- United States

- /

- Hospitality

- /

- NYSE:NCLH

Is Norwegian Cruise Line Stock a Potential Opportunity After 22% Drop in 2025?

Reviewed by Bailey Pemberton

- Wondering whether Norwegian Cruise Line Holdings is a hidden bargain or just treading water? You’re not alone, and today we’re doing a deep dive into what the numbers really say about its value.

- The stock has taken a sharp turn lately, dropping 5.2% over the last week and a significant 22.2% across the past month, adding to a year-to-date slide of 31.2%.

- Recently, sectors tied to leisure travel have faced broader volatility due to macroeconomic concerns and shifting consumer demand, putting cruise operators like Norwegian in the spotlight. Industry chatter around future travel sentiment and evolving booking trends is pushing investors to reassess both the risks and opportunities here.

- But here’s what stands out: on our valuation framework, Norwegian Cruise Line Holdings notched a 5 out of 6 on undervalued criteria. Let's look at how different methods stack up. Stick around, because there’s an even smarter way to make sense of valuation coming at the end.

Approach 1: Norwegian Cruise Line Holdings Discounted Cash Flow (DCF) Analysis

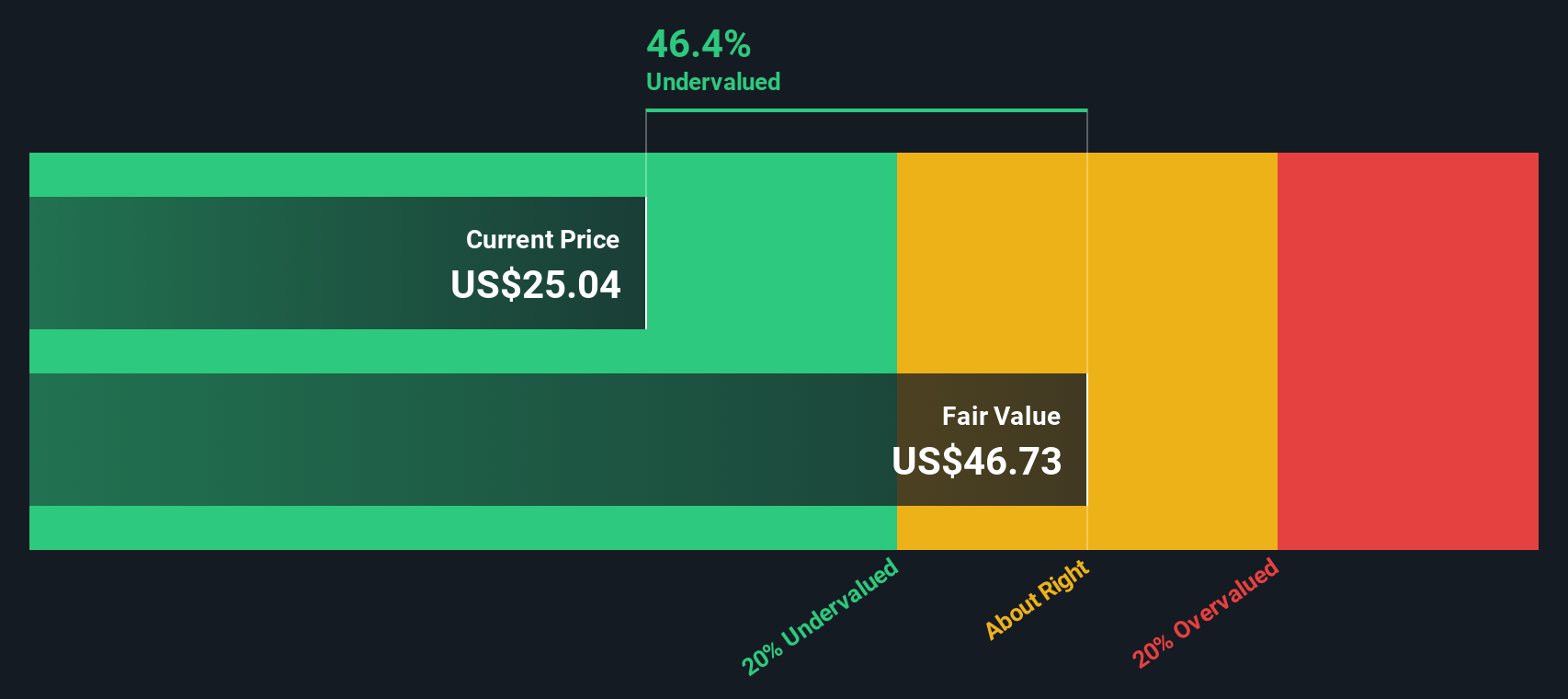

The Discounted Cash Flow (DCF) model projects a company’s future cash flows and discounts them to today’s value. Its goal is to estimate the “intrinsic value” of a business based on its long-term earning potential. For Norwegian Cruise Line Holdings, the DCF calculation uses a 2 Stage Free Cash Flow to Equity approach that considers both near-term analyst estimates and long-range projections.

Currently, Norwegian reports a last twelve months (LTM) Free Cash Flow of -$448.87 Million. Looking ahead, cash flow is forecasted to improve significantly, with projections reaching $1.97 Billion by 2029 according to analysts and Simply Wall St’s extrapolations. The model incorporates a step-up in free cash generation over the coming years as the industry recovers and operations normalize.

Based on this DCF analysis, the intrinsic value per share is estimated at $45.10. With Norwegian’s current share price trading at a steep discount, the implied undervaluation stands at 60.4 percent. This suggests the market may be underappreciating the company’s turnaround and long-term cash-generating potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Norwegian Cruise Line Holdings is undervalued by 60.4%. Track this in your watchlist or portfolio, or discover 905 more undervalued stocks based on cash flows.

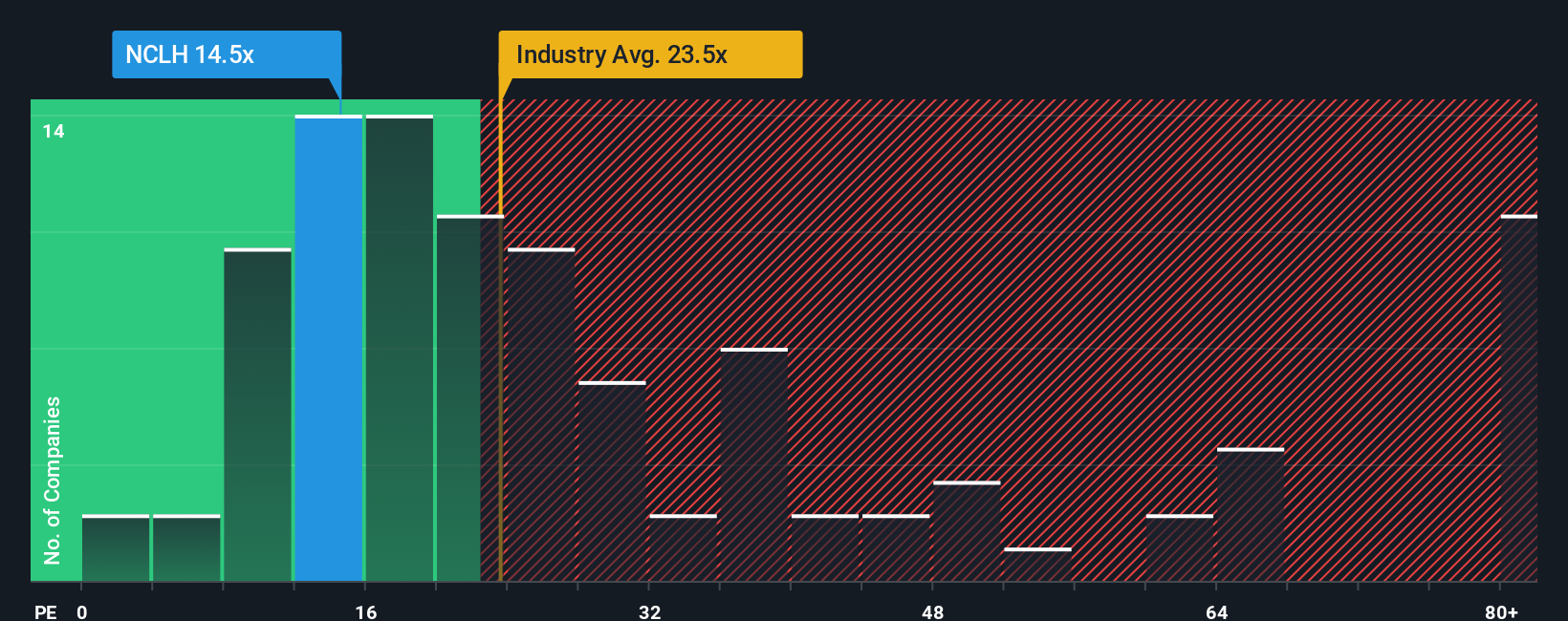

Approach 2: Norwegian Cruise Line Holdings Price vs Earnings (P/E)

The Price-to-Earnings (P/E) ratio is a widely used metric for valuing profitable companies because it reflects what investors are willing to pay today for a dollar of future earnings. For companies generating consistent profits, the P/E serves as a quick gauge of market expectations, profitability, and relative value.

Interpreting a fair P/E, however, is not one size fits all. Higher growth prospects and lower perceived risks usually justify higher P/E ratios, while companies with uncertain earnings or industry headwinds tend to trade at lower multiples.

Currently, Norwegian Cruise Line Holdings trades at a P/E of 12.2x. To put that in context, this is noticeably below both the Hospitality industry average of 20.8x and the peer group average of 36.0x. On its face, this discount might seem attractive, but raw comparisons do not always account for company-specific factors that can skew the story.

This is where Simply Wall St's Fair Ratio comes in. The Fair Ratio, calculated at 42.7x for Norwegian, incorporates the company’s earnings growth outlook, margins, risk profile, industry category and even market cap, giving a more holistic benchmark than traditional methods. Because it adjusts for unique characteristics and fundamental drivers, the Fair Ratio helps filter out misleading signals found in plain vanilla averages.

With Norwegian’s current P/E of 12.2x sitting well below its Fair Ratio of 42.7x, the stock looks meaningfully undervalued by this measure as well. This supports the idea that the market may not be pricing in the company’s full potential for earnings growth and recovery.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1416 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Norwegian Cruise Line Holdings Narrative

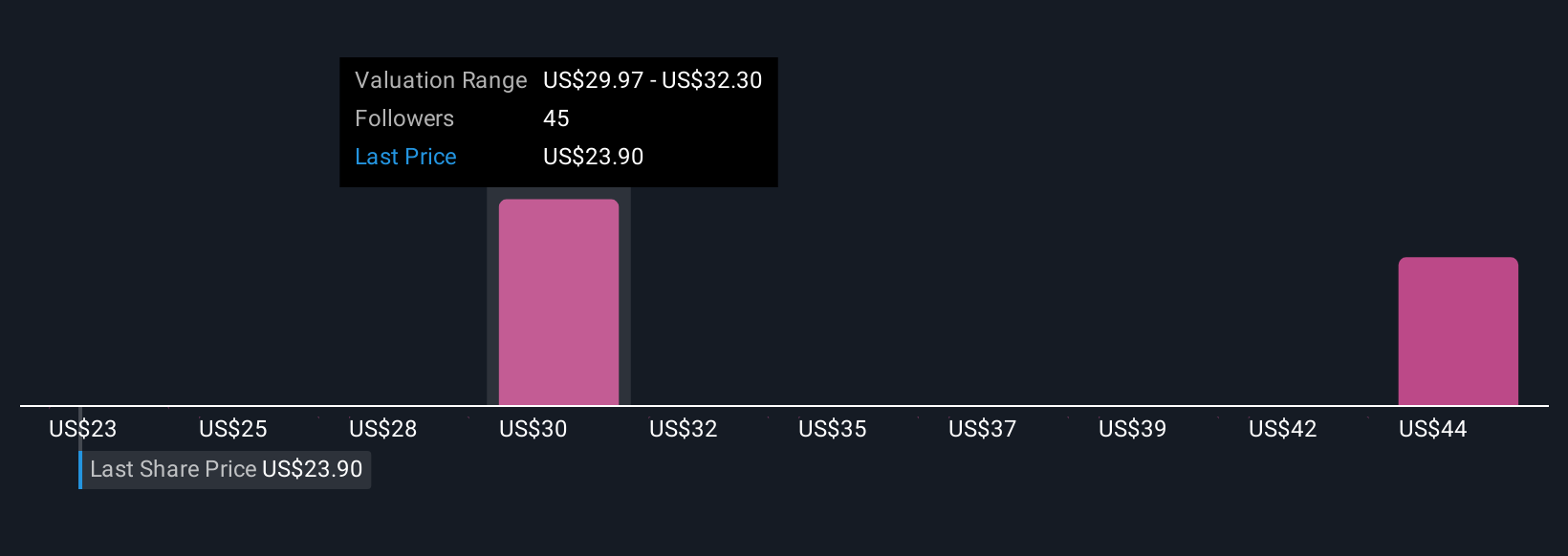

Earlier we mentioned there is an even better way to make sense of valuation, so let’s introduce you to Narratives. Narratives are a dynamic new tool that let you connect your own story and expectations for Norwegian Cruise Line Holdings directly to the numbers, including your estimates for future revenues, margins, and fair value.

Instead of just relying on standard ratios or consensus analyst targets, Narratives let you articulate why you think the company’s prospects will diverge from the herd, basing your view on underlying business changes, industry shifts, or unique insights. Narratives link your personal outlook to a detailed financial forecast, which then calculates your fair value and helps you clearly see the gap between your expectations and the current market price.

On Simply Wall St’s Community page, millions of investors post and update these Narratives as new information emerges, so your investment decisions can stay relevant to fresh news, earnings, and company developments. This means you can quickly see how your thesis compares to others and even adjust your Narrative as the story evolves.

For example, one Norwegian Cruise Line Holdings Narrative might forecast rapid growth from luxury fleet upgrades and higher onboard spending, implying a fair value of $40 per share. A more cautious Narrative could focus on high debt and muted demand, setting fair value at $23. This lets you choose the scenario that best fits your own investment view.

Do you think there's more to the story for Norwegian Cruise Line Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norwegian Cruise Line Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NCLH

Norwegian Cruise Line Holdings

Operates as a cruise company in North America, Europe, the Asia-Pacific, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives