- United States

- /

- Hospitality

- /

- NYSE:PRKS

United Parks & Resorts (NYSE:PRKS) stock performs better than its underlying earnings growth over last five years

Passive investing in index funds can generate returns that roughly match the overall market. But in our experience, buying the right stocks can give your wealth a significant boost. For example, the United Parks & Resorts Inc. (NYSE:PRKS) share price is up 98% in the last five years, slightly above the market return. We're also happy to report the stock is up a healthy 24% in the last year.

Since it's been a strong week for United Parks & Resorts shareholders, let's have a look at trend of the longer term fundamentals.

See our latest analysis for United Parks & Resorts

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the five years of share price growth, United Parks & Resorts moved from a loss to profitability. That's generally thought to be a genuine positive, so investors may expect to see an increasing share price.

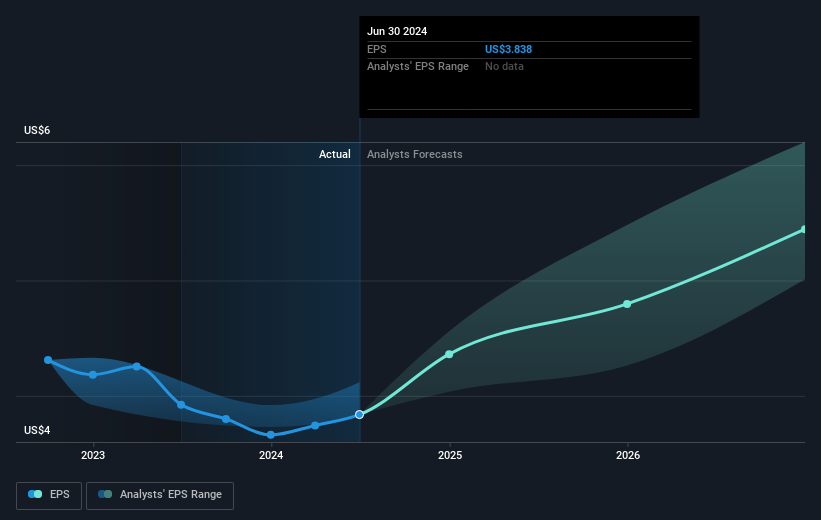

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of United Parks & Resorts' earnings, revenue and cash flow.

A Different Perspective

United Parks & Resorts shareholders are up 24% for the year. But that return falls short of the market. On the bright side, that's still a gain, and it's actually better than the average return of 15% over half a decade This could indicate that the company is winning over new investors, as it pursues its strategy. It's always interesting to track share price performance over the longer term. But to understand United Parks & Resorts better, we need to consider many other factors. Take risks, for example - United Parks & Resorts has 2 warning signs we think you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:PRKS

United Parks & Resorts

Operates as a theme park and entertainment company in the United States.

Fair value with limited growth.