- United States

- /

- Hospitality

- /

- NYSE:H

Will Hyatt (H) Leverage Debt-Fueled Expansion to Strengthen Its Competitive Position in Mexico?

Reviewed by Sasha Jovanovic

- Earlier this month, Parks Hospitality Holdings and Hyatt Hotels Corporation announced the opening of Hyatt Place Cancun Airport, marking the brand’s debut in Quintana Roo, Mexico, along with details of further expansion and a new fixed-income offering of US$400 million in senior unsecured notes due December 2035.

- This collaboration strengthens Hyatt’s presence in Mexico’s key travel market while the debt issuance could provide fresh capital to support ongoing development initiatives.

- We’ll examine how expectations of lower interest rates, which tend to reduce corporate borrowing costs, could influence Hyatt’s investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Hyatt Hotels Investment Narrative Recap

To be a Hyatt Hotels shareholder, you generally need confidence in the long-term growth of global travel and lodging markets, as well as Hyatt's ability to capitalize on its strong brand pipeline and loyalty program expansion. The recent jump in shares on interest rate optimism may support Hyatt’s near-term borrowing costs, but it does not materially change the key catalyst of international expansion or the primary risk from shifting booking behaviors and demand softness, especially in the U.S. upscale segment.

The most relevant announcement to recent market moves is Hyatt’s successful US$400 million fixed-rate senior unsecured note issuance, due December 2035. This capital raise comes as investors weigh how lower interest rates could improve Hyatt’s financial flexibility, possibly accelerating planned developments and supporting ongoing growth initiatives, though execution on these projects remains a key watchpoint for the stock’s strategic direction.

By contrast, investors should be aware that even as new capital is raised, the underlying risk of weaker U.S. booking trends, especially in the upscale category, remains a critical...

Read the full narrative on Hyatt Hotels (it's free!)

Hyatt Hotels' outlook projects $8.4 billion in revenue and $551.3 million in earnings by 2028. This requires 37.6% annual revenue growth and a $119.3 million earnings increase from $432.0 million currently.

Uncover how Hyatt Hotels' forecasts yield a $164.47 fair value, in line with its current price.

Exploring Other Perspectives

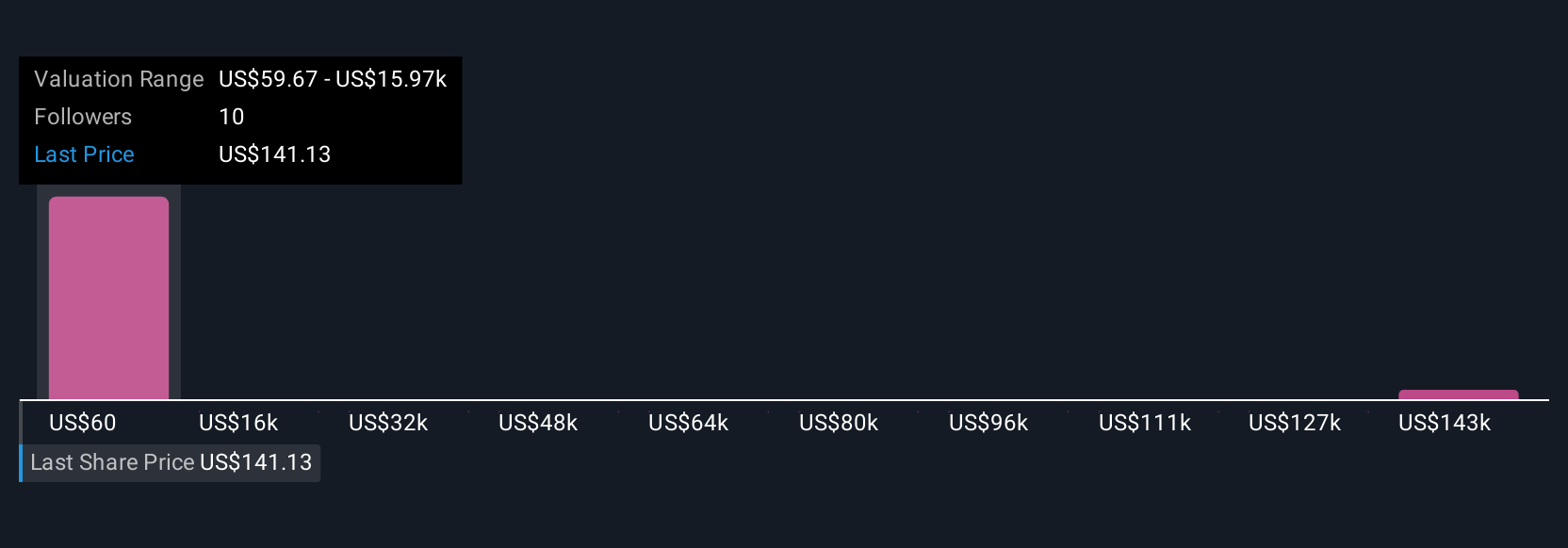

Five Simply Wall St Community members estimate Hyatt’s fair value between US$164 and US$159,128, showing striking differences in outlook. With shifting traveler behavior as a major risk, you can see how opinions can be far apart, consider exploring the full range for broader perspective.

Explore 5 other fair value estimates on Hyatt Hotels - why the stock might be a potential multi-bagger!

Build Your Own Hyatt Hotels Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hyatt Hotels research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Hyatt Hotels research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hyatt Hotels' overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hyatt Hotels might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:H

Hyatt Hotels

Operates as a hospitality company in the United States and internationally.

High growth potential with very low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success