- United States

- /

- Consumer Services

- /

- NYSE:SCI

Will SCI’s New $2.5 Billion Credit Facilities Reshape Service Corporation International’s Strategic Flexibility?

Reviewed by Sasha Jovanovic

- On November 20, 2025, Service Corporation International announced it had entered into a new senior unsecured credit agreement featuring a US$750 million term loan facility and a US$1.75 billion revolving credit facility, both maturing in November 2030 and backed by subsidiary guarantees.

- This substantial increase in borrowing capacity is designed to provide greater financial flexibility for the company, while new covenants on leverage and capital allocation may influence its future strategic moves.

- We'll examine how SCI's expanded credit facilities and debt structure might reshape its investment narrative going forward.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Service Corporation International Investment Narrative Recap

To be a shareholder in Service Corporation International, you need to believe in the company’s ability to sustain stable cash flows from preneed sales and maintain pricing power in its core funeral services even as cremation trends and acquisition reliance present ongoing challenges. The recent credit agreement expands SCI’s financial flexibility, but its impact on near-term earnings is not expected to materially alter the primary catalyst, which remains robust preneed and cemetery sales momentum, nor does it immediately change the biggest risk: managing elevated debt levels in a shifting rate environment.

Of the recent company updates, the latest earnings guidance revision in October is especially connected to today’s debt financing announcement. While added credit lines can support operations and future acquisitions, the lowered earnings outlook reminds investors that top-line growth and profitability are still being tested by margin pressures and unpredictable funeral demand cycles.

However, investors should also be cautious about the potential effect of higher leverage on future dividend growth and capital allocation if market conditions shift...

Read the full narrative on Service Corporation International (it's free!)

Service Corporation International's outlook projects $4.7 billion in revenue and $656.4 million in earnings by 2028. This forecast assumes a 3.5% annual revenue growth rate and a $121.5 million increase in earnings from the current $534.9 million.

Uncover how Service Corporation International's forecasts yield a $95.40 fair value, a 21% upside to its current price.

Exploring Other Perspectives

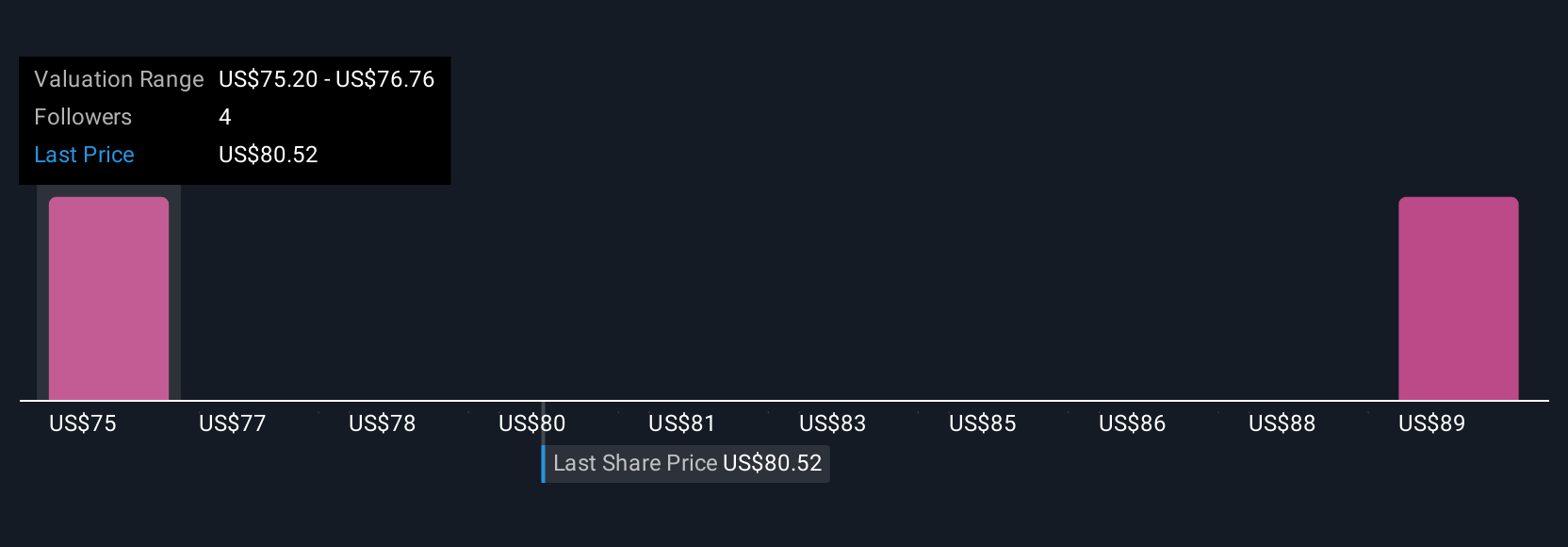

Simply Wall St Community members provided two fair value estimates for SCI, ranging from US$95.40 to US$102.12 per share. While expectations for robust preneed sales remain a possible catalyst, opinions on value still vary, reflecting how market participants weigh both opportunities and risks for SCI’s longer-term performance.

Explore 2 other fair value estimates on Service Corporation International - why the stock might be worth as much as 29% more than the current price!

Build Your Own Service Corporation International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Service Corporation International research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Service Corporation International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Service Corporation International's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SCI

Service Corporation International

Provides deathcare products and services in the United States and Canada.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.