- United States

- /

- Hospitality

- /

- NYSE:H

Hyatt Hotels (H): Assessing Valuation After Recent Share Price Dip

Reviewed by Simply Wall St

Hyatt Hotels (H) shares have trended lower over the past month, with the stock finishing yesterday at $137.41. However, over the longer term, the company’s three-year and five-year total returns remain solidly positive.

See our latest analysis for Hyatt Hotels.

The recent stretch of softer share price returns for Hyatt follows a year where momentum has cooled, with a 1-year total return of -4.86%. Even so, the company’s multi-year gains remain impressive. Its robust long-term performance suggests the recent dip may reflect shifting investor sentiment or short-term market jitters, rather than a fundamental decline.

If you’re thinking about where growth and leadership overlap, now is a great moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

Given the company’s strong historical growth and recent pullback, the key question now is whether Hyatt Hotels is currently undervalued or if the market has already accounted for its future prospects. Is there a buying opportunity here, or are markets fully pricing in what lies ahead?

Most Popular Narrative: 14.5% Undervalued

Hyatt Hotels’ narrative fair value estimate stands at $160.63, comfortably above the latest share price of $137.41. This implies the most closely watched narrative expects notable upside, supported by bullish assumptions about future expansion and profitability.

The strong development pipeline, with approximately 138,000 rooms and several new signings in diverse locations like India, Italy, and the U.S., is likely to drive revenue growth as these new properties come online.

Curious what’s behind this ambitious price target? The narrative leans heavily on bold revenue growth forecasts, shrinking margins, and a profit multiple that will surprise even savvy investors. Want to see which assumptions drive this valuation and if they really add up? Click through to get the full story and all the numbers the analysts are betting on.

Result: Fair Value of $160.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting booking behavior in the U.S. and uncertainty around the Playa acquisition could pose challenges to Hyatt’s optimistic growth outlook in the near term.

Find out about the key risks to this Hyatt Hotels narrative.

Another View: What Do the Ratios Say?

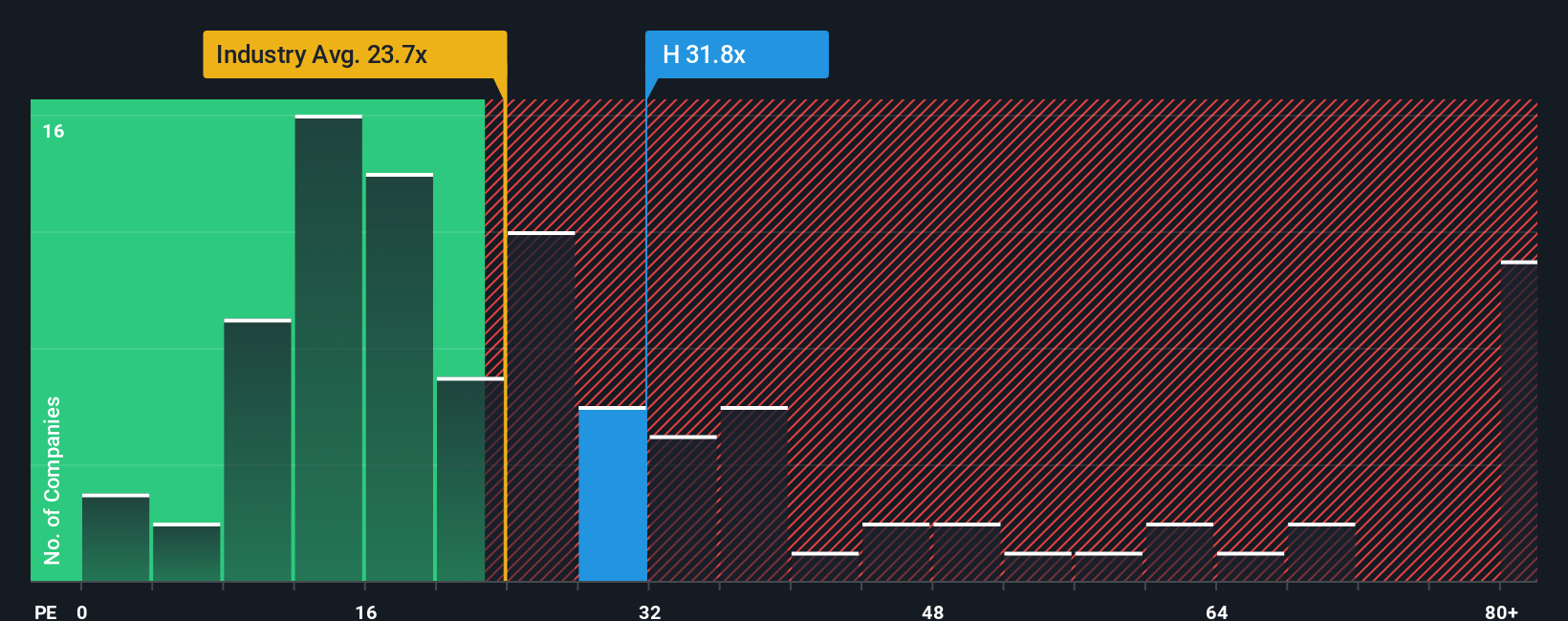

Looking beyond the narrative’s projections, Hyatt Hotels trades at a price-to-earnings ratio of 30.4x. This is well above the US Hospitality industry average of 23.3x, and also higher than the peer group average of 25.6x. Even compared to its own fair ratio of 25.2x, Hyatt still looks pricey.

This sizable premium means investors today are paying up for future growth. Will those expectations be met, or could the market's enthusiasm cool?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hyatt Hotels Narrative

If you want a different perspective or prefer to draw your own conclusions from the numbers, it only takes a few minutes to build your unique narrative. So why not Do it your way?

A great starting point for your Hyatt Hotels research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't let your portfolio miss out on tomorrow’s standouts. Take your next step by zeroing in on companies with potential that others overlook using these smart tools:

- Unlock high-potential value by targeting opportunities in these 836 undervalued stocks based on cash flows, which could be trading below their long-term growth prospects.

- Catch the next wave of innovation by focusing on these 27 AI penny stocks that are poised to benefit from the explosive growth in artificial intelligence.

- Maximize your income strategy by targeting steady returns with these 20 dividend stocks with yields > 3%, offering yields above 3% from established performers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hyatt Hotels might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:H

Hyatt Hotels

Operates as a hospitality company in the United States and internationally.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives