- United States

- /

- Hospitality

- /

- NYSE:SHAK

Autonomous Robot Delivery Rollout Could Be a Game Changer for Shake Shack (SHAK)

Reviewed by Sasha Jovanovic

- Earlier this week, Coco Robotics announced it has started delivering Shake Shack favorites to Chicago customers via autonomous robots in partnership with Uber Eats, initially launching at two locations with citywide expansion plans.

- This initiative not only integrates seamlessly with Shake Shack’s existing Uber Eats system but also eliminates extra steps for staff, aiming to accelerate fulfillment especially during peak demand and introduce a frictionless guest experience.

- We'll explore how the rollout of autonomous robot deliveries could impact Shake Shack's operational efficiency and long-term investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Shake Shack Investment Narrative Recap

To be a Shake Shack shareholder, you need to believe that investments in technology, innovation, and new formats can consistently drive sales and operational efficiency, even as input costs and competition remain pressures. While the launch of autonomous robot deliveries in Chicago highlights progress toward more efficient peak-hour fulfillment, this development does not materially change the company's current short-term catalysts or its biggest risks, such as persistent commodity cost pressures or the need for sustained traffic gains.

The recent Q3 earnings announcement stands out as particularly relevant, demonstrating improved revenues and a return to net profitability, yet the stock price fell slightly after the report. This underscores that, despite operational wins and new tech rollouts like robotics, investors remain focused on broader risk factors like cost inflation and the pace of comparable sales improvement.

Yet, despite the promise of automation, a key ongoing risk that investors should be aware of is the potential for rising beef and commodity costs to outweigh operational gains if...

Read the full narrative on Shake Shack (it's free!)

Shake Shack's outlook projects $2.0 billion in revenue and $107.9 million in earnings by 2028. This scenario assumes a 14.8% annual revenue growth rate and an $88 million increase in earnings from the current level of $19.9 million.

Uncover how Shake Shack's forecasts yield a $114.36 fair value, a 30% upside to its current price.

Exploring Other Perspectives

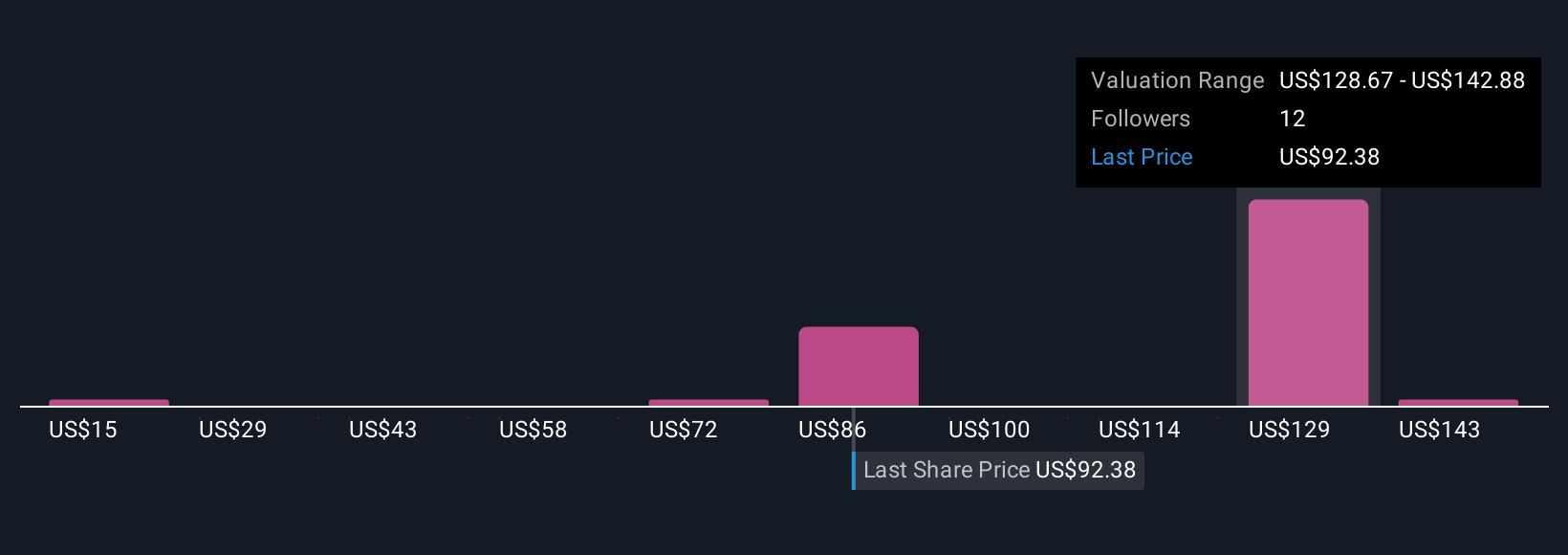

Five fair value estimates from the Simply Wall St Community for Shake Shack range widely from US$23.32 to US$157.09 per share. While opinions clearly diverge, upcoming shifts in operational efficiency through automation could influence both risk and reward for holders, see how others view SHAK’s outlook.

Explore 5 other fair value estimates on Shake Shack - why the stock might be worth less than half the current price!

Build Your Own Shake Shack Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Shake Shack research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Shake Shack research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Shake Shack's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SHAK

Shake Shack

Owns, operates, and licenses Shake Shack restaurants (Shacks) in the United States and internationally.

Solid track record with reasonable growth potential.

Market Insights

Community Narratives