- United States

- /

- Hospitality

- /

- NYSE:PLNT

How Planet Fitness’s (PLNT) Upcoming Investor Day and Earnings Could Shape Its Growth Narrative

Reviewed by Sasha Jovanovic

- Planet Fitness announced it will host an Investor Day on November 13, 2025, featuring presentations on strategy, operations, and multi-year targets, and also reported having around 20.8 million members and 2,762 clubs as of June 30, 2025.

- Following the company's announcement of an upcoming earnings release, which comes after exceeding revenue expectations last quarter, a major analyst reaffirmed support for Planet Fitness, signaling ongoing interest in the company's performance and outlook.

- We'll examine how the upcoming Investor Day and earnings announcement could impact Planet Fitness's growth-focused investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Planet Fitness Investment Narrative Recap

To be a Planet Fitness shareholder, the thesis often hinges on sustained membership growth, effective club expansion, and leveraging its value-focused, asset-light model. The upcoming Investor Day and earnings release both serve as short-term catalysts for confidence in the brand’s growth potential; however, neither announcement materially changes the immediate risk around member attrition linked to the click-to-cancel policy or the importance of maintaining new club momentum.

The Q3 earnings announcement is especially relevant, as it closely follows a quarter where Planet Fitness exceeded revenue expectations and showed solid same-store sales growth. This result will give investors a clearer data point on whether membership and top-line growth remain robust, key to supporting ongoing expansion and price targets set by analysts. In contrast, it is important for investors to be mindful of emerging challenges such as...

Read the full narrative on Planet Fitness (it's free!)

Planet Fitness is projected to achieve $1.6 billion in revenue and $312.8 million in earnings by 2028. This outlook relies on an annual revenue growth rate of 11.6% and a $123.8 million earnings increase from the current $189.0 million.

Uncover how Planet Fitness' forecasts yield a $122.81 fair value, a 34% upside to its current price.

Exploring Other Perspectives

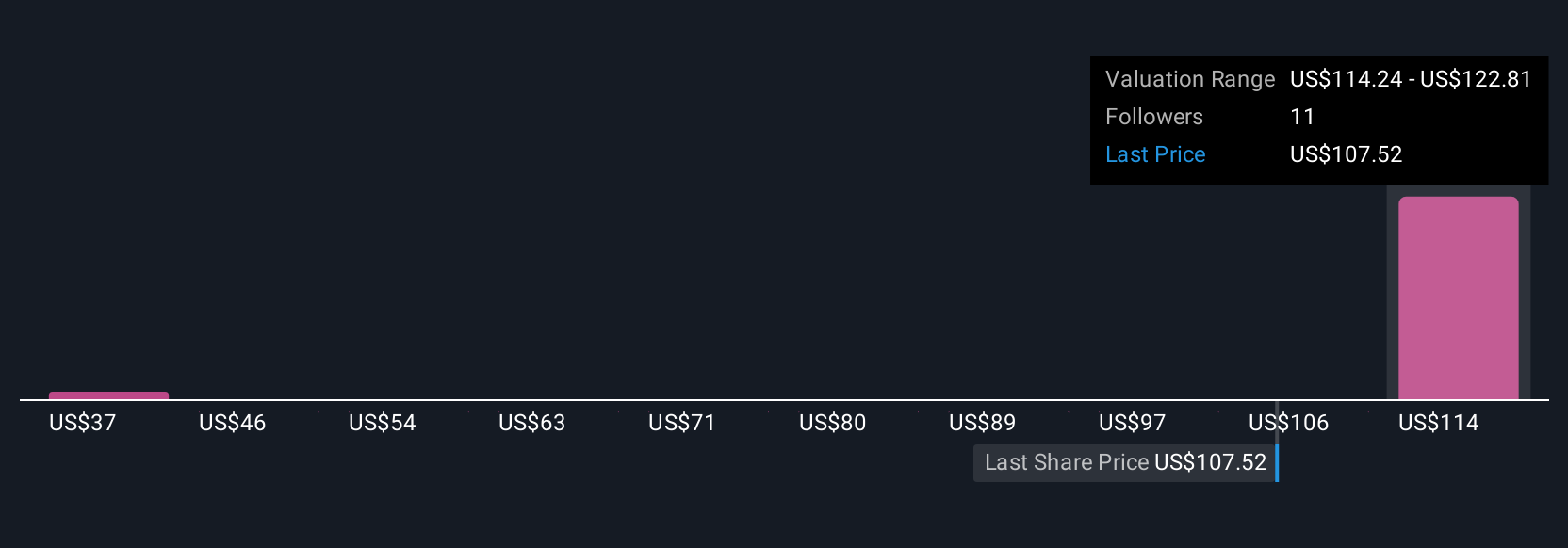

Simply Wall St Community members provided fair value estimates ranging from US$37.05 to US$122.81 based on three different analyses. While opinions vary, the recent focus on elevated attrition rates means even high-growth forecasts should be considered alongside changing member behavior trends.

Explore 3 other fair value estimates on Planet Fitness - why the stock might be worth as much as 34% more than the current price!

Build Your Own Planet Fitness Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Planet Fitness research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Planet Fitness research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Planet Fitness' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PLNT

Planet Fitness

Planet Fitness, Inc., together with its subsidiaries, franchises and operates fitness centers under the Planet Fitness brand.

Proven track record with limited growth.

Similar Companies

Market Insights

Community Narratives