- United States

- /

- Hospitality

- /

- NYSE:QSR

Restaurant Brands International (QSR) Margin Drop Reinforces Concerns on Profitability and Valuation Narrative

Reviewed by Simply Wall St

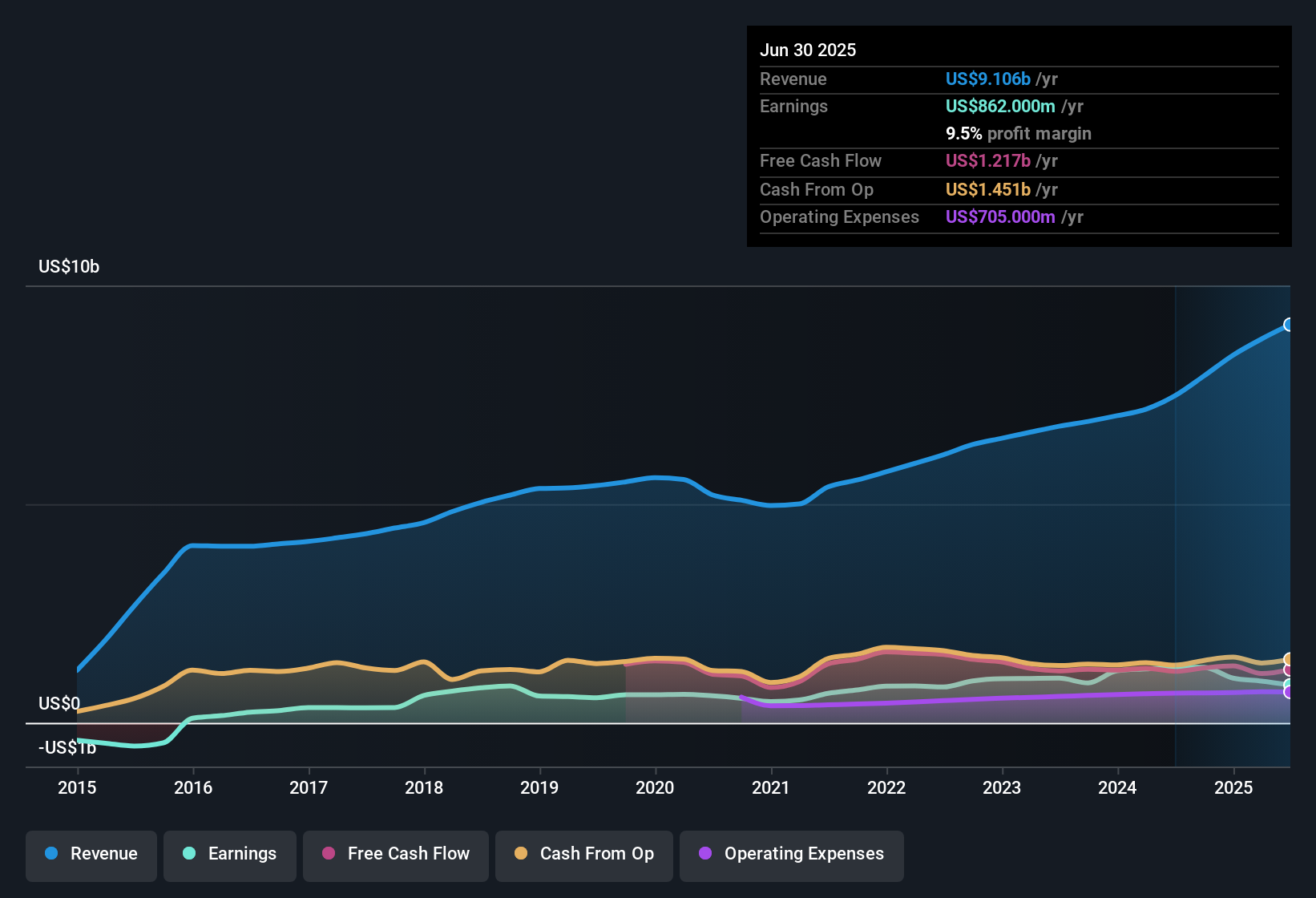

Restaurant Brands International (NYSE:QSR) posted net profit margins of 9.5%, down from 17% in the prior year, highlighting margin compression year-over-year. While the company’s earnings have grown by an average of 13.6% annually over the past five years, recent results show negative growth and forward-looking forecasts suggest annual earnings growth will slow to 7.76%. Revenue is projected to rise at 3.1% per year, which is notably behind the 10.3% pace of the broader US market. Despite these headwinds, QSR’s current share price of $67.01 sits below its estimated fair value of $82.02. This sets up a debate between recent profitability challenges and the stock’s valuation backdrop.

See our full analysis for Restaurant Brands International.Next up, we’ll put these latest numbers in context by comparing them to the narratives driving sentiment on Restaurant Brands International at Simply Wall St. Some perspectives could get reinforced, while others might be upended.

See what the community is saying about Restaurant Brands International

Profit Margin Projected to Nearly Double

- Analysts expect net profit margins to climb from 9.5% currently to 19.4% within three years, an ambitious forecast considering last year's decline from 17%.

- Consensus narrative notes this sizable margin recovery hinges on operational improvements and digital innovations driving system-wide efficiency.

- Digital ordering and loyalty platforms are seen as catalysts for higher per-store sales and EBITDA margins, directly backing expectations for nearly doubled profit margins.

- Yet, persistent cost inflation, especially in key inputs like beef and coffee, is highlighted by analysts as an obstacle that could limit the speed or extent of margin expansion unless offset by continued menu innovation and operational discipline.

- What’s notable is that the consensus view identifies franchise-led global expansion and menu refreshes as practical levers that could help margins snap back towards analyst targets if international headwinds remain manageable. 📊 Read the full Restaurant Brands International Consensus Narrative.

Capital-Light Growth Through Franchising

- The company’s franchise-led international expansion, particularly in populous markets like China, India, and Brazil, is supporting double-digit growth in unit count and securing recurring revenues with less capital at risk.

- According to the analysts' consensus, this capital-light model mitigates risk by scaling aggressively in emerging markets while shielding the company from some operational pressures.

- Strategic refranchising and faster-than-expected store remodels are said to strengthen franchisee profitability, aligning incentives and lifting cash flow at the corporate level.

- Execution challenges remain, namely bad debt spikes and restructuring in specific countries. Consensus believes a globally diversified footprint acts as a cushion against localized disruptions, and the franchise-first approach boosts earnings resilience.

Valuation Premium Despite Growth Slowdown

- QSR trades at a Price-To-Earnings Ratio of 25.5x, richer than both US Hospitality industry peers (23.7x) and its immediate rivals (22.8x), even as forward revenue growth estimates (3.1% per year) lag the industry pace (10.3%).

- Consensus narrative argues that while the headline multiple looks expensive against standard benchmarks, bulls point to the $67.01 share price still sitting below the DCF fair value of $82.02 and the analyst price target of $77.21.

- It is this discount to estimated intrinsic value, despite a sector premium on traditional earnings metrics, that keeps the valuation debate alive, especially if margin improvements materialize as projected.

- Analysts urge investors to scrutinize assumptions behind the margin and growth forecasts, given that the price target reflects the expectation of improved profitability, not just revenue gains.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Restaurant Brands International on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got another angle on the data? Share your insights and craft your version of the story in just a few minutes. Do it your way.

A great starting point for your Restaurant Brands International research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite some paths to recovery, Restaurant Brands International faces margin compression and a notable slowdown in revenue and earnings growth compared to sector peers.

If steady results are a must for your portfolio, consider using our stable growth stocks screener (2112 results) to discover companies delivering reliable growth and resilience across the market cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QSR

Restaurant Brands International

Operates as a quick-service restaurant company in Canada, the United States, and internationally.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives