- United States

- /

- Hospitality

- /

- NYSE:LUCK

Lucky Strike Entertainment (LUCK): Losses Narrowed 44% Annually, Profit Forecast Sets Up Narrative Test

Reviewed by Simply Wall St

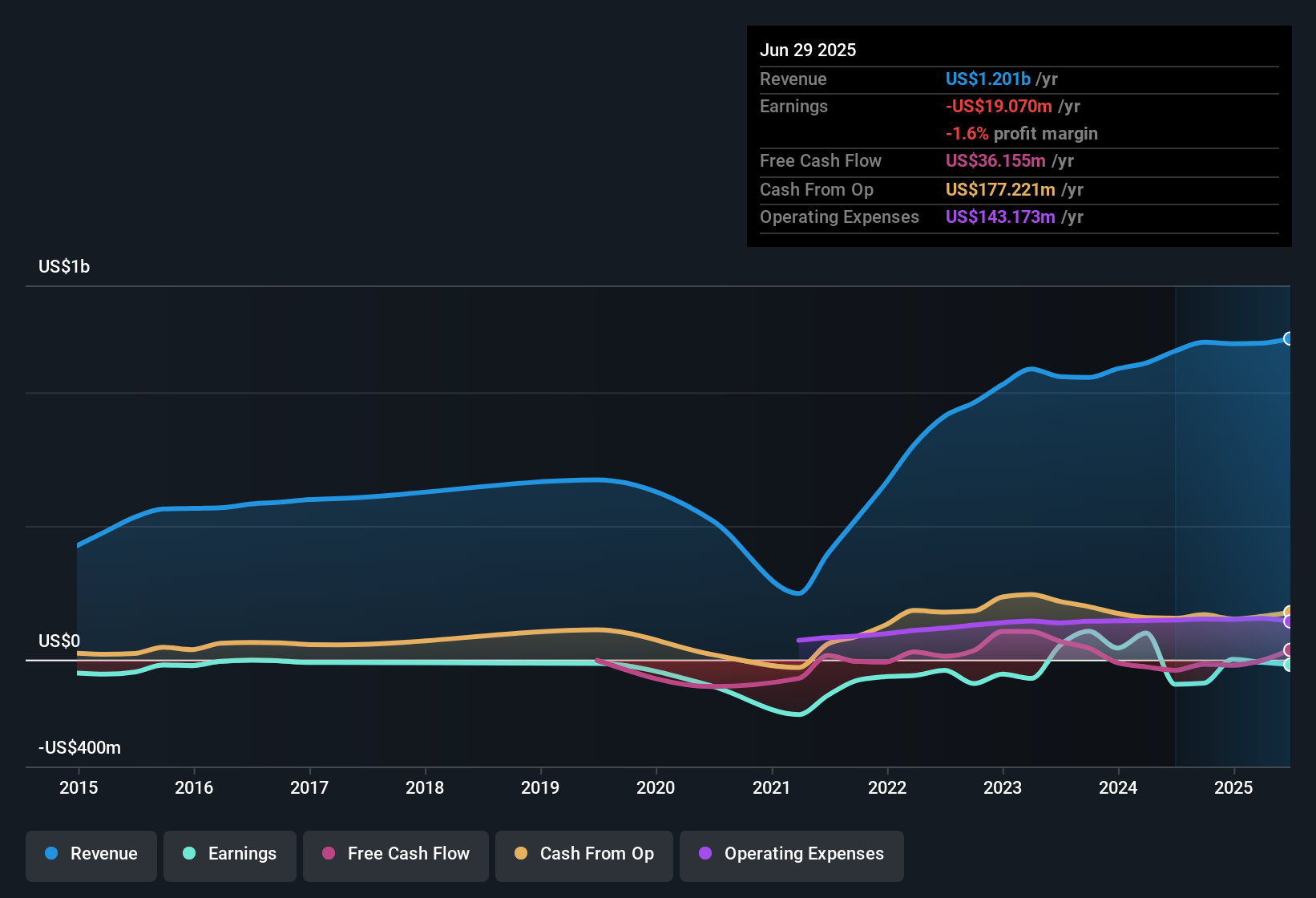

Lucky Strike Entertainment (LUCK) narrowed its losses at a swift 44% annual rate over the past five years and is now forecast to swing into profitability within the next three years. Analysts expect earnings to accelerate at 107.07% per year, even as revenue growth is set to lag the wider US market at 5.1% per year. With a current share price of $7.98 that sits significantly below an estimated fair value of $30.48, the company’s ongoing progress toward profit and attractive valuation have taken center stage for investors eyeing the next phase.

See our full analysis for Lucky Strike Entertainment.Now, let's see how the latest earnings stack up against the broad market narratives and community insights. Some expectations may get confirmed, while others could be put to the test.

See what the community is saying about Lucky Strike Entertainment

Margins Projected to Swing Positive by 2028

- Analysts expect profit margins to improve from -1.6% today to 4.0% within three years, marking a notable shift on the path toward profitability.

- According to the analysts' consensus view, this expected margin expansion is underpinned by ongoing investments in marketing and loyalty programs, as well as product innovation, designed to drive higher guest engagement and repeat visitation.

- Growth in season pass membership revenue and enhanced guest experiences are highlighted as the levers most likely to deliver above-trend margin gains.

- The company’s ability to deliver a positive swing in net margins will further depend on the scalability and returns from recent venue acquisitions. If successful, these acquisitions could create lasting operational efficiencies.

PE Ratio Remains a Growth Valuation Play

- If Lucky Strike meets consensus earnings expectations of $56.8 million by 2028, its forward PE ratio would rise to 40.9x, a hefty premium over the hospitality sector average of 24.0x.

- Analysts' consensus highlights that betting on this elevated PE requires confidence in sustained top-line and margin growth through loyalty initiatives and strategic acquisitions.

- The company’s DCF fair value estimate at $30.48, paired with a current share price of $7.98, indicates significant long-term upside only if ambitious earnings and margin goals are realized.

- However, even with industrious marketing and branding moves, the need to justify a 40.9x PE by 2028 underscores that much of the valuation case hinges on Lucky Strike turning forecasts into tangible bottom-line results.

Minor Risks: Debt Load and Slow Revenue Growth

- Risks called out in filings remain modest for now, centering on negative equity concerns and moderate revenue growth of just 5.1% annually versus the US market’s 10.5% pace.

- Analysts' consensus narrative cautions that significant real estate acquisitions have left Lucky Strike with $1.3 billion net debt and high fixed costs, potentially amplifying financial vulnerability if foot traffic disappoints or if labor costs spike further.

- The company’s exposure to intense competition from both digital and physical entertainment rivals, combined with dependence on evolving food and beverage trends, serves as a constant test of earnings resilience.

- These factors may limit flexibility on margins and cash flow, making it critical that Lucky Strike demonstrates consistent gains in venue performance and customer loyalty over the next several years to offset the risk.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Lucky Strike Entertainment on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a fresh angle on the numbers? Share your perspective and shape your own story in just a few minutes. Do it your way

A great starting point for your Lucky Strike Entertainment research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite narrowing losses, Lucky Strike faces pressure from slow revenue growth and a heavy debt load. These issues could strain financial flexibility if challenges persist.

If you'd prefer companies with robust finances and stronger balance sheets, check out solid balance sheet and fundamentals stocks screener (1979 results) built for investors seeking lower leverage and healthier liquidity.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LUCK

Lucky Strike Entertainment

Operates location-based entertainment venues in North America.

Fair value with moderate growth potential.

Market Insights

Community Narratives