- United States

- /

- Hospitality

- /

- NYSE:LUCK

A Closer Look at Lucky Strike Entertainment’s (LUCK) Valuation Following a Recent 3% Share Price Move

Reviewed by Simply Wall St

See our latest analysis for Lucky Strike Entertainment.

While Lucky Strike Entertainment’s latest 3% jump puts some spark back in the share price, longer-term momentum has been mixed. The 7-day share price return of 8.3% suggests renewed optimism among traders, but this sits against a one-year total shareholder return of -36.8% as the stock continues to struggle for sustainable traction.

If today’s move has you thinking bigger, now could be a good time to expand your search and explore fast growing stocks with high insider ownership.

With Lucky Strike Entertainment’s price still well below analyst targets even after today’s pop, investors are left to wonder if the stock is undervalued or if the market is already factoring in any hopes for a rebound.

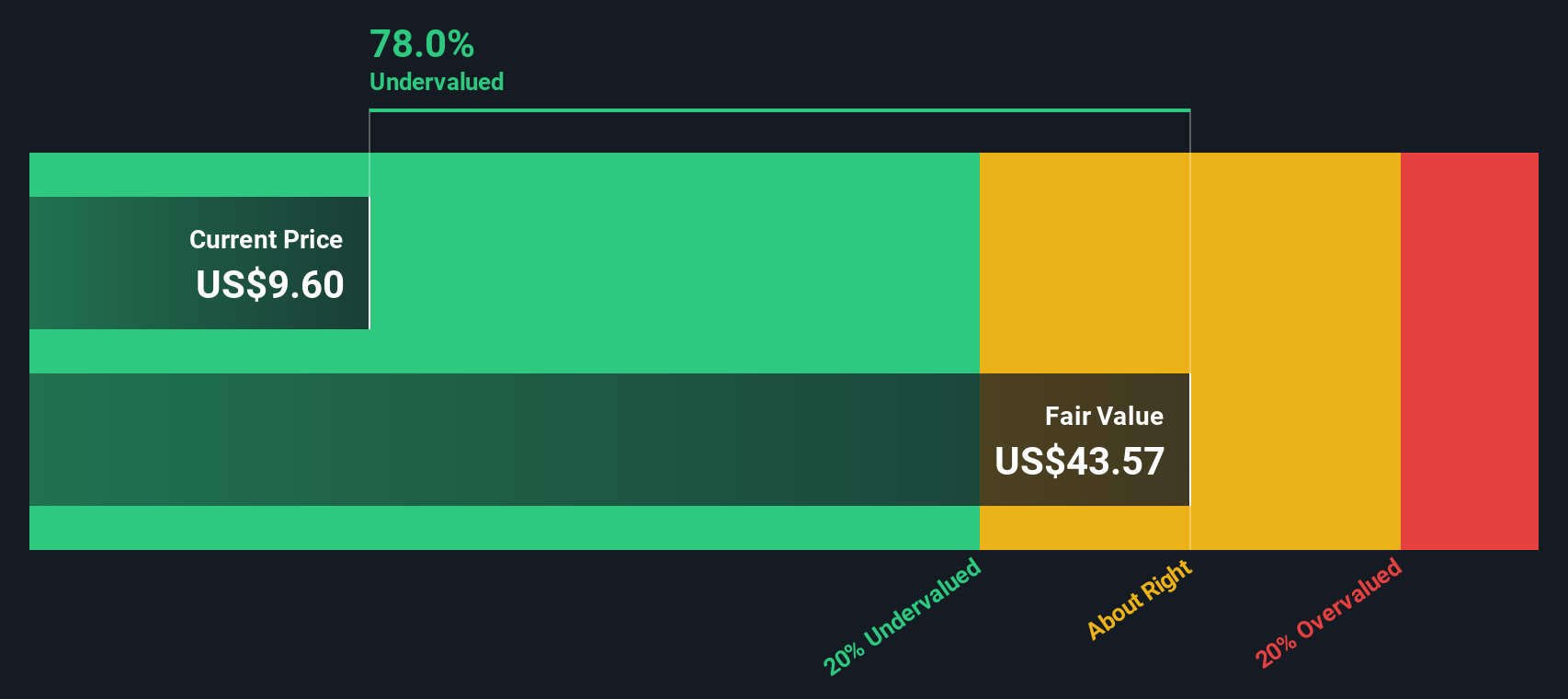

Most Popular Narrative: 43.2% Undervalued

The prevailing narrative puts Lucky Strike Entertainment’s fair value well above its last close, indicating a deep disconnect between analyst targets and market pricing. A significant uplift is required for the stock to meet consensus assumptions, setting high expectations for future performance.

The conversion of Bowlero locations to Lucky Strike, alongside targeted, higher-return marketing spend and refreshed branding, is already showing early signs of comp improvement in key markets and is expected to meaningfully accelerate same-store sales and operating leverage as the transition scales system-wide.

Curious why analysts are betting on a major turnaround? Their valuation hinges on projections of sustained revenue gains and a future profit multiple more often seen in high-growth sectors. What growth levers and bold margin assumptions are shaping this sky-high target? Read the full narrative to uncover the data fueling these expectations.

Result: Fair Value of $13.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent labor cost inflation or growing consumer preference for at-home entertainment could quickly diminish the current optimism around Lucky Strike’s rebound.

Find out about the key risks to this Lucky Strike Entertainment narrative.

Another View: DCF Model Tells a Different Story

While the market sees room for upside based on revenue and earnings projections, the SWS DCF model offers a reality check. It suggests Lucky Strike Entertainment could be overvalued at current prices and raises questions about whether analyst optimism is already reflected in the share price. Could growth fall short of the lofty expectations?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Lucky Strike Entertainment Narrative

If you see things differently or want to dive deeper into the numbers, you can shape your own Lucky Strike Entertainment story in just a few minutes. Do it your way.

A great starting point for your Lucky Strike Entertainment research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know the real edge comes from spotting opportunities before the crowd. Broaden your game plan and see what’s on the radar right now:

- Tap into market momentum by checking out these 927 undervalued stocks based on cash flows that are trading well below their intrinsic value and positioned for growth.

- Capitalize on the AI revolution by selecting these 25 AI penny stocks with breakthrough potential in automation, machine learning, and digital transformation.

- Enhance your returns and secure steady income with these 15 dividend stocks with yields > 3% offering yields over 3% and a track record of rewarding investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LUCK

Lucky Strike Entertainment

Operates location-based entertainment venues in North America.

Moderate growth potential with imperfect balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success