- United States

- /

- Hospitality

- /

- NYSE:QSR

A Look at Restaurant Brands International's (NYSE:QSR) Valuation Following Strong Q3 Earnings Growth

Reviewed by Simply Wall St

Restaurant Brands International (NYSE:QSR) just shared its third-quarter earnings, showing sales, revenue, and net income all climbed compared to last year. The increase in earnings per share highlights ongoing operational momentum for the company.

See our latest analysis for Restaurant Brands International.

Alongside the upbeat earnings, Restaurant Brands International has also reaffirmed its quarterly dividend, reflecting stable returns for shareholders. While the share price has slipped about 3% over the past three months, long-term investors have seen a strong 45% total shareholder return over five years. This suggests that momentum remains solid for those with patience.

If you’re rethinking your next move, it might be the perfect time to broaden your investment search and discover fast growing stocks with high insider ownership

But with shares trading at a 20% discount to analyst targets following a period of muted returns, investors are left wondering if Restaurant Brands International is now undervalued, or if the market has already priced in future growth.

Most Popular Narrative: 15.4% Undervalued

With a fair value of $77.69 set by the most widely followed narrative and a last close price of $65.69, Restaurant Brands International appears compelling to value-focused investors, with an upside that stands out amid market uncertainty. This narrative considers evolving business drivers and new growth assumptions to reach its verdict.

Rapid international expansion, particularly through the franchise-led model in markets such as China, India, Turkey, Japan, and Brazil, is driving double-digit unit and system-wide sales growth. This directly supports recurring, capital-light revenue streams and higher long-term earnings visibility. Acceleration in menu innovation (notably at Tim Hortons, Burger King, and across international markets) and the revitalization of core brands (for example, new product platforms, premium and value menu balance, high-profile partnerships, ongoing Burger King "Reclaim the Flame" initiatives) have led to consistent increases in same-store sales and customer traffic. These factors are likely to fuel continued top-line growth and margin expansion.

What’s driving this valuation? Analysts behind this narrative are betting big on a powerful mix of international expansion and inventive product launches. Curious how these qualitative strengths turn into hard numbers? Find out which bold financial forecasts underpin this bullish outlook.

Result: Fair Value of $77.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising commodity costs and stiff competition from rivals may still challenge Restaurant Brands International's growth trajectory in the quarters ahead.

Find out about the key risks to this Restaurant Brands International narrative.

Another View: What Do the Multiples Say?

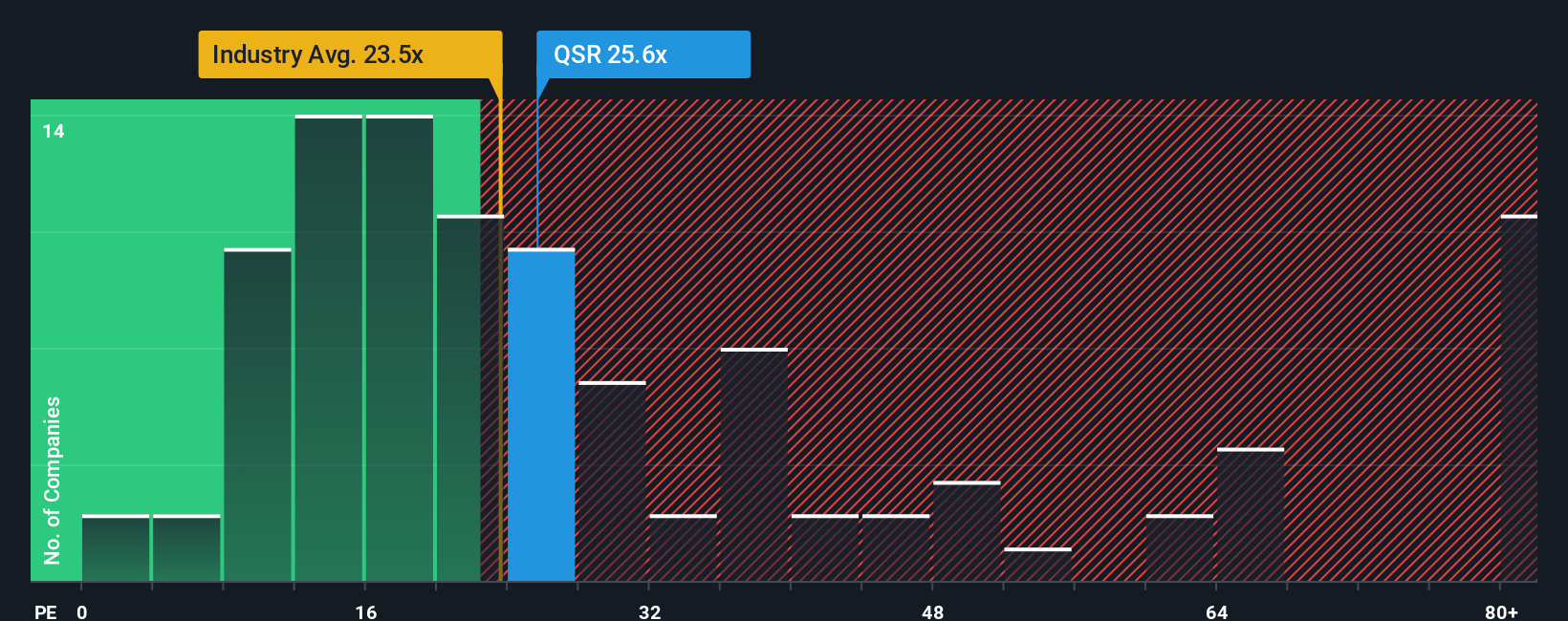

Looking at price-to-earnings, Restaurant Brands International trades at 23.2x earnings. That is slightly higher than the peer average of 22.5x, but sits just below the US Hospitality industry average of 23.5x. It is notably lower than the fair ratio of 31x, which suggests the market could recognize more value if sentiment improves. Could this modest gap signal an opportunity, or does it hint at lingering caution among investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Restaurant Brands International Narrative

If you have your own perspective or want to dive deeper into the data, you can craft a personalized narrative in just a few minutes. Do it your way

A great starting point for your Restaurant Brands International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Take your investing further by seeing what you could be missing. Simply Wall Street’s screeners put you front and center with tomorrow’s biggest growth and income opportunities.

- Boost your portfolio with strong income potential by checking out these 22 dividend stocks with yields > 3%, which features companies delivering yields above 3%.

- Unlock next-gen breakthroughs in medicine and technology by scanning these 33 healthcare AI stocks, which focuses on innovations transforming the healthcare sector.

- Seize opportunities others overlook by finding these 832 undervalued stocks based on cash flows, which identifies stocks trading below their true cash flow value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QSR

Restaurant Brands International

Operates as a quick-service restaurant company in Canada, the United States, and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives