- United States

- /

- Hospitality

- /

- NYSE:RCL

Are Rising Costs Shifting the Long-Term Investment Narrative for Royal Caribbean (RCL)?

Reviewed by Sasha Jovanovic

- Royal Caribbean Cruises Ltd. recently reported its third-quarter and nine-month results for 2025, with revenue of US$5.14 billion and net income of US$1.58 billion for the quarter, alongside continued high occupancy rates and increased passenger volumes compared to a year ago.

- Despite raising full-year guidance and announcing an ongoing buyback program, concerns over a slight revenue miss and rising costs emerged as key points for investors.

- We'll now explore how elevated operational costs and revenue trends may influence Royal Caribbean's investment narrative going forward.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Royal Caribbean Cruises Investment Narrative Recap

To be a Royal Caribbean shareholder, you need to believe demand for cruise vacations can withstand both consumer discretionary pressures and operating cost fluctuations. This latest report saw revenue and net income rise sharply, but the revenue shortfall and increasing costs came into focus without materially altering the immediate catalyst: ongoing high occupancy and yield growth from new ships; at the same time, the most immediate risk remains the possibility of softening close-in bookings if consumer spending weakens.

Royal Caribbean's recent buyback program update stands out, with over US$414 million in shares repurchased in just the third quarter. For investors, this aligns with current catalysts around capital returns and financial flexibility, offering additional shareholder value as core business metrics improve.

However, against this backdrop, it remains important for investors to keep an eye on the possibility of sudden shifts in consumer sentiment, as...

Read the full narrative on Royal Caribbean Cruises (it's free!)

Royal Caribbean Cruises is projected to generate $22.4 billion in revenue and $5.9 billion in earnings by 2028. This outlook requires 9.2% annual revenue growth and a $2.3 billion increase in earnings from the current $3.6 billion level.

Uncover how Royal Caribbean Cruises' forecasts yield a $344.09 fair value, a 34% upside to its current price.

Exploring Other Perspectives

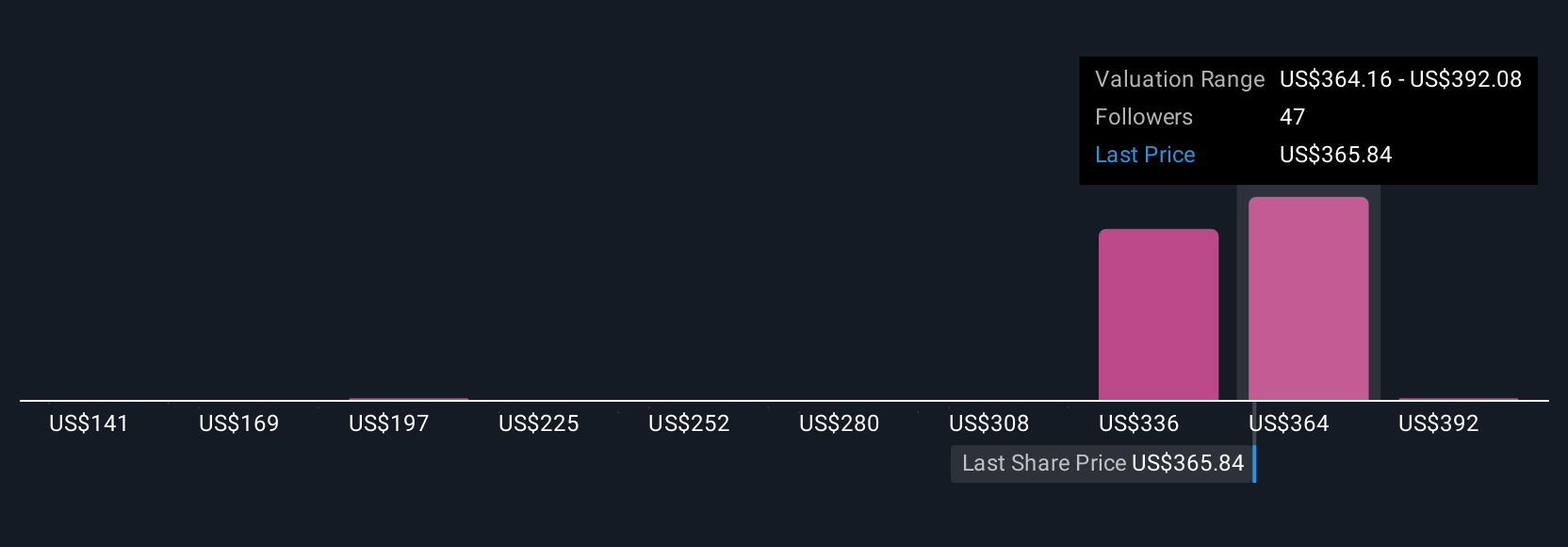

Simply Wall St Community members submitted 10 different fair value estimates for Royal Caribbean, ranging from US$214 to US$440 per share. While many see value, the risk of a sudden consumer pullback could have wide-ranging effects, making it worth exploring several viewpoints before acting.

Explore 10 other fair value estimates on Royal Caribbean Cruises - why the stock might be worth as much as 71% more than the current price!

Build Your Own Royal Caribbean Cruises Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Royal Caribbean Cruises research is our analysis highlighting 5 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Royal Caribbean Cruises research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Royal Caribbean Cruises' overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RCL

Very undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives