- United States

- /

- Consumer Services

- /

- NYSE:MH

Does the Recent 30% Drop in McGraw Hill Stock Signal Opportunity in 2025?

Reviewed by Bailey Pemberton

If you’re staring down McGraw Hill’s stock chart this week and feeling a little uncertain, you’re not alone. The stock closed at $11.99 most recently, which might look tempting for bargain hunters, but not without a second glance. Over the past month, shares have slipped by 19.6%, and they are down 12.8% in just the last 7 days. Year to date, there has been a drop of 29.5%. That is some heavy turbulence for any portfolio, and it has plenty of investors asking whether this is a blip or a warning sign.

What is driving these moves? Broader market developments have certainly played a part. Investors are recalibrating risk in the face of shifting economic conditions, and some names, such as McGraw Hill, have found themselves in the hot seat. The downside is short-term price pain. The upside is that, for anyone with an eye on valuation, periods like this can reveal opportunity that others might miss.

This is where it gets interesting. McGraw Hill currently clocks a valuation score of 4 out of 6, which means it is undervalued on two-thirds of major metrics we track. So what does that mean in real dollars and future prospects? Next, we will break down exactly what goes into that score using popular valuation methods, and later, I will share my favorite approach for seeing the full investment picture.

Approach 1: McGraw Hill Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s true value by projecting its future free cash flows and discounting them back to today’s value. This approach aims to capture how much cash McGraw Hill is expected to generate, considering both what analysts forecast for the next few years and what might come further down the line, all expressed in current dollars.

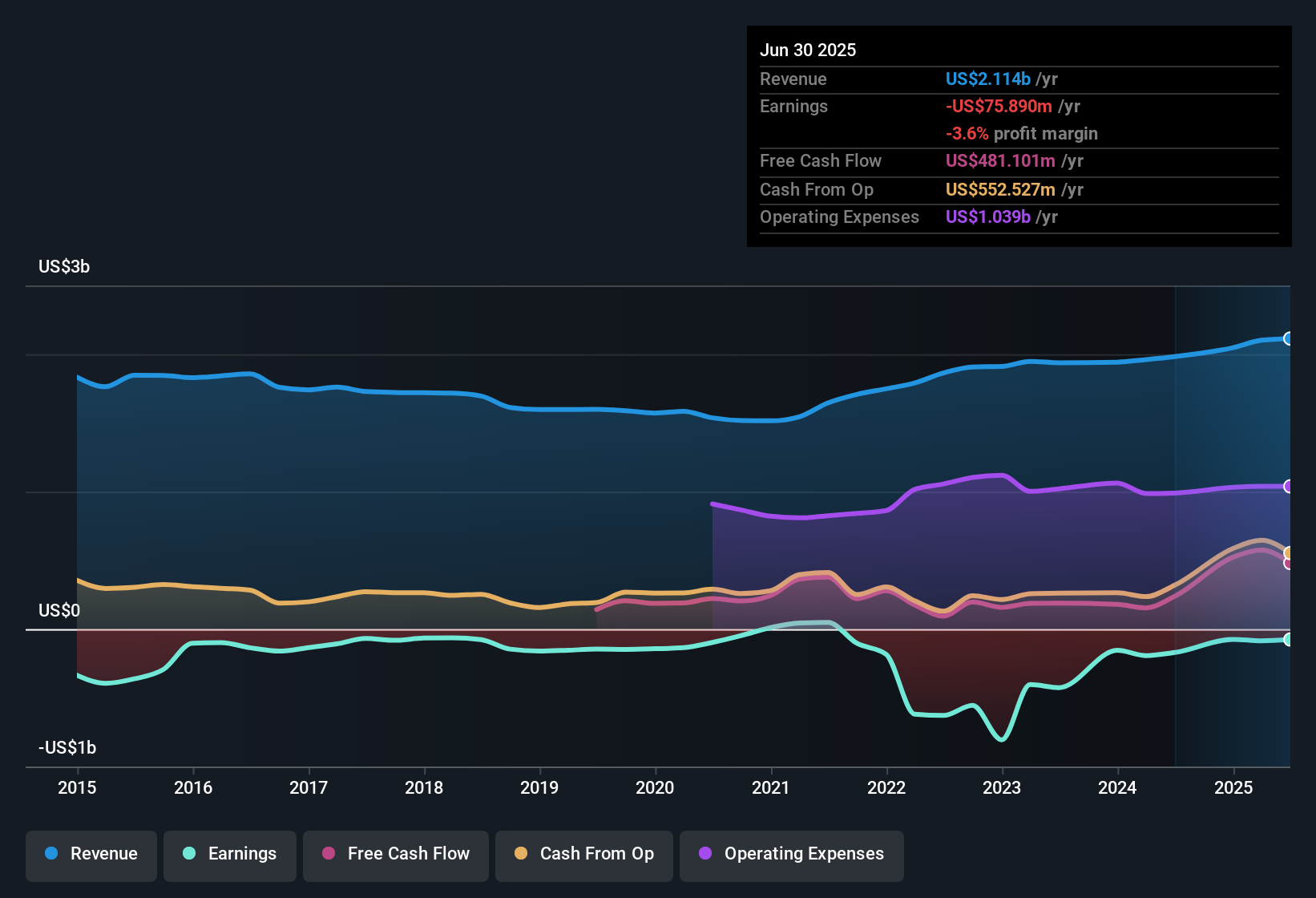

McGraw Hill’s latest reported Free Cash Flow sits at $473.4 million. Based on analyst estimates, this figure is projected to rise to $378.2 million by 2028. Looking further out, projections extrapolated by Simply Wall St suggest free cash flow could reach approximately $421.1 million by 2035. Most of these projections remain under the billion mark, which indicates measured but steady growth expectations for the business.

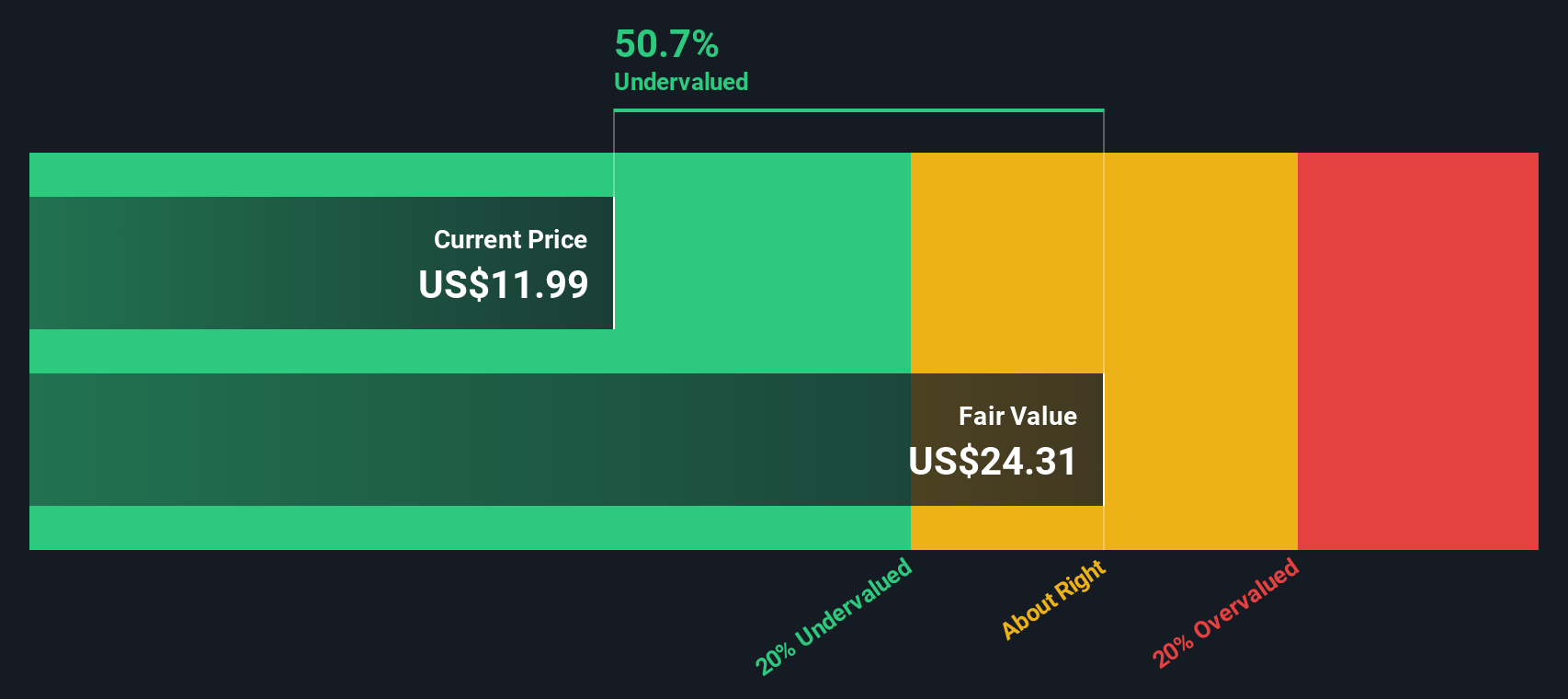

Taking all these forecasts together, the DCF model calculates an intrinsic value for McGraw Hill shares of $24.31. This represents a substantial premium over the recent market price of $11.99 per share. The stock is currently trading at roughly a 50.7% discount to its fair value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests McGraw Hill is undervalued by 50.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: McGraw Hill Price vs Sales

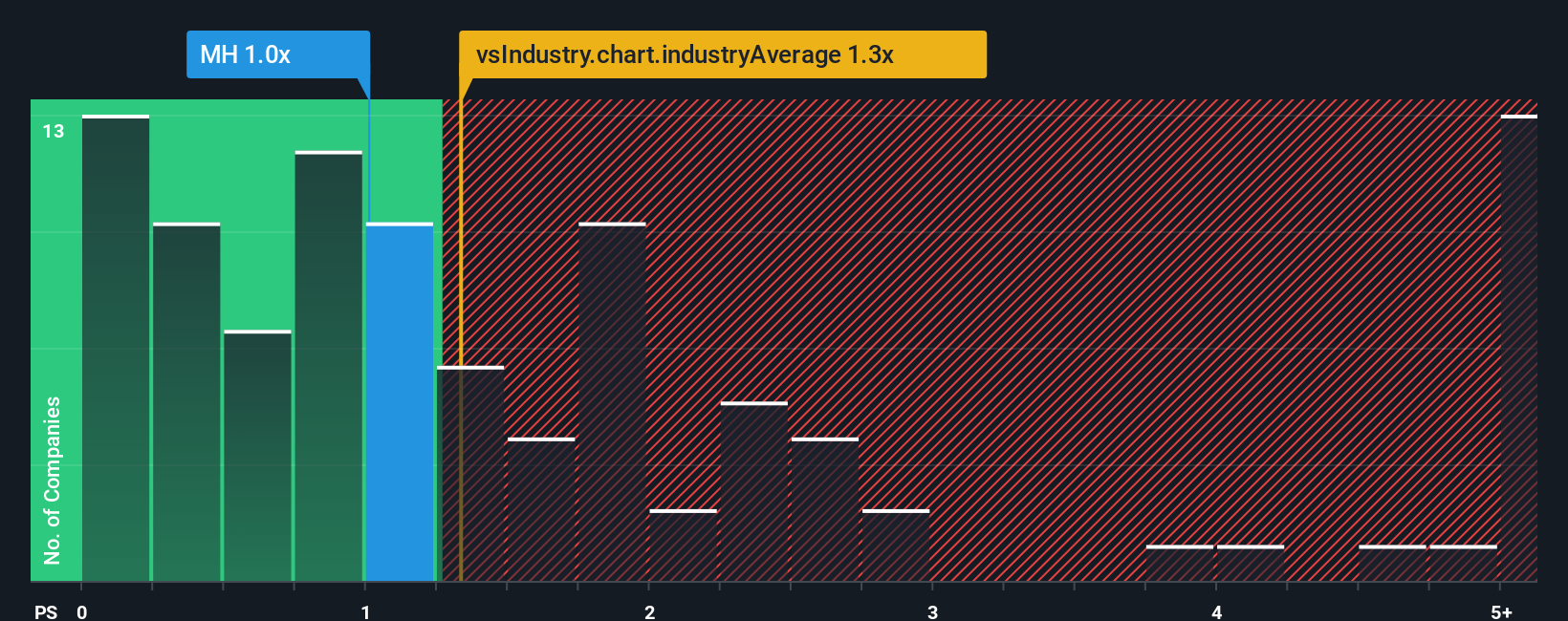

For a business like McGraw Hill, which is currently not reporting positive earnings, the Price-to-Sales (P/S) ratio is a widely accepted yardstick for valuation. This metric is particularly useful for companies where profitability is either negative or volatile, but underlying revenues remain relatively stable. The P/S ratio reflects how much investors are willing to pay for each dollar of the company’s sales. A lower ratio can point to undervaluation, especially in mature or defensive industries.

Growth expectations and risk are major factors that shape what counts as a “normal” or “fair” P/S ratio. Rapidly expanding companies with reliable sales growth and low risk tend to command higher ratios, while slower growth or riskier names usually trade lower. For McGraw Hill, the current P/S stands at 1.1x, which is below both the industry average of 1.6x and the peer group average of 2.0x. This suggests investors are cautious, potentially due to sector headwinds or company-specific factors.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. Unlike basic comparisons with peers or industry averages, the Fair Ratio takes a more holistic view, weighing earnings growth, profit margin, risk, market cap, and sector factors to deliver a tailored benchmark for each company. By incorporating all these elements, the Fair Ratio provides a more realistic baseline for judging valuation in context. This helps investors spot value traps or overlooked opportunities more accurately than blunt industry averages ever could.

Comparing McGraw Hill’s actual P/S of 1.1x to its context-adjusted Fair Ratio, the evidence points to the stock being undervalued. This valuation gap means investors today may be getting more for their money compared to what the company’s fundamentals warrant.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your McGraw Hill Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Narratives are a simple and powerful tool that lets investors tell the story behind their numbers by combining their perspective on a company’s future with their own forecasts for fair value, revenue, earnings, and margins.

With Narratives, that story becomes a live, actionable plan. You link the company’s unique journey to a personalized financial forecast, which then leads to a fair value estimate. This approach is available right now through Simply Wall St’s platform inside the Community page, where millions of investors refine their views together.

By using Narratives, you can easily see when you think it is the right time to buy or sell because you are directly comparing your calculated Fair Value with today’s market Price. Plus, Narratives are always up-to-date, automatically adjusting as soon as new facts, news, or earnings hit the market.

For example, McGraw Hill has Narratives showing a wide range of fair values. Some investors see huge upside, while others expect only minimal gains, each reflecting their unique take on the company. This brings investment decisions to life in a clearer, more personalized way.

Do you think there's more to the story for McGraw Hill? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MH

McGraw Hill

McGraw Hill, Inc., doing business as McGraw Hill, provides information solutions for K-12, higher education, and professional markets in the United States and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives