- United States

- /

- Hospitality

- /

- NYSE:LTH

Life Time Group Holdings, Inc.'s (NYSE:LTH) Price In Tune With Revenues

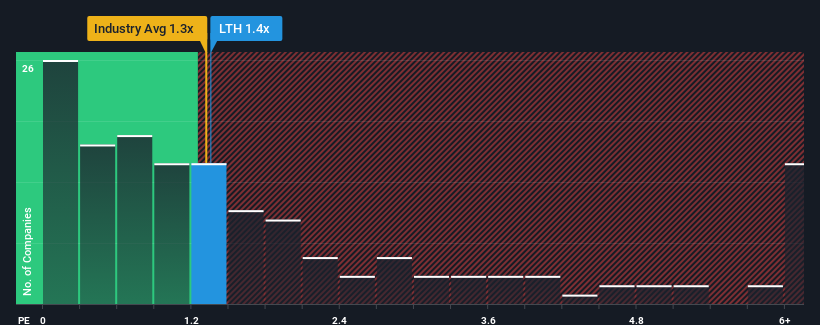

It's not a stretch to say that Life Time Group Holdings, Inc.'s (NYSE:LTH) price-to-sales (or "P/S") ratio of 1.4x right now seems quite "middle-of-the-road" for companies in the Hospitality industry in the United States, where the median P/S ratio is around 1.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Life Time Group Holdings

What Does Life Time Group Holdings' P/S Mean For Shareholders?

Recent times haven't been great for Life Time Group Holdings as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Life Time Group Holdings will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Life Time Group Holdings' to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 25% last year. The strong recent performance means it was also able to grow revenue by 125% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue should grow by 11% per annum over the next three years. That's shaping up to be similar to the 13% each year growth forecast for the broader industry.

In light of this, it's understandable that Life Time Group Holdings' P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've seen that Life Time Group Holdings maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

Having said that, be aware Life Time Group Holdings is showing 2 warning signs in our investment analysis, and 1 of those is a bit unpleasant.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:LTH

Life Time Group Holdings

Provides health, fitness, and wellness experiences to a community of individual members in the United States and Canada.

Solid track record with reasonable growth potential.