- United States

- /

- Consumer Services

- /

- NYSE:HRB

Does H&R Block’s Outperformance and Raised Outlook Reinforce the Bull Case for HRB?

Reviewed by Sasha Jovanovic

- H&R Block recently reported revenues that exceeded analyst expectations and provided full-year revenue guidance above estimates, as announced by its CEO Jeff Jones.

- The company's leadership attributed this performance to ongoing transformation efforts, highlighting strong revenue growth and continued innovation as key drivers of these results.

- We'll now examine how H&R Block's robust revenue performance and positive leadership outlook could influence its long-term investment narrative.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

H&R Block Investment Narrative Recap

To own shares in H&R Block, an investor needs to believe that the company's transformation efforts can offset both ongoing digital disruption and persistent market share losses. The recent earnings beat and raised revenue guidance reflect strength, but these results do not fully resolve the most important near-term risk: intensifying competition from low-cost digital tax services, which continues to weigh on H&R Block's growth outlook. The recent news does not materially change this risk, though positive execution may support the near-term share price.

One recent announcement that ties directly to growth catalysts is H&R Block’s collaboration with OpenAI, aiming to build generative AI tools for its tax professionals. This partnership highlights the company's ongoing investments in technology and innovation, supporting its efforts to compete more effectively against digital-first rivals. As the industry moves further towards automation and hybrid models, developments like this can influence both how quickly H&R Block adapts and the sustainability of its revenue growth.

In contrast, investors should remain aware that even as H&R Block invests in digital innovation, the shift toward fully online tax solutions introduces risks that could...

Read the full narrative on H&R Block (it's free!)

H&R Block's narrative projects $4.1 billion in revenue and $653.0 million in earnings by 2028. This requires 3.0% annual revenue growth and a $46.3 million increase in earnings from $606.7 million today.

Uncover how H&R Block's forecasts yield a $55.00 fair value, a 8% upside to its current price.

Exploring Other Perspectives

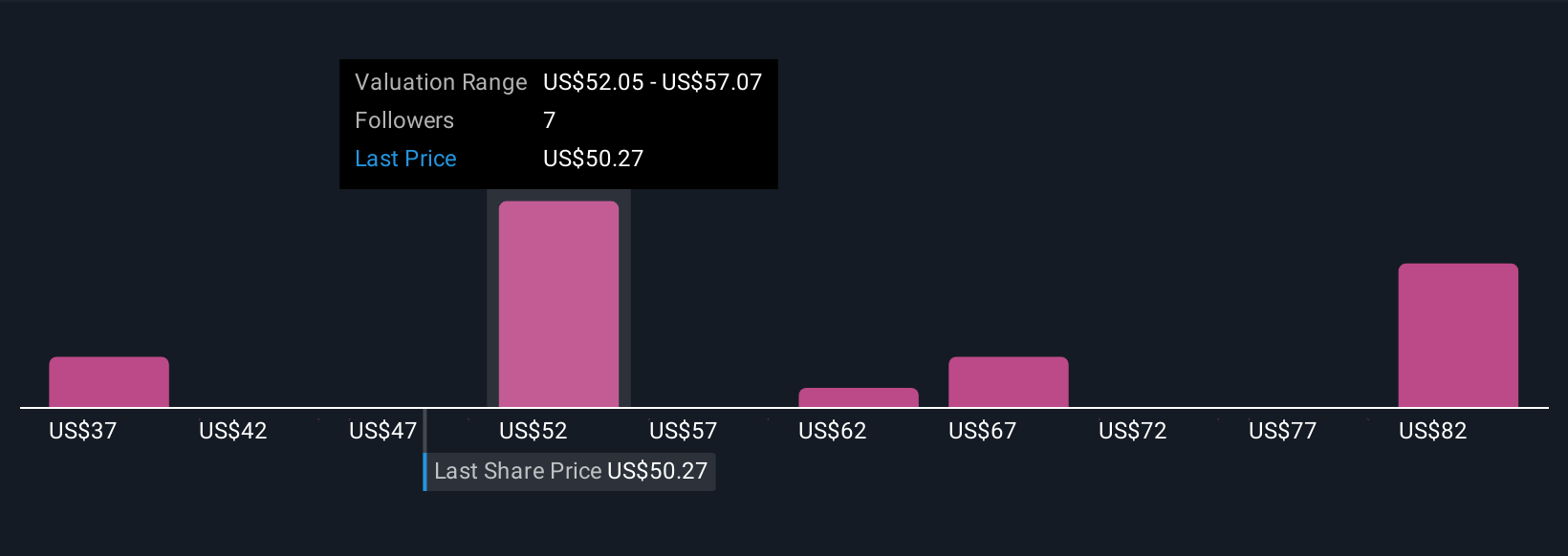

The Simply Wall St Community includes seven unique fair value estimates for H&R Block, spanning a wide range from US$37 to US$89.01 per share. While some see extreme opportunity, others remain cautious as competition from digital-first tax filing is the sector’s current focal point, highlighting how investor views can vary widely and why it pays to consider several alternative viewpoints.

Explore 7 other fair value estimates on H&R Block - why the stock might be worth 28% less than the current price!

Build Your Own H&R Block Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your H&R Block research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free H&R Block research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate H&R Block's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if H&R Block might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HRB

H&R Block

Through its subsidiaries, provides assisted and do-it-yourself (DIY) tax return preparation services in the United States, Canada, and Australia.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives