- United States

- /

- Hospitality

- /

- NYSE:SGHC

How Investors May Respond To Super Group (SGHC) Surging Q3 Results and Raised Full-Year Revenue Guidance

Reviewed by Sasha Jovanovic

- Super Group (SGHC) Limited recently reported third-quarter 2025 results, posting US$557 million in sales and US$96 million net income, both increasing markedly year-over-year, and raised its full-year revenue guidance to a range of US$2.17 billion to US$2.27 billion.

- This combination of strong sales momentum and higher projected revenues highlights management's confidence in the company's ongoing expansion and operational performance.

- We'll now consider how this robust quarterly performance and higher revenue guidance update impact Super Group's investment narrative and outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Super Group (SGHC) Investment Narrative Recap

If you believe in Super Group’s ability to drive consistent revenue and profit growth through disciplined geographic expansion and product innovation, then the latest quarterly beat and upgraded full-year revenue guidance reinforce that narrative. While these results materially support the near-term catalyst of expanding outside the U.S. and capitalizing on regulatory tailwinds, the biggest ongoing risk remains the potential for tightening regulations and marketing constraints in key regions, which could still impact scalability and margins. Among the recent developments, July’s announcement of Super Group’s exit from the U.S. iGaming market stands out as particularly relevant. The successful redirection of resources to more profitable markets, as seen in the latest earnings outperformance, indicates an effective pivot toward high-return territories that may drive structural improvements in profitability. However, in contrast to this positive trend, investors should also be aware that regulatory tightening in Europe and APAC could suddenly...

Read the full narrative on Super Group (SGHC) (it's free!)

Super Group (SGHC)'s narrative projects $2.6 billion in revenue and $453.0 million in earnings by 2028. This requires 10.3% yearly revenue growth and a $316.8 million increase in earnings from the current $136.2 million.

Uncover how Super Group (SGHC)'s forecasts yield a $17.62 fair value, a 43% upside to its current price.

Exploring Other Perspectives

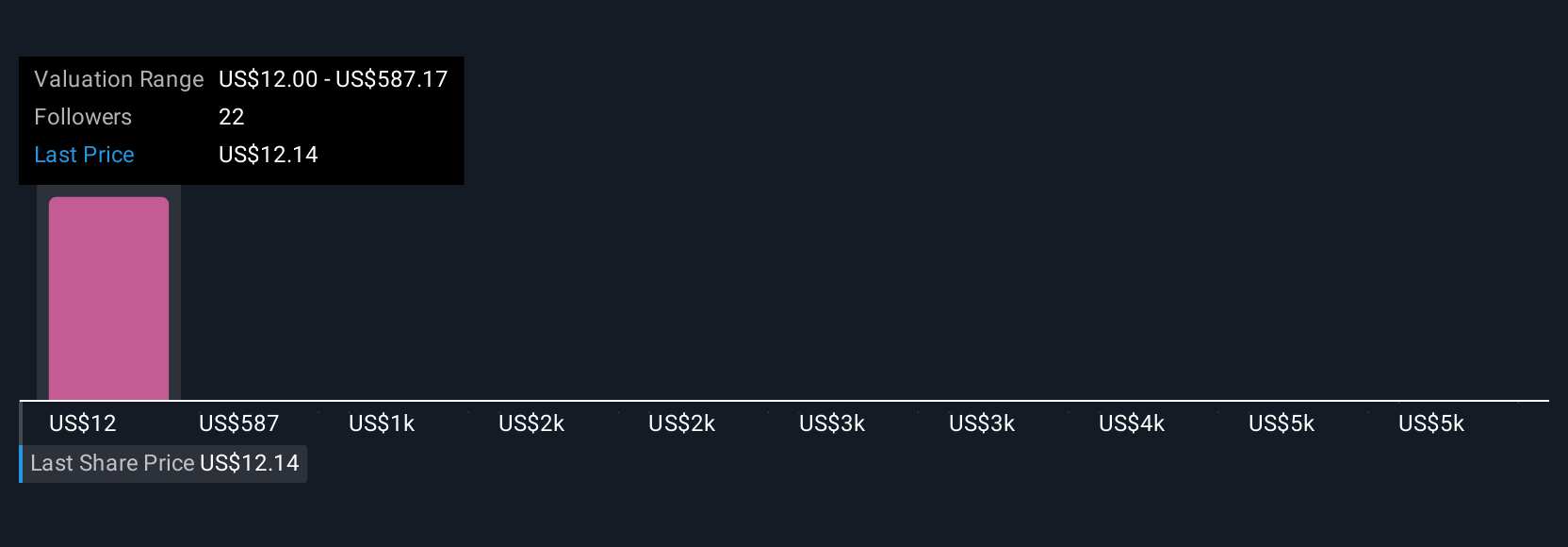

Fair value estimates from four Simply Wall St Community members span a wide range, from US$12 to over US$5,763. With strong recent sales growth but regulatory risks looming, investors may see differing visions for Super Group’s future. Compare your own view with other perspectives before reaching a conclusion.

Explore 4 other fair value estimates on Super Group (SGHC) - why the stock might be worth just $12.00!

Build Your Own Super Group (SGHC) Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Super Group (SGHC) research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Super Group (SGHC) research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Super Group (SGHC)'s overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SGHC

Super Group (SGHC)

Operates as an online sports betting and gaming operator.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives