- United States

- /

- Hospitality

- /

- NYSE:MTN

Is Vail Resorts a Bargain After a 17.6% Drop This Year?

Reviewed by Bailey Pemberton

- Wondering if Vail Resorts is a hidden gem or just coasting on reputation? Let’s dig into whether the current share price makes sense for investors looking for genuine value.

- The stock has seen some rough patches lately, falling 0.7% in the last week and down 17.6% year-to-date, which may spark questions about both risk and potential rebound.

- Recent headlines have focused on visitor numbers and evolving travel trends as more vacationers return to leisure destinations. The company's strategic investments, including new resort acquisitions and improvements, have stirred up optimism but also debate around future profitability.

- When it comes to valuation, Vail Resorts scores a solid 4 out of 6 for being undervalued in our checks, but everyone’s got their own yardstick. Let’s break down the different approaches, and stick around for the end of this article for an even smarter way to judge value.

Find out why Vail Resorts's -12.8% return over the last year is lagging behind its peers.

Approach 1: Vail Resorts Discounted Cash Flow (DCF) Analysis

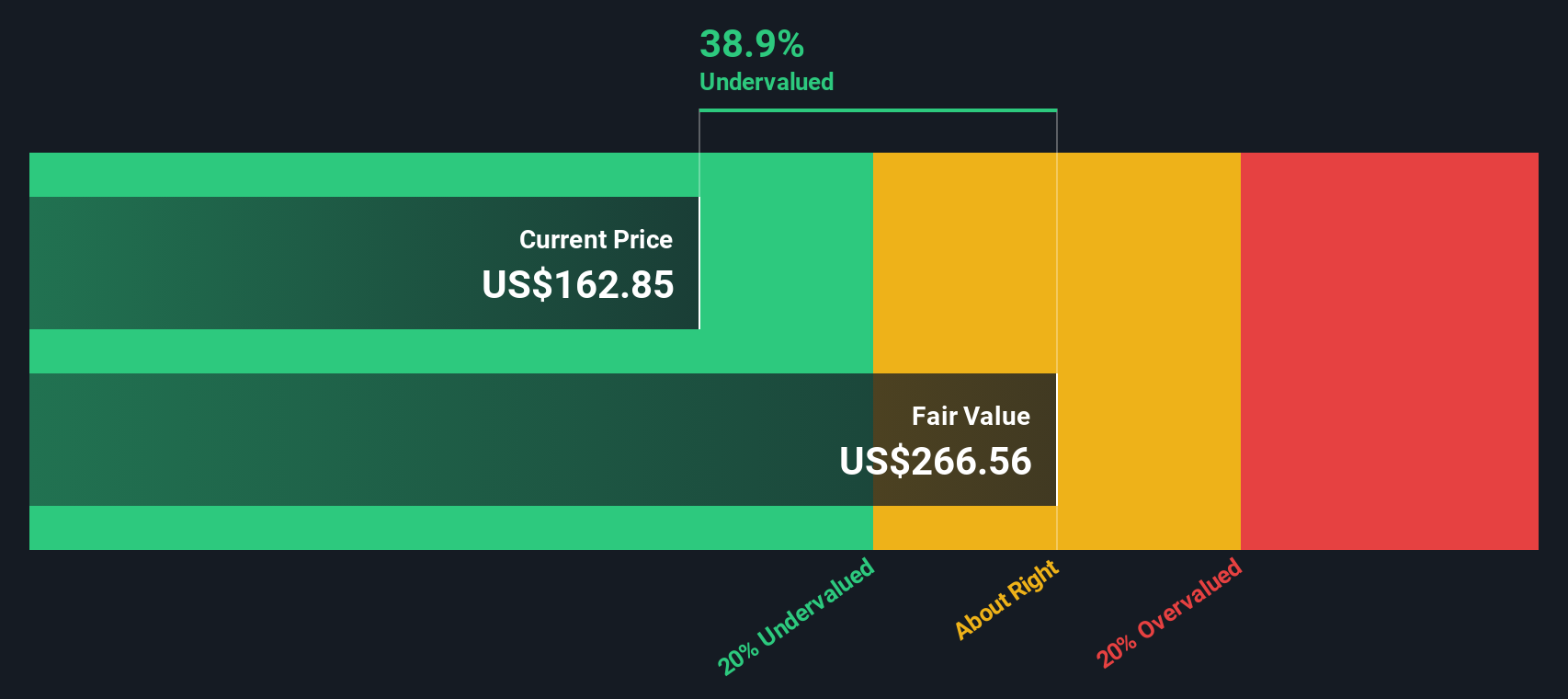

The Discounted Cash Flow (DCF) model estimates a company's true worth by projecting its future cash flows and then discounting them back to today's dollars. This helps investors judge what a business is fundamentally worth, rather than focusing only on market hype or short-term trends.

For Vail Resorts, the latest reported Free Cash Flow stands at $296.6 Million. Analyst estimates project strong growth, with Free Cash Flow expected to reach $603 Million in 2028. Over the next ten years, forecasts combining both analyst outlook and Simply Wall St's extrapolations show a steady rise in annual cash generation.

After running these cash flow projections through the DCF model, Vail Resorts' estimated intrinsic value lands at $254.42 per share. Compared to the current market price, the stock appears about 43.3% undervalued, suggesting a substantial margin of safety for investors looking at the company's long-term prospects.

Bottom line, the DCF analysis paints Vail Resorts as significantly undervalued according to the numbers behind the business rather than the buzz.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Vail Resorts is undervalued by 43.3%. Track this in your watchlist or portfolio, or discover 843 more undervalued stocks based on cash flows.

Approach 2: Vail Resorts Price vs Earnings

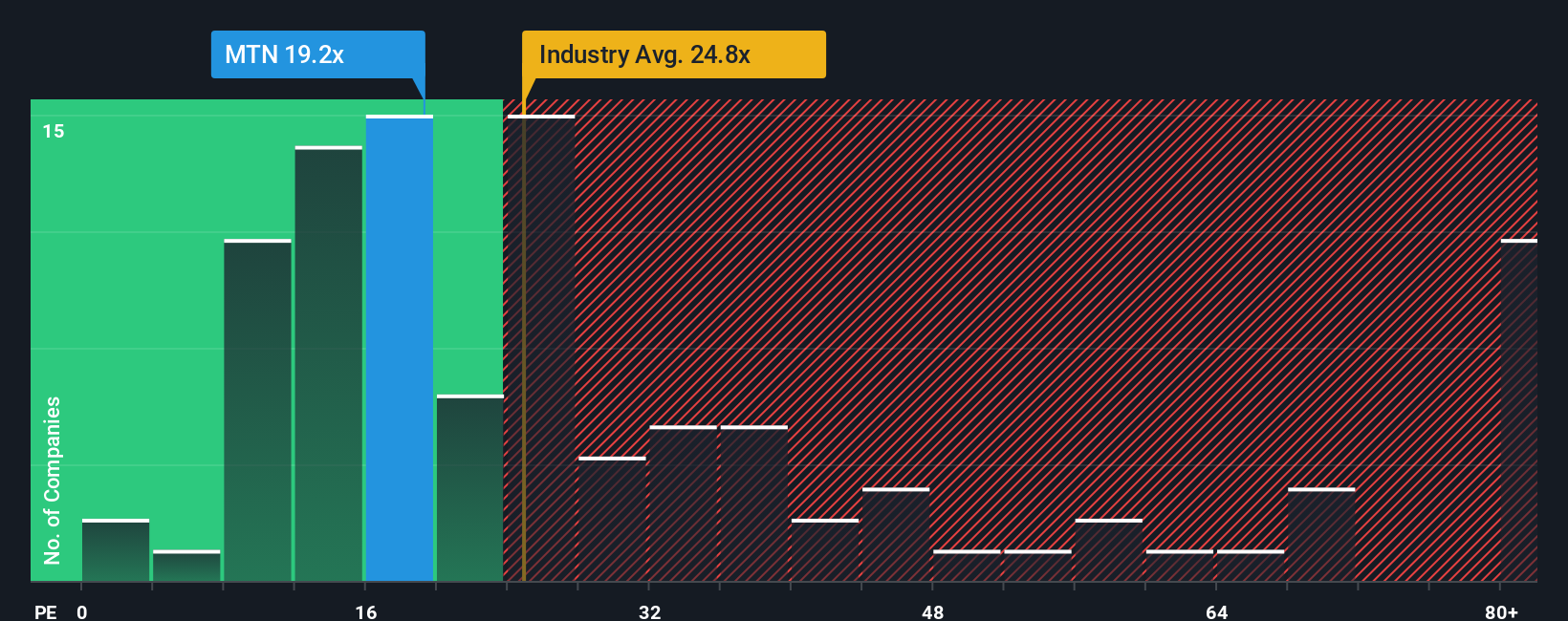

The Price-to-Earnings (PE) ratio is one of the most widely used metrics for valuing profitable companies like Vail Resorts. It gives investors a quick way to compare how much they are paying for a company’s earnings, helping to cut through market noise.

What counts as a “normal” or fair PE ratio will depend largely on expectations for future growth and company risk. Firms with higher predicted earnings growth or lower risk can justify higher multiples, while lower-growth, riskier peers generally trade at a discount.

Vail Resorts currently trades at a PE ratio of 18.5x. That is notably below both its peer group average of 30.4x and the Hospitality industry average of 23.7x. On the surface, that might seem like a bargain, especially given the recent uptick in travel demand and Vail’s steady profitability.

However, a more meaningful benchmark is Simply Wall St’s proprietary “Fair Ratio.” This metric estimates the ideal multiple for Vail Resorts, factoring in not just industry and peers, but also the company’s own earnings growth, margins, market cap, and specific risks. Compared to generic industry or peer averages, the Fair Ratio is better tailored to Vail’s actual business profile and future prospects.

Vail Resorts’ Fair Ratio is calculated to be 17.6x. With the current PE of 18.5x, the stock trades just slightly above our fair estimate, suggesting the current price is about right when all relevant fundamentals are considered.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1404 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Vail Resorts Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. Think of a Narrative as your personal story behind the numbers: it connects what you believe about a company’s future, such as revenue and margin trends, to a financial forecast and, ultimately, to a "fair value" for the stock.

Rather than relying only on traditional ratios or consensus views, Narratives empower you to build your own thesis, adjusting assumptions like future growth, profit margins, and discount rates to reflect your perspective. This approach transforms investing from a numbers-driven exercise into a dynamic, story-led process where you can clearly see how changes in the business or industry feed into a valuation and investment decision.

Narratives are available right now on Simply Wall St’s Community page, a platform used by millions of investors. They update dynamically when new earnings or news emerge, helping you stay informed and react quickly with the latest insights. For Vail Resorts, for example, one Narrative might focus on cost efficiencies and international expansion to justify a high price target of $244.0, while another highlights risks like declining visitation, landing on a much lower target of $146.0. This demonstrates how your individual view shapes your assessment of fair value.

If you want to invest smarter and more confidently, Narratives are a dynamic, accessible way to turn your beliefs into actionable decisions.

Do you think there's more to the story for Vail Resorts? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTN

Vail Resorts

Operates mountain resorts and regional ski areas in the United States and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives