Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that GreenTree Hospitality Group Ltd. (NYSE:GHG) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for GreenTree Hospitality Group

How Much Debt Does GreenTree Hospitality Group Carry?

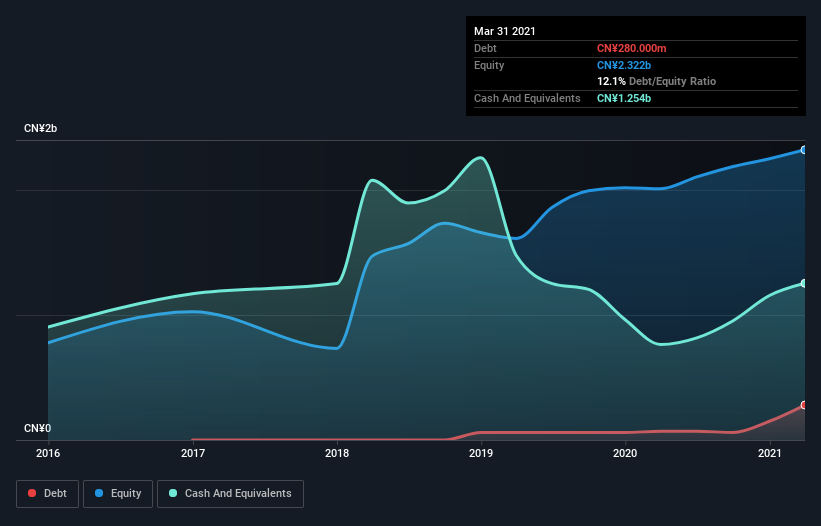

The image below, which you can click on for greater detail, shows that at March 2021 GreenTree Hospitality Group had debt of CN¥280.0m, up from CN¥70.0m in one year. However, its balance sheet shows it holds CN¥1.25b in cash, so it actually has CN¥973.9m net cash.

How Healthy Is GreenTree Hospitality Group's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that GreenTree Hospitality Group had liabilities of CN¥1.03b due within 12 months and liabilities of CN¥979.9m due beyond that. Offsetting these obligations, it had cash of CN¥1.25b as well as receivables valued at CN¥421.1m due within 12 months. So it has liabilities totalling CN¥335.0m more than its cash and near-term receivables, combined.

Of course, GreenTree Hospitality Group has a market capitalization of CN¥6.33b, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. While it does have liabilities worth noting, GreenTree Hospitality Group also has more cash than debt, so we're pretty confident it can manage its debt safely.

But the bad news is that GreenTree Hospitality Group has seen its EBIT plunge 20% in the last twelve months. We think hat kind of performance, if repeated frequently, could well lead to difficulties for the stock. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if GreenTree Hospitality Group can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. GreenTree Hospitality Group may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the most recent three years, GreenTree Hospitality Group recorded free cash flow worth 57% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Summing up

While it is always sensible to look at a company's total liabilities, it is very reassuring that GreenTree Hospitality Group has CN¥973.9m in net cash. So we don't have any problem with GreenTree Hospitality Group's use of debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that GreenTree Hospitality Group is showing 2 warning signs in our investment analysis , you should know about...

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you decide to trade GreenTree Hospitality Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:GHG

GreenTree Hospitality Group

Through its subsidiaries, develops leased-and-operated, and franchised-and-managed hotels and restaurants in the People’s Republic of China.

Adequate balance sheet slight.

Market Insights

Community Narratives