- United States

- /

- Hospitality

- /

- NYSE:H

Hyatt Hotels (H): Assessing Valuation After Q3 Earnings Miss and Expansion Momentum

Reviewed by Simply Wall St

Hyatt Hotels (NYSE:H) shares saw a reaction after the company reported third quarter earnings that missed Wall Street expectations. Revenue and adjusted EPS both came in below consensus, prompting questions around near-term profitability.

See our latest analysis for Hyatt Hotels.

Despite missing on earnings this quarter, Hyatt’s shares have displayed notable short-term momentum, jumping 6% in one day and gaining nearly 14% over the past week. The 1-year total shareholder return is just below flat. The stock still boasts a remarkable 72% three-year total return, which points to strong long-term performance amid ongoing property expansions and loyalty program growth.

If Hyatt’s strategic moves in hospitality piqued your interest, now is a great opportunity to broaden your search and discover fast growing stocks with high insider ownership

The question now is whether Hyatt’s muted near-term profits and recent expansion create an attractive entry point. Alternatively, the market may have already priced in all of the company’s future growth potential, leaving investors with limited upside.

Most Popular Narrative: 3.3% Undervalued

With the narrative fair value at $160.63 and Hyatt Hotels' last close at $155.34, the price is seen as slightly below what analysts believe is justified. This small gap sets up a close call between current market optimism and the narrative's calculated potential.

The sale of Playa's real estate, alongside other owned properties, is anticipated to reduce Hyatt's ownership of hotels. This aligns with its asset-light strategy and could potentially improve net margins by lowering capital expenditure and maintenance costs.

Curious what math gets Hyatt so close to its target? This narrative leans heavily on aggressive growth plans and profit margin shifts. However, the underlying assumptions about future earnings and valuation multiples could surprise you. Ready to see what really moves the needle?

Result: Fair Value of $160.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, short-term shifts in U.S. booking behavior and economic volatility could present challenges to Hyatt's optimistic growth outlook and profitability expectations.

Find out about the key risks to this Hyatt Hotels narrative.

Another View: Valuation Using Sales Ratios

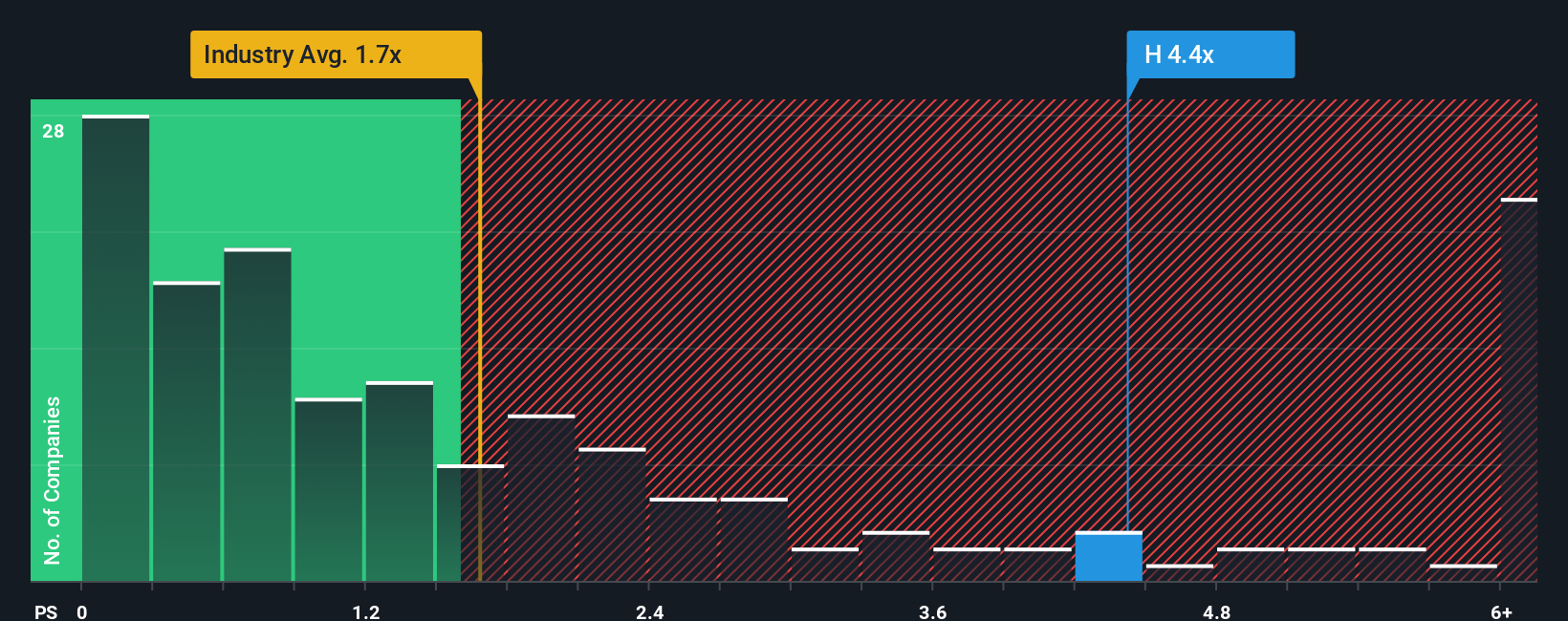

While fair value suggests Hyatt is undervalued, looking at its price-to-sales ratio tells a different story. Hyatt trades at 4.4 times sales, which is well above the industry average of 1.7 and even higher than the peer average of 3.6. The fair ratio is just 3.9. This premium could signal valuation risk if the market shifts, but it might also reflect investor confidence in Hyatt’s future. Is this a warning or an opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hyatt Hotels Narrative

If you think a different story is hiding in the data or want to run your own numbers, it only takes a few minutes to build your own view. Do it your way

A great starting point for your Hyatt Hotels research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investing means never settling for just one opportunity. Use the Simply Wall Street Screener now and get ahead with ideas that others might overlook.

- Capitalize on the explosive growth in artificial intelligence by checking out these 25 AI penny stocks, which are poised to disrupt industries worldwide.

- Boost your passive income strategy with these 16 dividend stocks with yields > 3%, offering attractive yields above 3% and designed for long-term stability and cash flow.

- Step into the future of computing and innovation by exploring these 28 quantum computing stocks, blazing a trail in quantum breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hyatt Hotels might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:H

Hyatt Hotels

Operates as a hospitality company in the United States and internationally.

High growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives