- United States

- /

- Hospitality

- /

- NYSE:MGM

MGM Resorts (MGM) Valuation in Focus After $300M Grand Tower Renovation and Bellagio Entertainment Upgrade

Reviewed by Simply Wall St

MGM Resorts International (MGM) just rolled out two big updates that could reshape its portfolio in Las Vegas. The company is investing $300 million in a major overhaul at MGM Grand. At the same time, it is introducing a fresh entertainment partnership at Bellagio’s Mayfair Supper Club.

See our latest analysis for MGM Resorts International.

Despite MGM’s high-profile revamp at MGM Grand and fresh entertainment push at Bellagio, the share price has yet to reflect renewed optimism. It is holding at $32.55 after a 5.8% one-day jump, but ultimately showing a -13.9% total shareholder return over the past year. Longer-term returns have lagged, although momentum could shift if these upgrades reinvigorate growth prospects and investor sentiment.

If MGM’s bold moves have you scanning for fresh opportunities, now is the perfect time to broaden your search and uncover fast growing stocks with high insider ownership

Given that MGM shares are well below analyst targets and sentiment remains lukewarm, the key question is whether the current price undervalues MGM’s potential or if the market already reflects expectations for future growth.

Most Popular Narrative: 26% Undervalued

The narrative consensus fair value sits at $44.15, a notable premium to MGM's $32.55 last close. This gap has caught the eye of investors looking for a rebound. To understand what is driving this optimism, let's spotlight a crucial narrative catalyst.

"Ongoing capital investments in property upgrades, high-end experiential offerings (such as VIP suites, new luxury villas, and exclusive partnerships like Marriott), and strategic renovations are positioned to enhance pricing power and drive RevPAR (revenue per available room), which should support long-term earnings growth and improve profitability per visitor."

Think there's more to this bullish valuation? The most popular narrative counts on game-changing upgrades, new earnings streams, and bold margin forecasts. Wonder which assumptions could send the stock surging? Find out what could make MGM's story take an unexpected turn.

Result: Fair Value of $44.15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in Las Vegas demand or stumbles in MGM’s digital growth strategy could quickly challenge the bullish case for a rebound.

Find out about the key risks to this MGM Resorts International narrative.

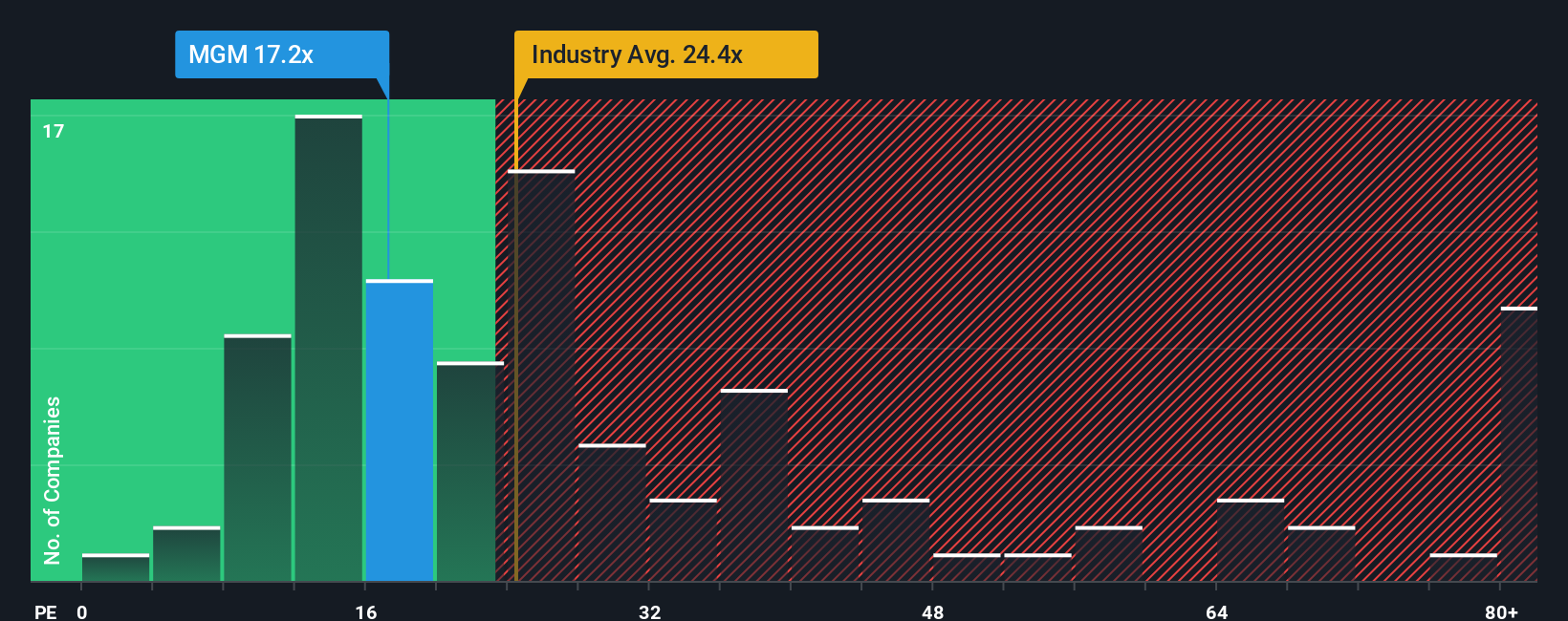

Another View: Challenging the Narrative with Valuation Multiples

While the fair value estimate suggests MGM is trading at a discount, the picture changes when looking at earnings multiples. MGM’s price-to-earnings ratio stands at 132.5x, far above both the industry average of 20.7x and its fair ratio of 47.5x. This premium suggests investors may be overlooking risks that could limit upside. Does the current price reflect reality, or could expectations prove too ambitious?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MGM Resorts International Narrative

If you see things differently or want to dig into the numbers yourself, you can easily craft your own perspective in just a few minutes. Do it your way

A great starting point for your MGM Resorts International research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready for Your Next Smart Move?

If you want to secure the next winning stock before the crowd, act now with these top screeners. Real opportunities like these rarely last long.

- Unlock the next wave of AI breakthroughs by tapping into these 25 AI penny stocks, where innovative companies are setting new standards in automation and machine learning advancements.

- Scoop up overlooked gems by seizing these 917 undervalued stocks based on cash flows, packed with stocks the market hasn’t fully appreciated yet. This may be of interest to value-minded investors.

- Supercharge your income potential and build a resilient portfolio by choosing from these 17 dividend stocks with yields > 3%, offering attractive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MGM

MGM Resorts International

Through its subsidiaries, operates as a gaming and entertainment company in the United States, China, and internationally.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives