- United States

- /

- Hospitality

- /

- NYSE:GHG

GreenTree Hospitality Group Ltd. Just Missed EPS By 22%: Here's What Analysts Think Will Happen Next

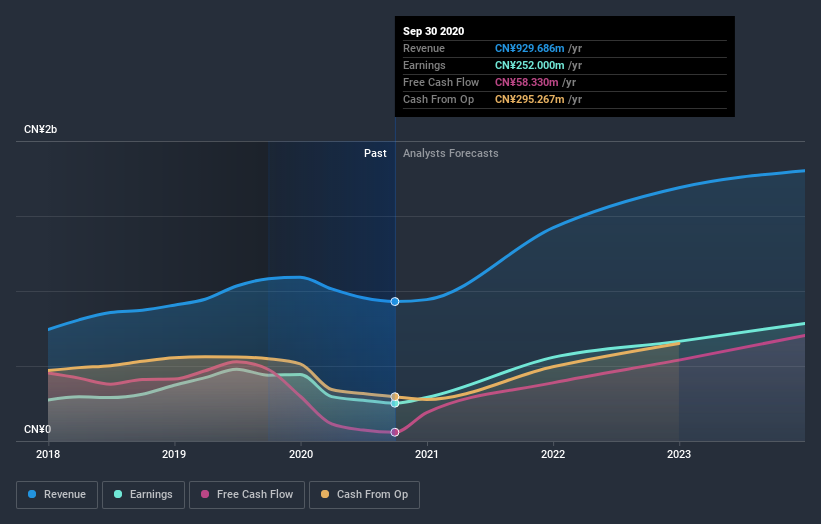

It's been a good week for GreenTree Hospitality Group Ltd. (NYSE:GHG) shareholders, because the company has just released its latest third-quarter results, and the shares gained 3.8% to US$13.13. Statutory earnings per share fell badly short of expectations, coming in at CN¥0.81, some 22% below analyst forecasts, although revenues were okay, approximately in line with analyst estimates at CN¥267m. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

View our latest analysis for GreenTree Hospitality Group

After the latest results, the six analysts covering GreenTree Hospitality Group are now predicting revenues of CN¥1.42b in 2021. If met, this would reflect a sizeable 53% improvement in sales compared to the last 12 months. Per-share earnings are expected to surge 124% to CN¥5.47. Before this earnings report, the analysts had been forecasting revenues of CN¥1.44b and earnings per share (EPS) of CN¥5.68 in 2021. So it looks like there's been a small decline in overall sentiment after the recent results - there's been no major change to revenue estimates, but the analysts did make a minor downgrade to their earnings per share forecasts.

It might be a surprise to learn that the consensus price target was broadly unchanged at CN¥114, with the analysts clearly implying that the forecast decline in earnings is not expected to have much of an impact on valuation. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. The most optimistic GreenTree Hospitality Group analyst has a price target of CN¥20.06 per share, while the most pessimistic values it at CN¥15.20. This is a very narrow spread of estimates, implying either that GreenTree Hospitality Group is an easy company to value, or - more likely - the analysts are relying heavily on some key assumptions.

Of course, another way to look at these forecasts is to place them into context against the industry itself. The analysts are definitely expecting GreenTree Hospitality Group's growth to accelerate, with the forecast 53% growth ranking favourably alongside historical growth of 11% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 23% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect GreenTree Hospitality Group to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. Fortunately, they also reconfirmed their revenue numbers, suggesting sales are tracking in line with expectations - and our data suggests that revenues are expected to grow faster than the wider industry. The consensus price target held steady at CN¥114, with the latest estimates not enough to have an impact on their price targets.

With that in mind, we wouldn't be too quick to come to a conclusion on GreenTree Hospitality Group. Long-term earnings power is much more important than next year's profits. At Simply Wall St, we have a full range of analyst estimates for GreenTree Hospitality Group going out to 2023, and you can see them free on our platform here..

And what about risks? Every company has them, and we've spotted 2 warning signs for GreenTree Hospitality Group you should know about.

If you decide to trade GreenTree Hospitality Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NYSE:GHG

GreenTree Hospitality Group

Through its subsidiaries, develops leased-and-operated, and franchised-and-managed hotels and restaurants in the People’s Republic of China.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026