- United States

- /

- Hospitality

- /

- NYSE:PRSU

Valuation Check: Is Pursuit Attractions and Hospitality (NYSE:PRSU) Still Undervalued After Recent Short-Term Pullback?

Reviewed by Simply Wall St

Pursuit Attractions and Hospitality (NYSE:PRSU) has been on investors’ radar after recent movement in its shares, which slipped 2% at last close and have seen a 1% pullback over the past month. In light of this, many are wondering how valuations stack up today.

See our latest analysis for Pursuit Attractions and Hospitality.

Pursuit’s recent share price has seen a mild setback over the last month, but taking a step back reveals a mixed picture. While the 90-day share price return was a strong 22.7%, the one-year total shareholder return is still negative at -6.1%. Momentum has clearly cooled off in the short term; however, the stock’s long run remains in positive territory with a notable five-year total shareholder return of 79.7%.

If you’re interested in discovering what else is trending, now’s a great time to broaden your scope and explore fast growing stocks with high insider ownership

With shares off their highs and long-term gains still in play, the central question for investors now is whether Pursuit Attractions and Hospitality remains undervalued, or if the market has already factored in its future prospects.

Most Popular Narrative: 14.1% Undervalued

Pursuit Attractions and Hospitality’s most widely followed narrative values shares more than 14% above yesterday’s closing price. The current consensus points to substantial upside, setting the stage for big expectations if the company’s future plans play out as projected.

Continued expansion into iconic, high-demand travel destinations like Costa Rica and ongoing investments in premium, immersive experiences (e.g., upgrades in Montana, new attractions in Jasper) are likely to capture a growing global middle class and increasing demand from millennial/Gen Z travelers seeking authentic, shareable experiences. This supports sustained revenue and earnings growth.

What powers this bullish projection? A combination of rapid profit margin shifts and aggressive long-term growth bets fuel the fair value math. The details of these bold assumptions may surprise you. Tap through to see exactly what’s driving analyst conviction behind this number.

Result: Fair Value of $42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks such as labor shortages or regulatory changes in travel could quickly challenge this upbeat outlook and shift sentiment for Pursuit Attractions and Hospitality.

Find out about the key risks to this Pursuit Attractions and Hospitality narrative.

Another View: Multiples Suggest Expensive Shares

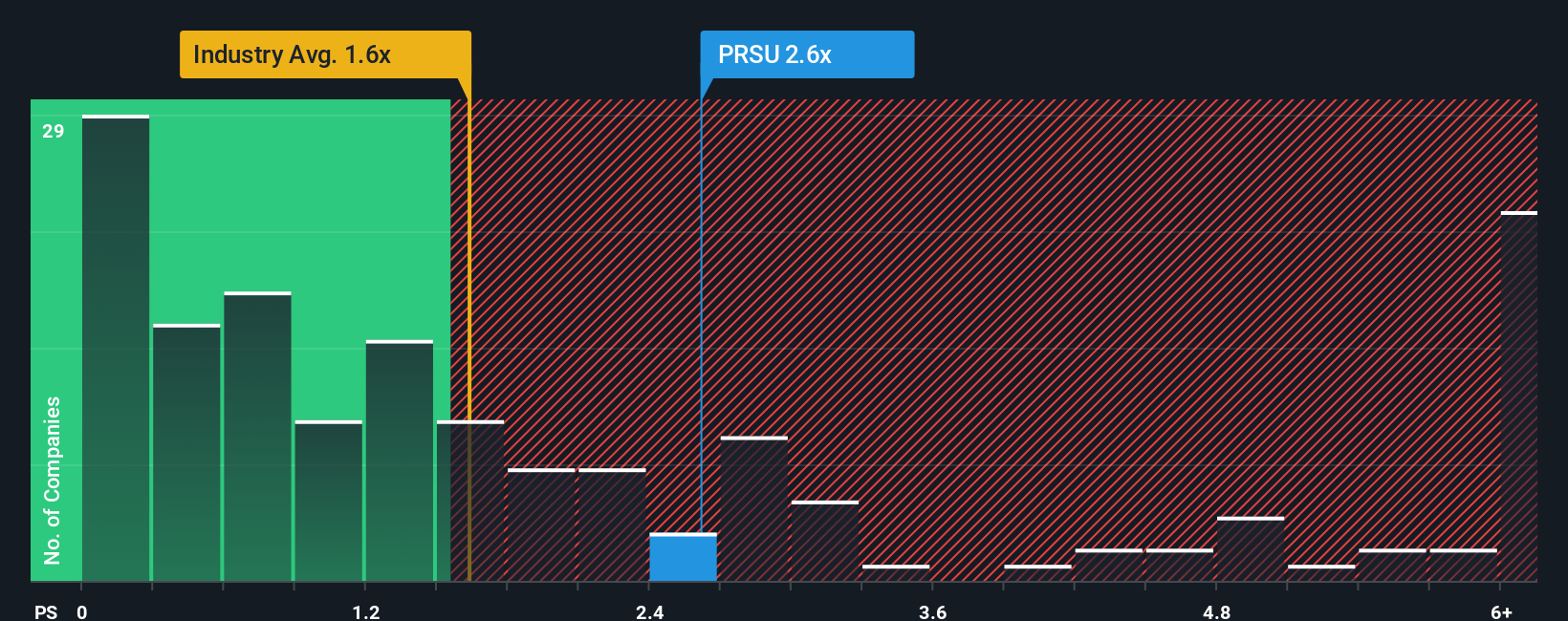

While the most popular narrative points to Pursuit Attractions and Hospitality being undervalued, market multiples tell a different story. The current price-to-sales ratio is 2.7x, much higher than both the US Hospitality industry’s average of 1.7x and the peer group’s 1.1x. Even the fair ratio sits notably lower at 1x. This gap signals investors are already paying a premium, raising questions about how much potential upside is left if growth does not accelerate.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pursuit Attractions and Hospitality Narrative

If you see things differently or want to dive deeper with your own research, you can quickly build your personal view to share or review. Do it your way

A great starting point for your Pursuit Attractions and Hospitality research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Thousands of investors are gaining an edge with fresh ideas tailored to specific opportunities. Boost your portfolio with these smart screens and avoid missing tomorrow’s winners.

- Boost your returns by sorting through these 864 undervalued stocks based on cash flows that show compelling value supported by strong cash flow fundamentals.

- Take advantage of big income opportunities by checking out these 21 dividend stocks with yields > 3% designed for investors who want yields above 3%.

- Get ahead of the tech revolution and focus on innovation leaders with these 26 AI penny stocks harnessing artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRSU

Pursuit Attractions and Hospitality

An attraction and hospitality company, owns and operates hospitality destinations in the United States, Canada, and Iceland.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives