- United States

- /

- Hospitality

- /

- NYSE:MGM

Will Record MGM China Gains and BetMGM Payouts Offset MGM’s (MGM) Impairment and Las Vegas Slowdown?

Reviewed by Sasha Jovanovic

- MGM Resorts International recently reported its third quarter 2025 results, revealing record revenue from MGM China and digital operations, but also a US$285.3 million net loss due to a goodwill impairment tied to withdrawing its application for a New York casino license and continued weakness in Las Vegas amid renovations and softer room rates.

- A unique development was the announcement that BetMGM will begin distributing cash to MGM Resorts starting in the fourth quarter, which may contribute to improved free cash flow as the company continues its international and digital expansion efforts.

- We’ll explore how the Las Vegas weakness and major impairment charge reshape the narrative for MGM’s future growth and profitability.

Find companies with promising cash flow potential yet trading below their fair value.

MGM Resorts International Investment Narrative Recap

To be a shareholder in MGM Resorts International, you need to believe in the company’s ability to drive long-term growth through digital expansion, successful international ventures, and a recovery in Las Vegas performance. The recent news, highlighting record results in Macau, progress in digital operations, but also a significant net loss due to an impairment tied to New York, does not materially change the biggest near-term catalyst: a rebound in Las Vegas segment earnings, but it does place more attention on execution risks in large-scale projects and digital investment returns.

Among recent announcements, the finalization of a JPY 45.2 billion term loan facility stands out for its relevance to international catalysts, particularly funding for MGM Osaka. This fresh debt supports MGM’s global ambitions and underscores the size of financial obligations required for these multi-year projects, which could influence free cash flow and leverage well ahead of Las Vegas stabilization or further digital growth.

In sharp contrast to the rally in digital and Macau segments, investors should be alert to the risk of persistent weakness at MGM’s value-oriented Las Vegas properties, especially if visitation trends...

Read the full narrative on MGM Resorts International (it's free!)

MGM Resorts International's narrative projects $18.4 billion in revenue and $906.1 million in earnings by 2028. This requires a 2.3% annual revenue growth rate and a $369.7 million increase in earnings from $536.4 million today.

Uncover how MGM Resorts International's forecasts yield a $44.21 fair value, a 38% upside to its current price.

Exploring Other Perspectives

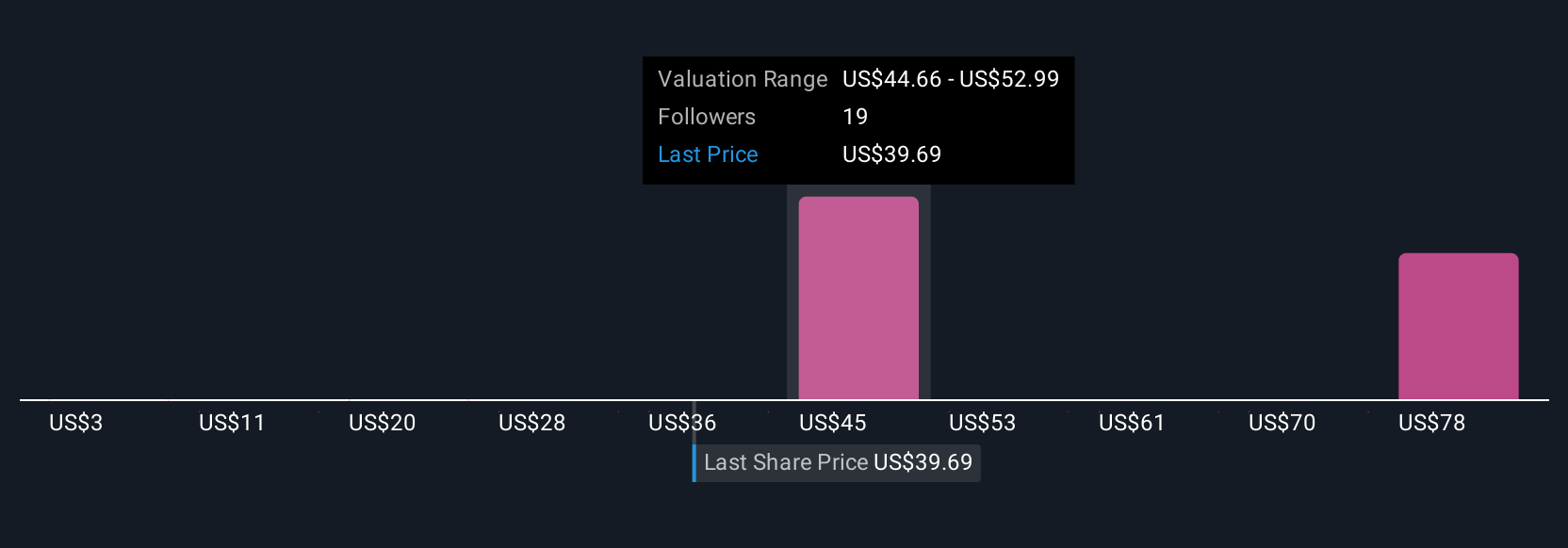

Seven fair value estimates from the Simply Wall St Community range from US$26.92 to US$86.31 per share, showing wide variation. As you consider these differing outlooks, remember that ongoing investment in digital gaming may continue to impact margins and overall profitability, making it important to weigh multiple perspectives on MGM’s future.

Explore 7 other fair value estimates on MGM Resorts International - why the stock might be worth over 2x more than the current price!

Build Your Own MGM Resorts International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MGM Resorts International research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free MGM Resorts International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MGM Resorts International's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MGM

MGM Resorts International

Through its subsidiaries, operates as a gaming and entertainment company in the United States, China, and internationally.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives