- United States

- /

- Hospitality

- /

- NYSE:MCD

McDonald’s (MCD): Margin Dip Challenges Bullish View on Consistent Profit Growth

Reviewed by Simply Wall St

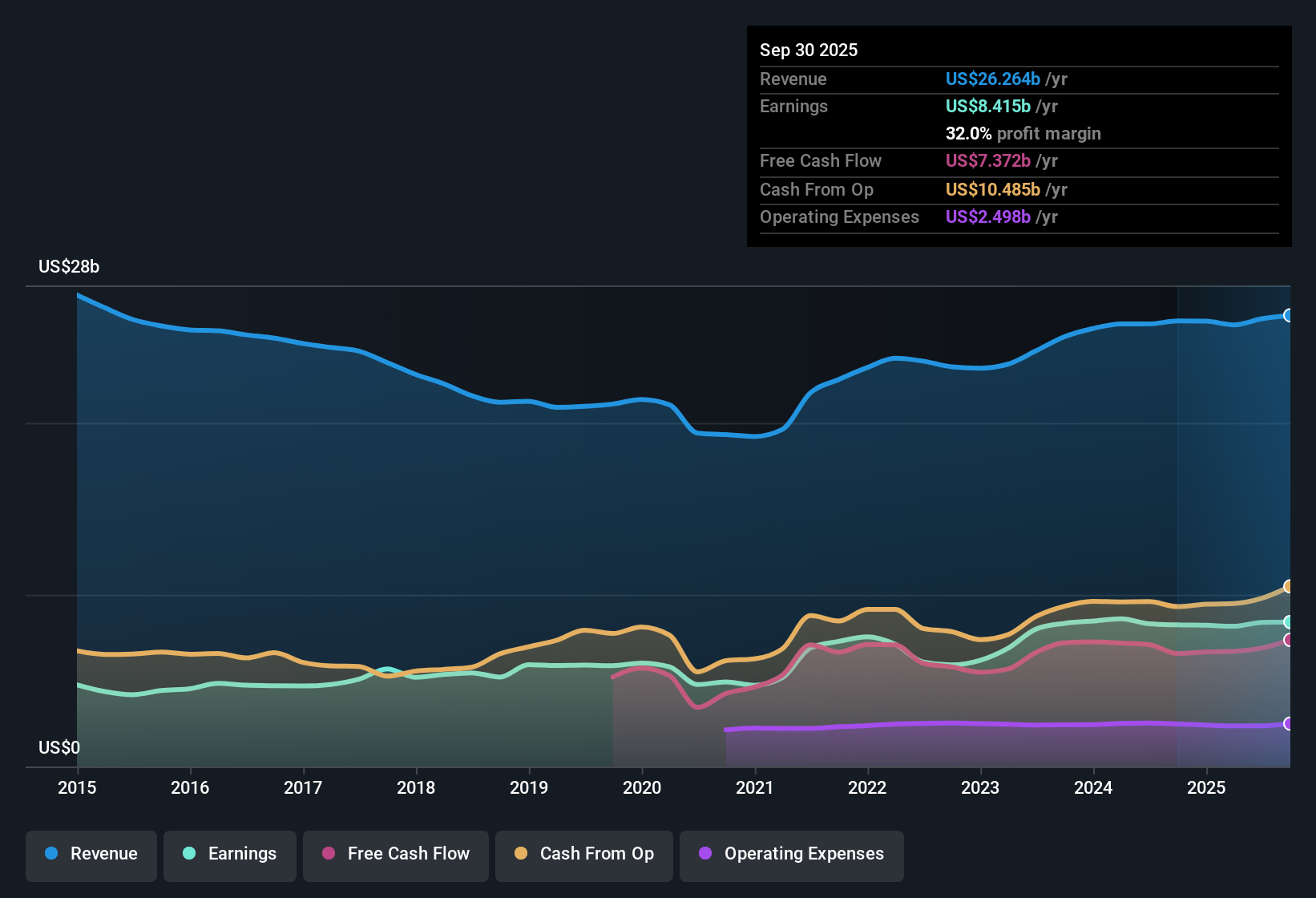

McDonald’s (MCD) reported earnings growth of 1% in the most recent year, falling short of its strong 9.9% per year average over the past five years. Net profit margins stand at 32.2%, slightly down from 32.3% a year ago, while revenue is forecast to grow at 5.2% per year, slower than the broader US market's 10.4% pace. Looking forward, the company’s earnings are projected to rise at 6.8% per year, lagging behind the US market average of 15.8%. Investors may weigh these results against McDonald’s track record of high-quality earnings, its attractive dividend, and a continued, although somewhat slower, trend of profit and revenue growth.

See our full analysis for McDonald's.Next, we’ll put McDonald’s results side by side with prevailing market narratives to see where expectations hold up and where perspectives might shift.

See what the community is saying about McDonald's

Profit Margins Resist Cost Pressures

- Net profit margins are holding at 32.2%, only a hair below last year’s 32.3%, despite rising input costs being cited as a major risk for McDonald’s and its peers.

- The analysts’ consensus view leans on McDonald’s resilient operating model, noting that ongoing investments in technology and cost management are expected to drive margins further. Projections reach 34.1% in three years.

- This margin stability supports the consensus idea that McDonald’s strong free cash flow and margin expansion remain a core part of its long-term earnings story, even while competitors struggle with inflation and wage growth.

- Still, consensus indicates that if input costs continue to rise or traffic among low-income diners drops, maintaining or expanding margins could become challenging. Margin momentum will be crucial to monitor.

- Consensus says these results keep McDonald’s margin story alive, but warns cost headwinds could reverse the trend quickly. 📊 Read the full McDonald's Consensus Narrative.

Global Expansion and Digital Ambitions

- Plans to open 2,200 new stores in 2025, especially in emerging markets like China, highlight the scale of McDonald’s push to drive future long-term segment growth even as US growth moderates.

- Analysts' consensus narrative ties this aggressive international and digital strategy directly to the longer-term revenue outlook.

- The pipeline of new international locations, combined with loyalty programs and digital ordering (aiming for 250 million active users globally by 2027), is expected to boost market share and lift average ticket sizes, countering competition and demographic shifts.

- Even so, consensus notes that these strategies require significant ongoing investment and careful execution, with the payoff dependent on sustained consumer demand and technological adoption.

Premium Valuation Against Industry

- At a current price-to-earnings ratio of 26x, McDonald’s trades at a premium to the wider US hospitality sector (23.7x), though still well below the peer average of 55.5x.

- Analysts' consensus outlook frames this valuation as justified by McDonald’s steady earnings track record and global brand strength. However, with revenue growth forecasts at just 5.2% annually (lagging the US market’s 10.4%), shares may require even stronger margin expansion or unit growth to warrant further upside.

- The consensus view is that with the current share price at $305.67 and a price target of $330.33, the stock is seen as fairly priced. Upside potential depends on the successful delivery of growth initiatives.

- This premium sets expectations high, and even a small miss on growth or margins could weigh on the valuation versus industry peers.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for McDonald's on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own interpretation of the numbers? Take just a few minutes to shape your view and add your perspective. Do it your way

A great starting point for your McDonald's research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

While McDonald’s maintains solid margins and brand strength, its slower revenue and earnings growth forecasts lag behind faster-growing peers and the broader US market.

If you want the potential for more consistent double-digit gains, our stable growth stocks screener (2082 results) can help you discover companies better positioned for sustained performance and expansion.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MCD

McDonald's

Owns, operates, and franchises restaurants under the McDonald’s brand in the United States and internationally.

Established dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives