- United States

- /

- Hospitality

- /

- NYSE:NCLH

Why Norwegian Cruise Line Holdings (NCLH) Is Down 16.2% After Mixed Q3 2025 Bookings and Profit Outlook

Reviewed by Sasha Jovanovic

- Norwegian Cruise Line Holdings recently reported its third-quarter 2025 results, highlighting record bookings, strong consumer demand, and increased revenue, but also revealing a decline in GAAP net income and lower-than-expected fourth-quarter projections.

- Amid continued investment in family-focused offerings and Caribbean expansion, the company is accelerating its shift toward shorter sailings and upgraded private island amenities to attract new demographics and boost occupancy.

- We'll now examine how the company's mixed earnings, improved bookings but falling profits, impact Norwegian Cruise Line's investment outlook and growth strategy.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Norwegian Cruise Line Holdings Investment Narrative Recap

To be a shareholder in Norwegian Cruise Line Holdings, you need to believe that its aggressive push into family-oriented, shorter sailings in the Caribbean will translate strong bookings into improved long-term profitability, an assumption tested by the company’s recent report of record revenue but falling GAAP net income. While the pullback in near-term earnings outlook may temper enthusiasm about a rapid rebound, the biggest catalysts and risks, such as the velocity of occupancy and pressure on yields, remain relatively unchanged in the short term.

One relevant recent announcement is the planned expansion of Great Stirrup Cay, including a new waterpark and upgraded amenities targeting multi-generational travel. This underscores the company's focus on experience-driven destinations, a potential driver for occupancy and onboard spending, and directly links to near-term catalysts around attracting new guests and stimulating additional revenue sources.

But against these positive developments, investors should be mindful of currency risk and substantial euro-denominated debt, which could...

Read the full narrative on Norwegian Cruise Line Holdings (it's free!)

Norwegian Cruise Line Holdings is projected to reach $12.6 billion in revenue and $1.7 billion in earnings by 2028. This outlook assumes a 9.5% annual revenue growth rate and an earnings increase of about $981 million from the current $719.2 million.

Uncover how Norwegian Cruise Line Holdings' forecasts yield a $29.74 fair value, a 60% upside to its current price.

Exploring Other Perspectives

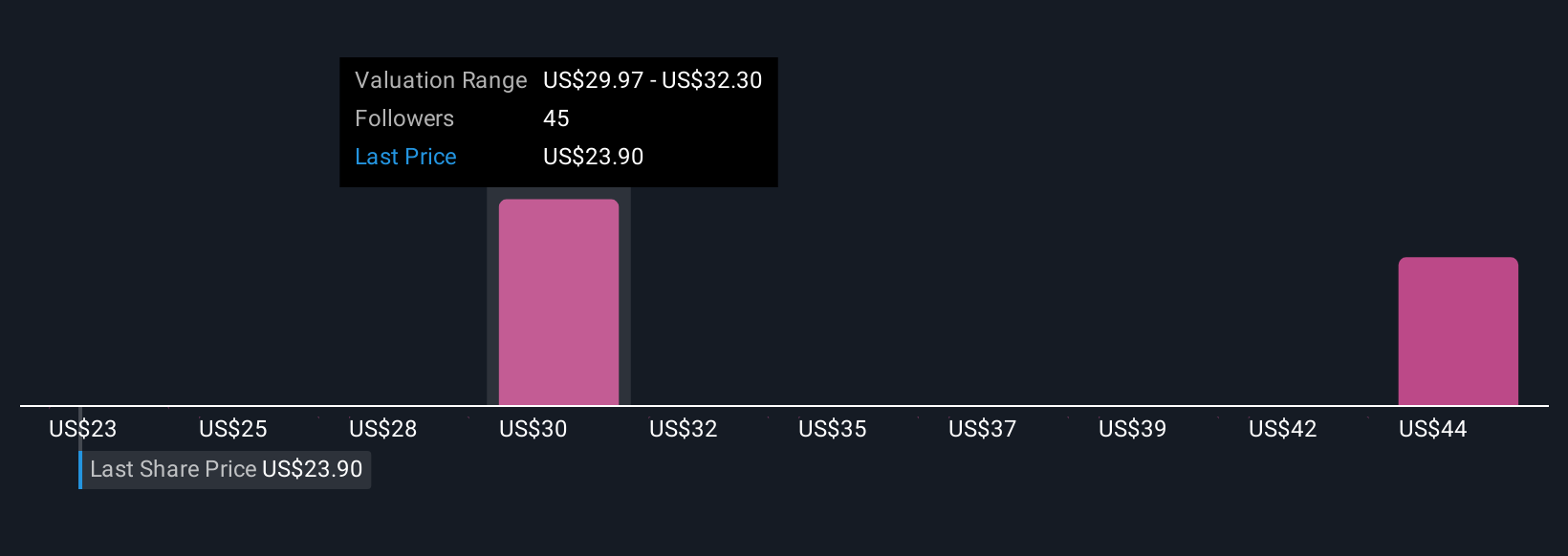

Six Simply Wall St Community members estimate Norwegian Cruise Line’s fair value between US$29.60 and US$45.80 per share. While ongoing efforts in private island expansion boost the investment case for many, persistent debt-related risks remain top of mind for most market participants, be sure to consider the range of opinions before you decide.

Explore 6 other fair value estimates on Norwegian Cruise Line Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own Norwegian Cruise Line Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Norwegian Cruise Line Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Norwegian Cruise Line Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Norwegian Cruise Line Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norwegian Cruise Line Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NCLH

Norwegian Cruise Line Holdings

Operates as a cruise company in North America, Europe, the Asia-Pacific, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives