- United States

- /

- Hospitality

- /

- NYSE:SGHC

Super Group (NYSE:SGHC): Assessing Valuation Following Recent Share Price Volatility

Reviewed by Simply Wall St

Super Group (NYSE:SGHC) has seen a volatile stretch over the past month, with shares dipping roughly 15%. While there is no single event behind this move, it invites a closer look at what is driving recent sentiment.

See our latest analysis for Super Group (SGHC).

Despite some recent turbulence, Super Group (SGHC) still has strong momentum on its side. The latest one-month share price return was a notable -14.5%. Zooming out reveals an impressive 81% year-to-date share price gain and a 1-year total shareholder return of over 180%, suggesting investors with a longer view have been well rewarded.

If the market’s shifting moods have you curious, it might be the perfect time to broaden your perspective and discover fast growing stocks with high insider ownership

With Super Group’s impressive rally, the key question now is whether further upside remains, or if current prices already reflect the company’s strong growth. Could there still be an opportunity for investors, or is future progress fully priced in?

Most Popular Narrative: 35.5% Undervalued

Super Group (SGHC) is trading at $11.37, while the fair value suggested by the most popular narrative is $17.63. This sizable gap has sparked debate about what is powering the bullish outlook on the stock.

Accelerated investment in technology, including the addition of a Group CTO and scaling AI/data-driven initiatives, is enhancing product offerings, automating processes, and driving cost and marketing efficiencies. This may lead to structurally higher EBITDA margins and improved free cash flow.

Curious what ambitious targets are built into this price? Analysts are betting on a rare combination of profit margin expansion and three-year earnings growth that could reshape expectations for the entire sector. See the full story to uncover the assumptions supporting this bold fair value.

Result: Fair Value of $17.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regional regulatory pressures and rising marketing costs could challenge Super Group’s ambitious growth plans and put pressure on future profitability.

Find out about the key risks to this Super Group (SGHC) narrative.

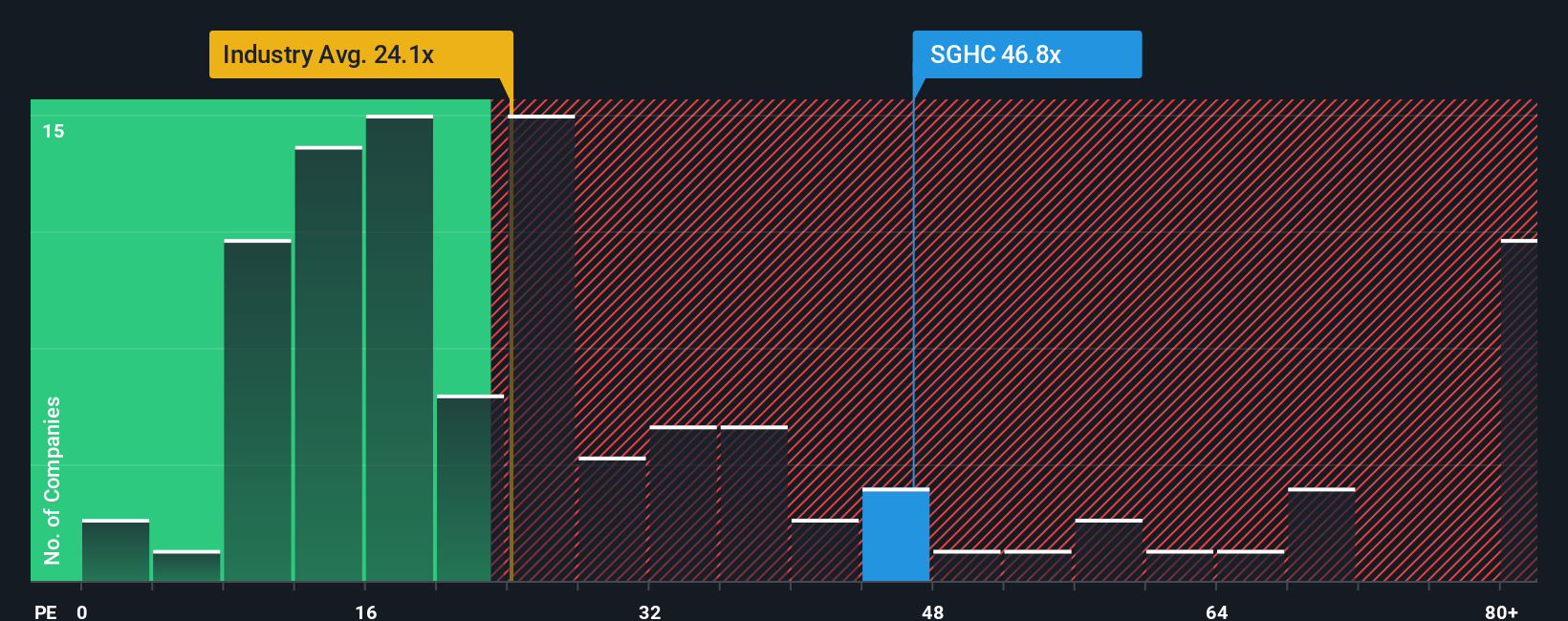

Another View: Market Ratios Tell a Cautionary Tale

Looking through the lens of market valuation, the current price puts Super Group at a price-to-earnings ratio of 39.8x. That is much higher than the industry average of 24.1x or even its peer group at 14.5x. The fair ratio, based on fundamentals, points closer to 37x. This gap suggests investors are paying up for growth, but it also raises the stakes if future earnings do not stack up. Could this premium persist, or is adjustment on the horizon?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Super Group (SGHC) Narrative

If you see things differently or would rather dive into the details on your own terms, building your own perspective is quick and easy. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Super Group (SGHC).

Looking for more investment ideas?

Ready to take your investing to the next level? Don’t wait on the sidelines while others uncover tomorrow’s biggest opportunities. Let Simply Wall Street lead you to smarter stock picks now.

- Unlock high-growth potential in artificial intelligence trends by tapping into these 26 AI penny stocks, which are shaping productivity and innovation across every industry.

- Boost your income with consistent cash flow and start growing your wealth with these 21 dividend stocks with yields > 3% offering yields above 3%.

- Ride the momentum of emerging tech by seizing the chance to invest in these 28 quantum computing stocks at the forefront of computational breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SGHC

Super Group (SGHC)

Operates as an online sports betting and gaming operator.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives