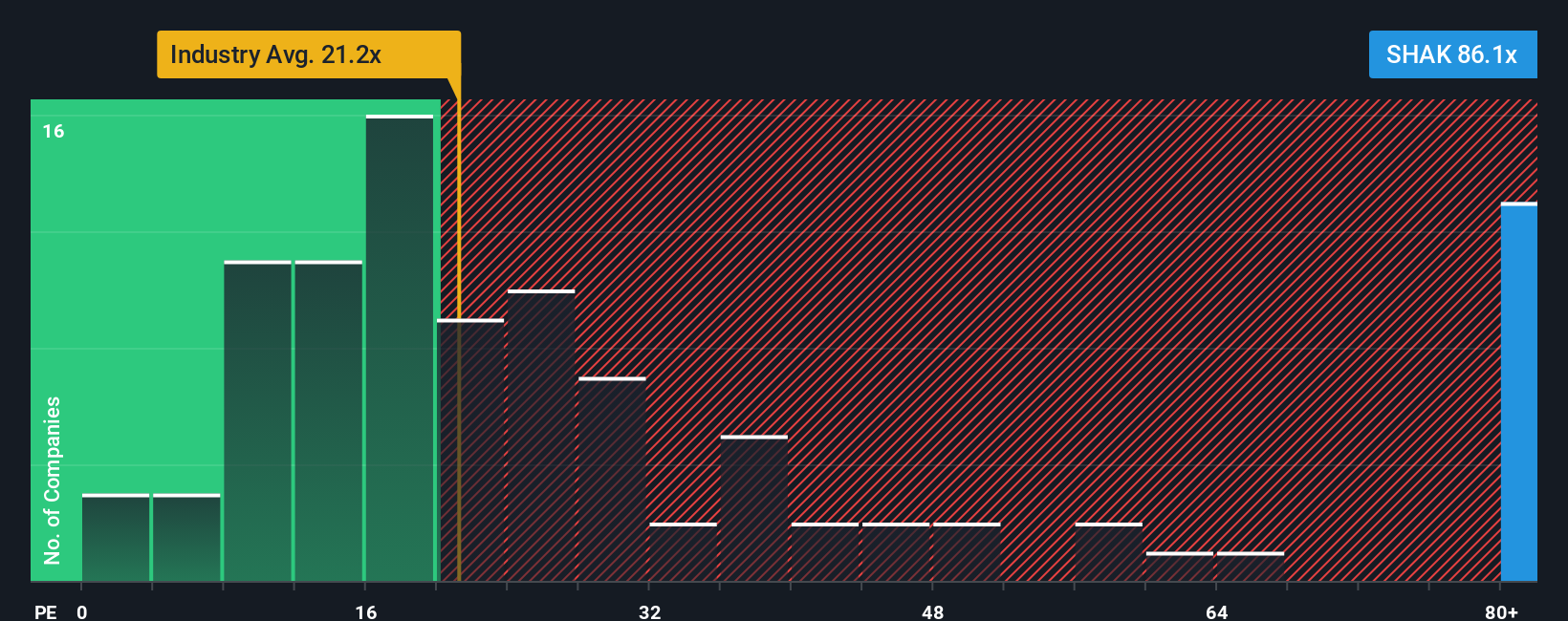

Taking a different approach, Shake Shack’s price compared to its current earnings is much higher than both the industry average and its direct peers. Its ratio sits at 79.1 times earnings, while the US Hospitality sector averages just 20.7 times, and its peers come in at 25.9 times. The market’s fair ratio suggests 27 times would be more reasonable. This large gap raises real questions about whether investors are pricing in too much future growth or if the premium is worth paying for a comeback.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Shake Shack Narrative

If you see things differently or want to dive deeper into Shake Shack's numbers, it's easy to craft your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Shake Shack.

Looking for more investment ideas?

Why settle for just one stock when countless opportunities are waiting? Let Simply Wall Street’s powerful screener connect you with standout businesses and future winners.

- Unlock steady income streams by checking out these 16 dividend stocks with yields > 3% offering yields above 3% for your portfolio.

- Capitalize on booming trends and access tomorrow’s leaders with these 25 AI penny stocks that are making waves with artificial intelligence breakthroughs.

- Seize undervalued potential by reviewing these 919 undervalued stocks based on cash flows currently trading for less than their future cash flows suggest.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SHAK

Shake Shack

Owns, operates, and licenses Shake Shack restaurants (Shacks) in the United States and internationally.

Solid track record with reasonable growth potential.

Market Insights

Community Narratives