- United States

- /

- Hospitality

- /

- NYSE:NCLH

Will Norwegian Cruise's (NCLH) Luxury Expansion Reshape Its Long-Term Brand and Competitive Edge?

Reviewed by Sasha Jovanovic

- Norwegian Cruise Line Holdings recently confirmed a newbuild order with Fincantieri for a third Prestige-Class ship for its ultra-luxury Regent Seven Seas Cruises, scheduled for delivery in 2033 as part of its ongoing expansion in the luxury segment.

- This investment highlights Norwegian's focus on enhancing its premium offerings and underlines the company's commitment to positioning itself in the highly competitive ultra-luxury cruise market.

- We’ll examine how continued fleet expansion in the luxury segment adds new context to Norwegian’s long-term investment narrative and growth outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Norwegian Cruise Line Holdings Investment Narrative Recap

To be a Norwegian Cruise Line Holdings shareholder today, you need confidence in the company’s push into ultra-luxury cruising and its ability to execute cost discipline, despite high debt levels and challenging Caribbean yields. The recent Prestige-Class ship order for 2033 showcases Norwegian’s luxury segment ambitions but does not materially affect its most important short-term catalyst, cost management and margin expansion, or its most pressing risk from leverage and refinancing needs.

Among recent company events, the announced expansion of Great Stirrup Cay stands out as relevant, signaling Norwegian’s intent to increase experiential offerings and onboard spend amid ongoing competitive and pricing pressures. This family-oriented destination enhancement complements the company’s investment in luxury cruising, aligning with underlying demand trends and their efforts to optimize yield and occupancy.

However, offsetting these ambitions is the persistent risk from elevated leverage and sizeable euro debt maturities...

Read the full narrative on Norwegian Cruise Line Holdings (it's free!)

Norwegian Cruise Line Holdings' narrative projects $12.6 billion in revenue and $1.7 billion in earnings by 2028. This requires 9.5% yearly revenue growth and a $980.8 million earnings increase from $719.2 million today.

Uncover how Norwegian Cruise Line Holdings' forecasts yield a $28.20 fair value, a 59% upside to its current price.

Exploring Other Perspectives

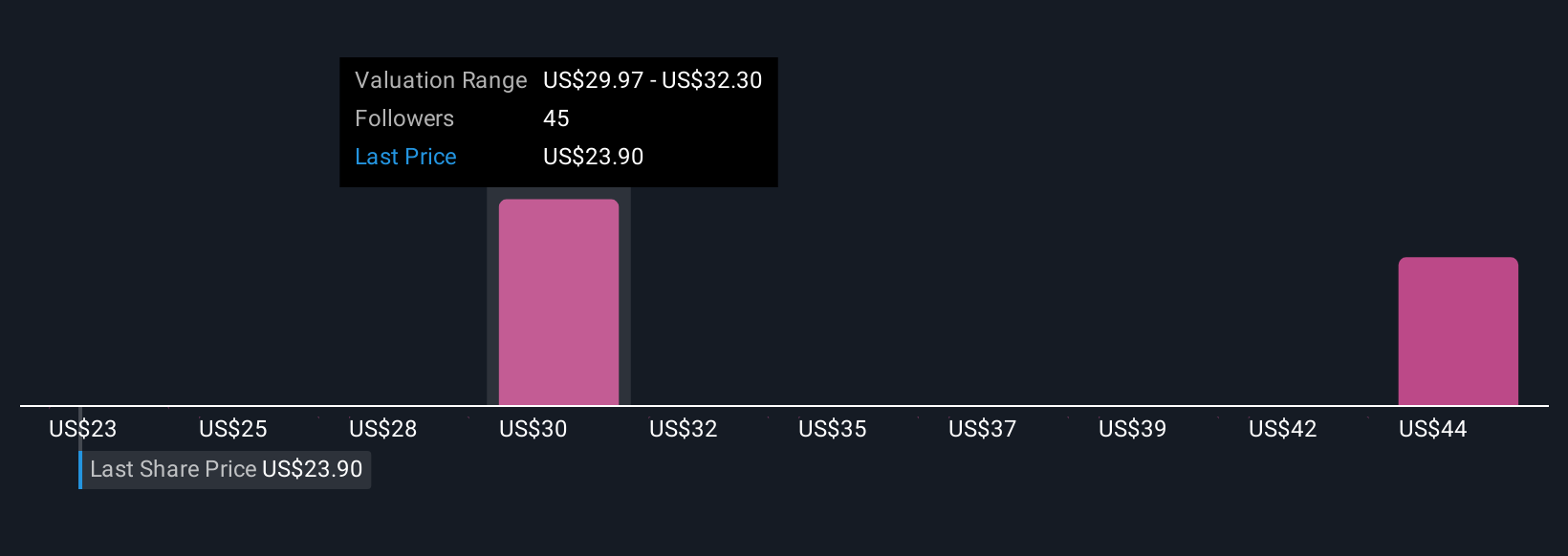

Six members of the Simply Wall St Community estimate Norwegian’s fair value between US$28.20 and US$45.10, reflecting a wide range of individual forecasts. These diverse views sit alongside analyst caution about debt refinancing risks, underlining why it’s important to explore multiple perspectives on Norwegian’s longer-term performance.

Explore 6 other fair value estimates on Norwegian Cruise Line Holdings - why the stock might be worth just $28.20!

Build Your Own Norwegian Cruise Line Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Norwegian Cruise Line Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Norwegian Cruise Line Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Norwegian Cruise Line Holdings' overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norwegian Cruise Line Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NCLH

Norwegian Cruise Line Holdings

Operates as a cruise company in North America, Europe, the Asia-Pacific, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives