- United States

- /

- Hospitality

- /

- NYSE:MGM

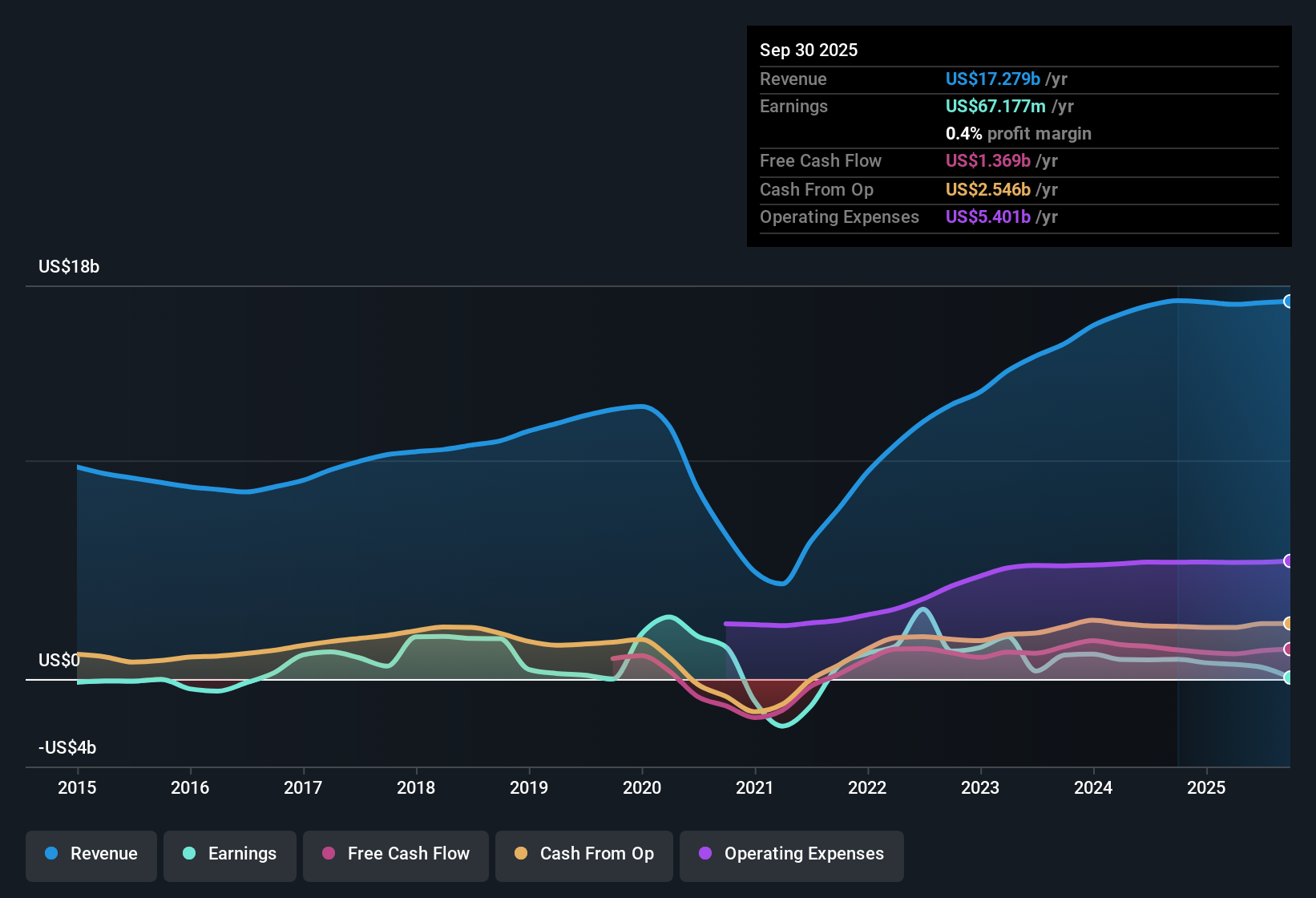

MGM Resorts (MGM) Net Margin Falls to 0.4% After $307M Loss, Challenging Bullish Growth Outlook

Reviewed by Simply Wall St

MGM Resorts International (MGM) reported net profit margins of just 0.4% for the latest period, falling from last year's 5.2%. The company was hit by a one-off $307.1 million loss. Analysts expect annual earnings to surge 38.7% over the next three years, outpacing the broader US market's projected 15.7% yearly growth. Shares are trading at $30.72, notably below both the estimated fair value of $72.06 and Wall Street price targets. With profitability pressured and significant discounts on the stock, investors are weighing the mix of short-term weakness against strong growth forecasts.

See our full analysis for MGM Resorts International.Now, let’s see how these headline results compare with the main narratives shaping market sentiment, and where the numbers might tell a different story.

See what the community is saying about MGM Resorts International

Capital Investments Shape Future Margins

- MGM has announced substantial capital deployments into new global projects such as MGM Osaka and Dubai, with large-scale property upgrades and new luxury offerings aiming to enhance margins and diversify revenue away from core US operations.

- According to the analysts' consensus view, ongoing investments in luxury and digital properties are expected to structurally improve profit margins. However, heavy capital outlays carry the risk of delayed paybacks or future cost overruns.

- Consensus narrative highlights international expansion, new high-end room inventory, and the development pipeline as primary drivers for future profit margin gains over the next three years.

- At the same time, heavy project spending on large-scale resorts and upgrades may expose the company to unforeseen costs, which could impact free cash flow if revenue targets are not achieved.

- Consensus narrative notes that MGM is anticipating margin expansion from current levels of 0.4% to 4.9% in three years as capital projects start contributing. Some analysts flag persistent cost pressures and execution risk in such long-dated initiatives.

Consensus perspective sees a tension between bold growth bets and real margin improvement. See how analysts weigh both sides in the full consensus narrative. 📊 Read the full MGM Resorts International Consensus Narrative.

Digital Gaming Bets Drive Growth Forecasts

- Analysts expect annual earnings growth of 38.7% over the next three years, which is more than double the broader US market estimate of 15.7% per year, driven largely by expansion in digital gaming and international betting markets.

- Consensus narrative points out that rapid progress in digital gaming and cross-border betting (including BetMGM and entry into Brazil) heavily supports the bullish case for long-term revenue and margin growth.

- Expanding digital and sports betting segments are forecast to unlock higher-margin, faster-growing revenue streams, expected to complement slower-growing core casino operations.

- Margin improvement, with analyst estimates moving from 3.1% to 4.9% in three years, is seen as contingent on successfully scaling these digital efforts while managing marketing spend.

Valuation: Premium PE, Discounted Price

- MGM’s Price-to-Earnings ratio stands at 125.2x, well above the US hospitality industry average of 23.7x and the peer group average of 33.2x. However, the current share price of $30.72 is at a sharp discount to both its DCF fair value of $72.06 and the allowed analyst price target of $44.21.

- Consensus narrative flags this wide gap between valuation metrics and current price, noting bulls see deep value but highlighting that future growth must deliver for investors to realize potential upside.

- The disparity between a premium PE multiple and a heavily discounted share price encapsulates both skepticism about near-term profits and belief in outsized future growth.

- For the analyst scenario to play out, MGM needs to grow earnings to $906.1 million by 2028 and trade at a PE ratio of 16.3x on those earnings, representing a significant rerating from today’s valuation.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for MGM Resorts International on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a fresh perspective on these figures? In just a few minutes, you can create your own narrative and share your insights. Do it your way.

A great starting point for your MGM Resorts International research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

MGM’s weak profitability and volatile margins raise ongoing questions about near-term earnings reliability. This is despite growth potential from new ventures.

If you’re looking for steadier results, use stable growth stocks screener (2112 results) to focus on companies delivering consistent revenue and earnings performance regardless of market swings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MGM

MGM Resorts International

Through its subsidiaries, operates as a gaming and entertainment company in the United States, China, and internationally.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives