- United States

- /

- Hospitality

- /

- NYSE:RCL

Does Royal Caribbean’s Recent 16.9% Drop Signal a Hidden Value Opportunity?

Reviewed by Bailey Pemberton

- Ever wondered if Royal Caribbean Cruises is trading at a fair price, or if there’s hidden value just waiting to be uncovered? Let’s dig in to see what’s really going on beneath the surface of the share price.

- The stock has sailed through some choppy waters recently, with a jump of 4.4% this week but losing 16.9% over the past month. Longer-term, it is still impressively up 15.3% year-to-date and 10.6% over the last twelve months.

- Recent headlines have focused on the cruise industry’s strong demand recovery and capacity expansion, as well as Royal Caribbean’s ongoing efforts to manage debt while investing in new ships. These developments have stoked both optimism and debate among investors about the company’s growth prospects and resilience.

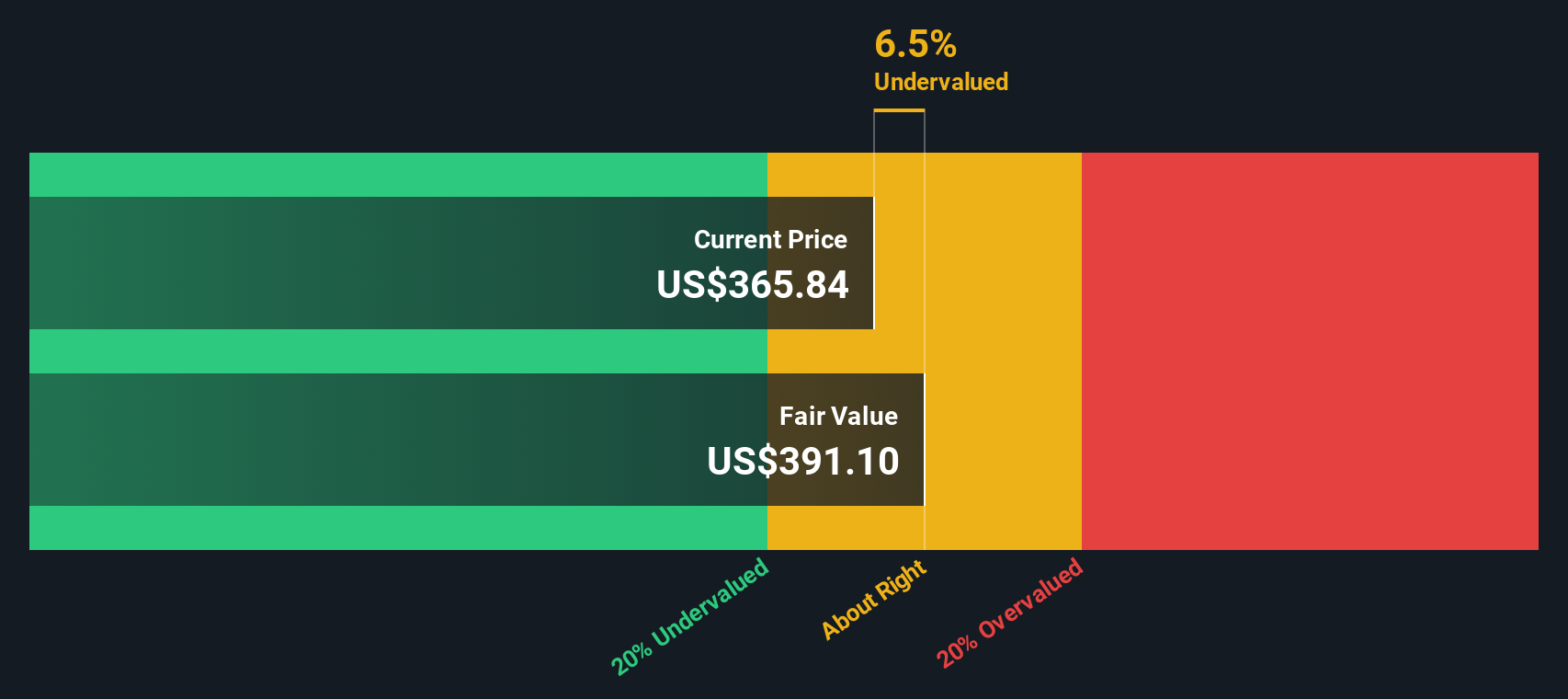

- On our valuation checks, Royal Caribbean Cruises earns a stellar 6 out of 6, outpacing peers for potential value. Next, we will look at how traditional valuation approaches stack up for RCL, but keep an eye out for the method at the end that might just offer the most complete view.

Approach 1: Royal Caribbean Cruises Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. This approach aims to determine what those future dollars are truly worth right now.

For Royal Caribbean Cruises, the model starts with its latest reported Free Cash Flow (FCF) of $2.18 Billion. Analysts forecast strong growth, with FCF expected to reach $6.22 Billion by 2029. Looking further ahead, projections indicate free cash flows could climb above $10 Billion annually by 2035. These far-out figures are extrapolations rather than direct analyst estimates.

Based on this forward-looking assessment, the DCF model calculates a fair value for Royal Caribbean stock of $434.20 per share. Comparing this to the current market price, the model suggests the stock is undervalued by about 39.2%.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Royal Caribbean Cruises is undervalued by 39.2%. Track this in your watchlist or portfolio, or discover 917 more undervalued stocks based on cash flows.

Approach 2: Royal Caribbean Cruises Price vs Earnings (PE)

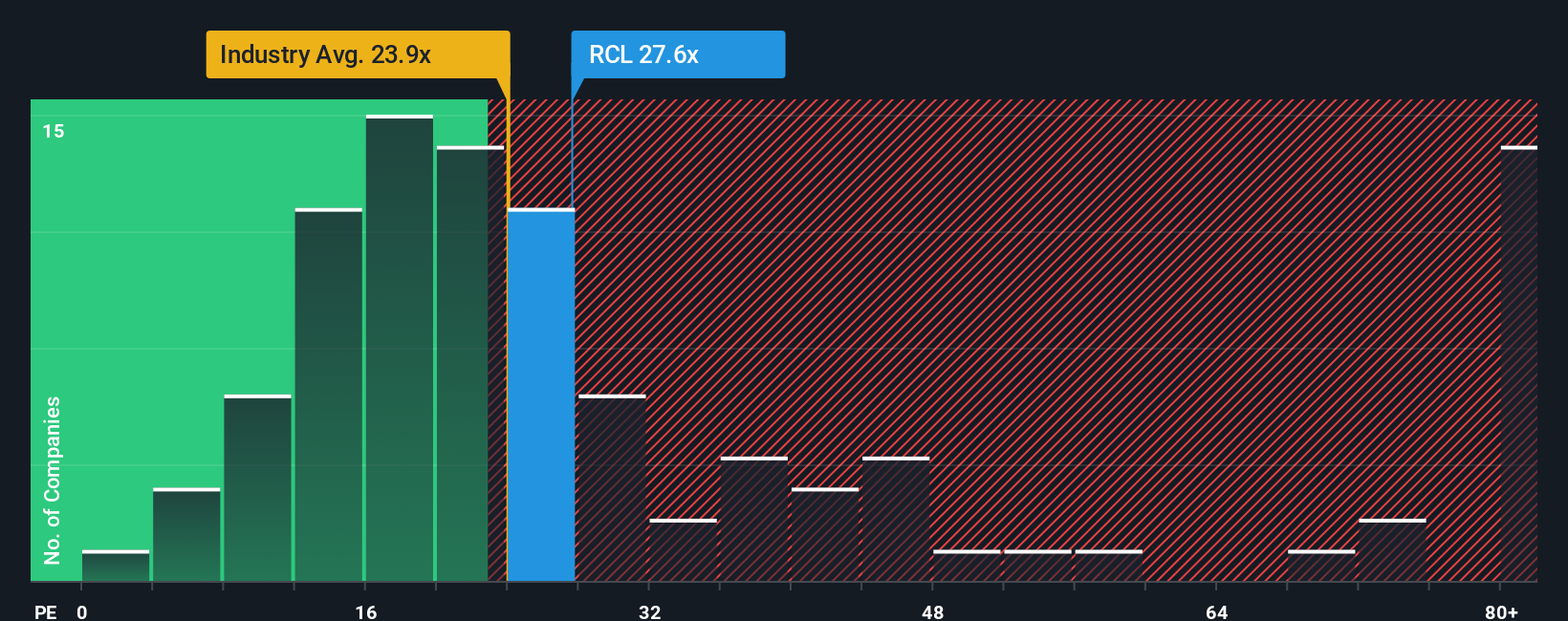

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies like Royal Caribbean Cruises because it directly compares a company’s current share price to its earnings per share. For businesses generating consistent profits, the PE ratio offers a clear, straightforward picture of how much investors are paying for each dollar of earnings.

It is important to remember, though, that what constitutes a “normal” or “fair” PE ratio can vary. Factors such as a company’s growth expectations and risk profile will influence whether a higher or lower PE is justified. Fast-growing, lower-risk companies typically command higher PE ratios, while slower growth or more risk generally means a lower PE is appropriate.

Right now, Royal Caribbean Cruises trades at a PE ratio of 17.7x. That is notably below the Hospitality industry average of 20.8x and also trails the average of its listed peers at 26.4x. However, absolute comparisons like these do not consider important differences such as Royal Caribbean’s earnings growth, profit margins, market cap or unique risks.

That is where Simply Wall St’s “Fair Ratio” comes in. This proprietary benchmark accounts for all those underlying factors to estimate what a reasonable PE multiple should be for Royal Caribbean Cruises right now. This approach goes beyond just lining up industry or peer averages and offers a more tailored and relevant standard by including the company’s actual growth trajectory and risk profile.

For Royal Caribbean Cruises, the Fair Ratio is 28.8x, comfortably above both the current PE and those typical benchmarks. The stock’s actual PE multiple sits well below this figure, suggesting the market may be discounting the company more than is warranted based on its earnings outlook and fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1422 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Royal Caribbean Cruises Narrative

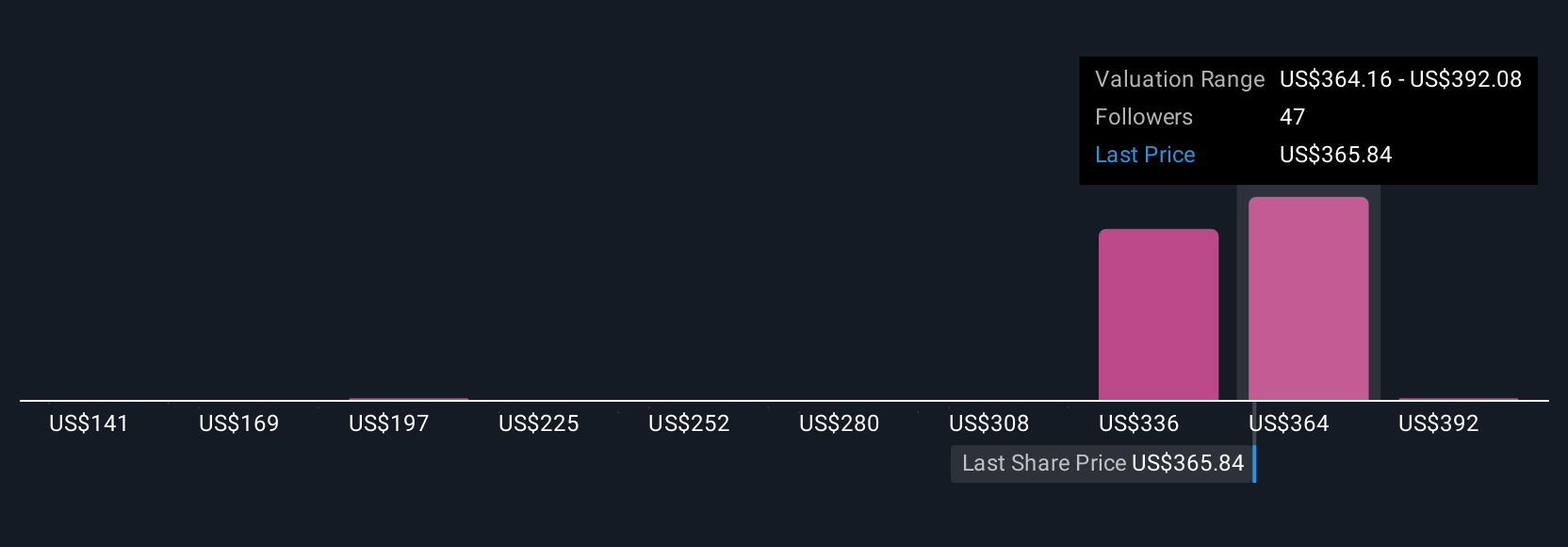

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your story behind the numbers. It lets you connect your own expectations for Royal Caribbean Cruises’ future revenue, earnings, and profit margins to a tailored financial forecast and a unique fair value.

Rather than relying on simple ratios or averages, a Narrative puts you in control. You can set your own assumptions and see how changing details might shift the company's outlook. Narratives act as a bridge from Royal Caribbean’s business story, such as new ships and growing onboard spend, through to what you actually think the stock is worth today.

The best part is that Narratives are easy to create and compare on Simply Wall St’s Community page, where millions of investors are already using them to discuss and challenge different views. Narratives update automatically as new information and earnings arrive, ensuring your investment thesis stays current.

For example, some investors might set a bullish Narrative for Royal Caribbean Cruises, forecasting robust earnings and higher fair values (as high as $420.00), while others build more cautious Narratives, reflecting risks and setting their fair value as low as $218.00. Narratives make these perspectives visible so you can compare your fair value to the current price and confidently decide when to buy or sell.

Do you think there's more to the story for Royal Caribbean Cruises? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RCL

Very undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives