- United States

- /

- Hospitality

- /

- NYSE:MCD

Is the Golden Arches Still Fairly Priced After a 4.4% Drop This Week?

Reviewed by Bailey Pemberton

- Curious if McDonald's stock is still a value buy, especially after its long run as a household name? You're not alone. Let's dig into whether the current price reflects the real value of this fast-food giant.

- Despite delivering a 3.6% return over the last year, McDonald's shares faced a -4.4% dip in the past week, which may indicate a possible shift in market sentiment or risk perception.

- Recent market chatter has focused on McDonald's ongoing expansion into new international markets and its push for digital innovation. These factors have fueled investor debate and may be contributing to recent volatility. Headlines have also highlighted global economic uncertainties, keeping investors alert to how broader trends could impact the brand.

- On our standard valuation check, McDonald's scores a 2 out of 6. Before you pass judgment, let’s run through the valuation approaches and, most importantly, see if there’s a smarter way to assess its true worth by the end of this article.

McDonald's scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: McDonald's Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model forecasts a company's future cash flows and then discounts them back to today's dollars, helping estimate the intrinsic value of the business. This approach is widely used because it focuses on the money a company is expected to actually generate for shareholders.

For McDonald's, the latest reported Free Cash Flow stands at $7.2 billion. Analyst estimates project this number to steadily increase, reaching approximately $10.6 billion by the end of 2028. Although analyst data typically covers up to five years, subsequent projections such as those extending out to 2035 are extrapolated by Simply Wall St and foresee continued growth in cash generation each year.

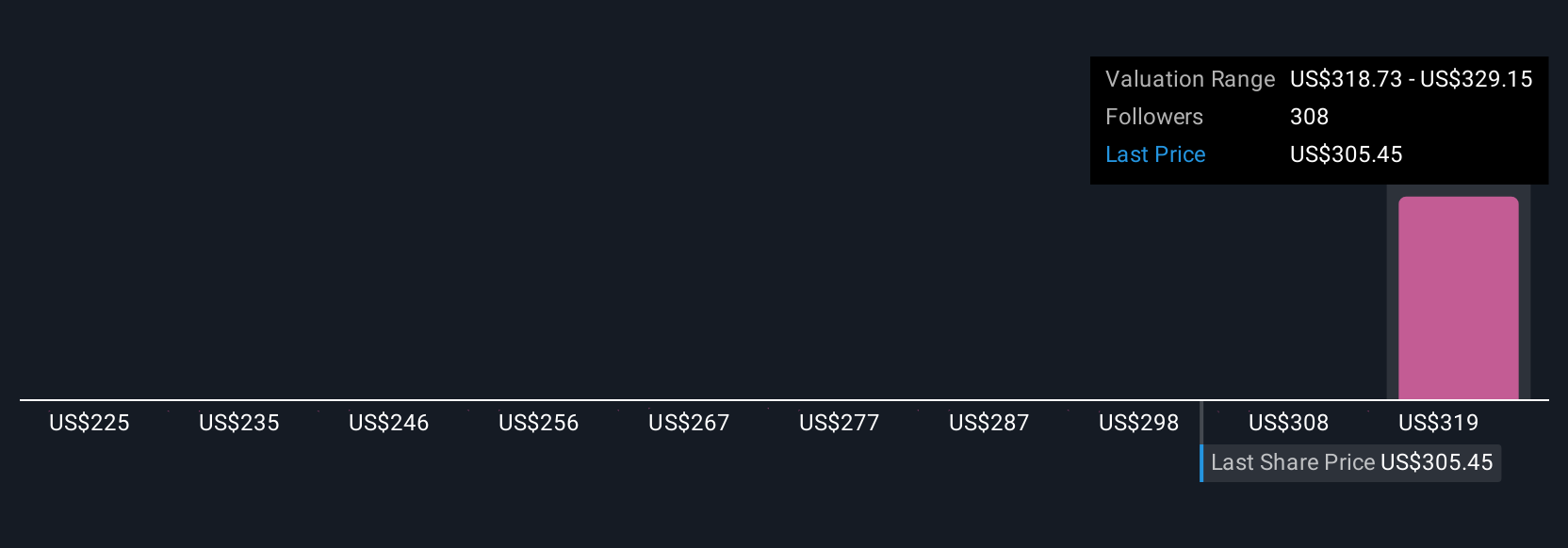

By feeding these forecasts into the DCF model and discounting them at an appropriate rate, McDonald's estimated intrinsic value comes to $250.96 per share. However, this is about 18.1% below the company's current trading price, suggesting that the stock is currently overvalued by the market when based on cash flow fundamentals.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests McDonald's may be overvalued by 18.1%. Discover 843 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: McDonald's Price vs Earnings (PE)

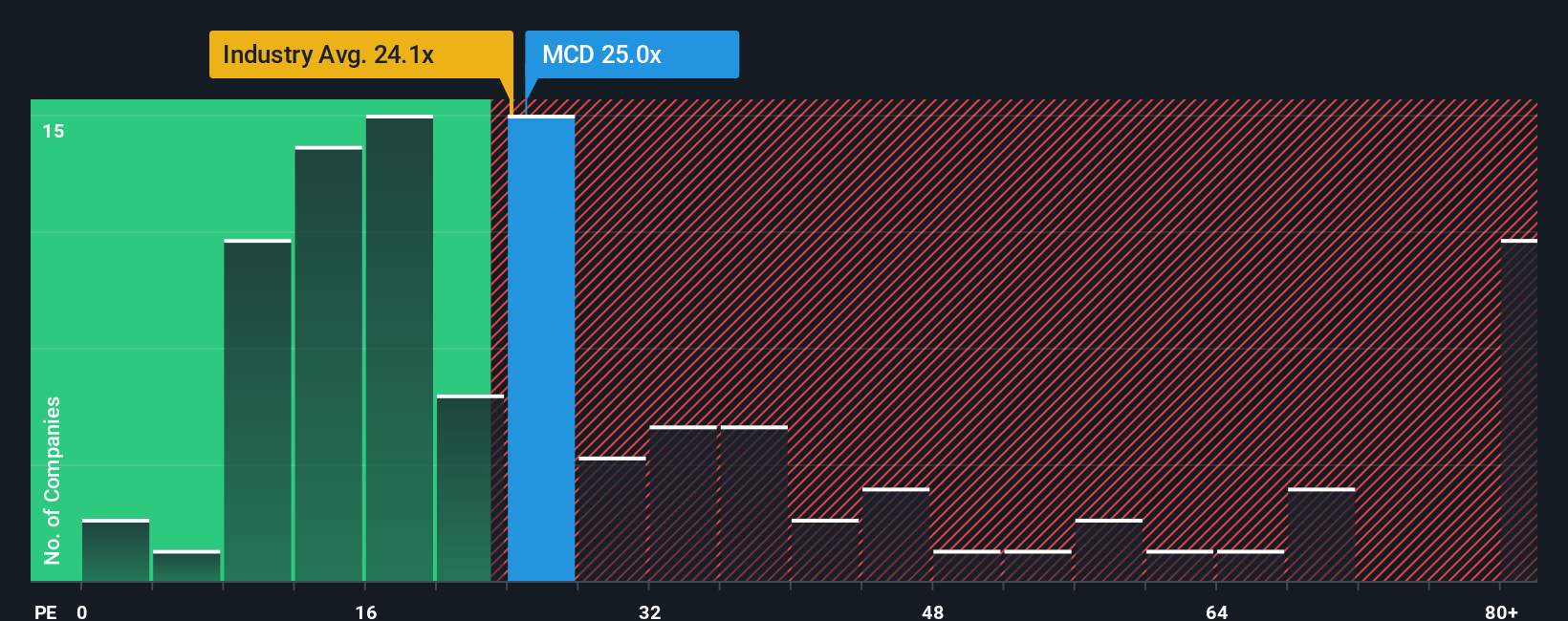

The Price-to-Earnings (PE) ratio is a key metric for valuing profitable companies like McDonald's, as it shows how much investors are willing to pay for each dollar of earnings. It's especially relevant here because McDonald's generates consistent profits, making the earnings-based approach meaningful for assessment.

Growth expectations and risk levels play a central role in setting what counts as a "fair" PE ratio. Companies projected to grow faster, with more stable earnings and stronger market positions, often command higher PE multiples, while more volatile or slower-growth firms usually deserve lower ones.

Currently, McDonald's trades at a PE ratio of 25x. This sits above the Hospitality industry average of 23.5x but is notably lower than its peer group average of 55.4x. However, just comparing to industry or peers does not capture all the unique aspects of McDonald's business or risk profile.

This is where Simply Wall St's proprietary "Fair Ratio" comes in. The Fair Ratio, 28.9x in McDonald's case, is customized to reflect not just industry averages, but also factors like the company’s current earnings growth, profit margins, market capitalization and risk profile. This makes it a more holistic and insightful benchmark than raw peer or industry comparisons.

Given McDonald's current PE of 25x and a Fair Ratio of 28.9x, the stock currently looks to be valued about right by the market on an earnings basis.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your McDonald's Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, story-driven tool that lets you create your own perspective on a company by combining your assumptions about its future, such as revenue, earnings growth, and profit margins, with your view of what the business is really worth.

Narratives connect the dots from a company's story and future outlook to a financial forecast, then translate that outlook into a fair value, all in one approachable, interactive framework. Available to millions of investors on Simply Wall St’s Community page, Narratives make it easy for anyone to build, share, and update their investment thesis as new information, news, or earnings come in.

By comparing your Narrative's fair value to the current market price, you can quickly see if you think McDonald's is worth buying, holding, or selling. Plus, because Narratives stay up to date when big events happen, your investment decision can keep pace with reality.

For instance, one McDonald's investor might have a bullish Narrative and see fair value at $373, driven by optimism about global expansion and tech investments. A more cautious investor may set their Narrative at $260, focusing on risks like competitive pricing or slowing traffic. This demonstrates how Narratives put your unique perspective front and center in the investment process.

Do you think there's more to the story for McDonald's? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MCD

McDonald's

Owns, operates, and franchises restaurants under the McDonald’s brand in the United States and internationally.

Established dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives