- United States

- /

- Consumer Services

- /

- NasdaqGS:MCW

Mister Car Wash (NYSE:MCW) Use Of Debt Could Be Considered Risky

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Mister Car Wash, Inc. (NYSE:MCW) does carry debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Mister Car Wash

What Is Mister Car Wash's Debt?

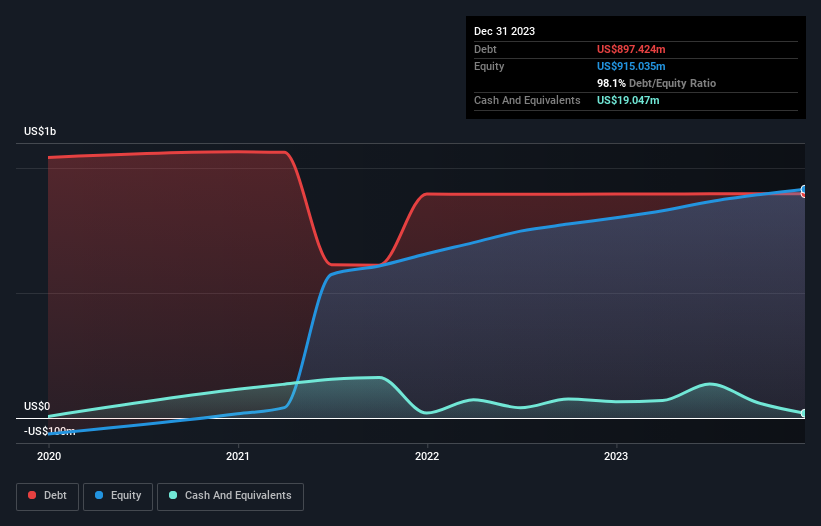

As you can see below, Mister Car Wash had US$897.4m of debt, at December 2023, which is about the same as the year before. You can click the chart for greater detail. However, because it has a cash reserve of US$19.0m, its net debt is less, at about US$878.4m.

How Strong Is Mister Car Wash's Balance Sheet?

According to the last reported balance sheet, Mister Car Wash had liabilities of US$169.6m due within 12 months, and liabilities of US$1.80b due beyond 12 months. Offsetting this, it had US$19.0m in cash and US$21.0m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$1.93b.

This deficit is considerable relative to its market capitalization of US$2.49b, so it does suggest shareholders should keep an eye on Mister Car Wash's use of debt. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While we wouldn't worry about Mister Car Wash's net debt to EBITDA ratio of 3.5, we think its super-low interest cover of 2.4 times is a sign of high leverage. So shareholders should probably be aware that interest expenses appear to have really impacted the business lately. Even more troubling is the fact that Mister Car Wash actually let its EBIT decrease by 4.8% over the last year. If that earnings trend continues the company will face an uphill battle to pay off its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Mister Car Wash can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last two years, Mister Car Wash saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

We'd go so far as to say Mister Car Wash's conversion of EBIT to free cash flow was disappointing. And furthermore, its level of total liabilities also fails to instill confidence. Overall, it seems to us that Mister Car Wash's balance sheet is really quite a risk to the business. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 3 warning signs for Mister Car Wash (of which 1 is a bit concerning!) you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:MCW

Mister Car Wash

Provides conveyorized car wash services in the United States.

Moderate growth potential with questionable track record.

Market Insights

Community Narratives