- United States

- /

- Consumer Services

- /

- NYSE:GHC

How Graham Holdings’ (GHC) $900 Million Debt Restructuring Is Shaping Its Corporate Finance Strategy

Reviewed by Sasha Jovanovic

- Graham Holdings recently completed a US$400 million five-year revolving credit facility and issued US$500 million in senior unsecured notes due 2033, aimed at refinancing existing debt and enhancing financial flexibility.

- This debt restructuring plan replaces upcoming maturities and expands the company’s access to capital on improved financial terms, underscoring a significant shift in its balance sheet management.

- We’ll explore how Graham Holdings’ increased access to flexible funding shapes its future investment narrative and corporate finance trajectory.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Graham Holdings' Investment Narrative?

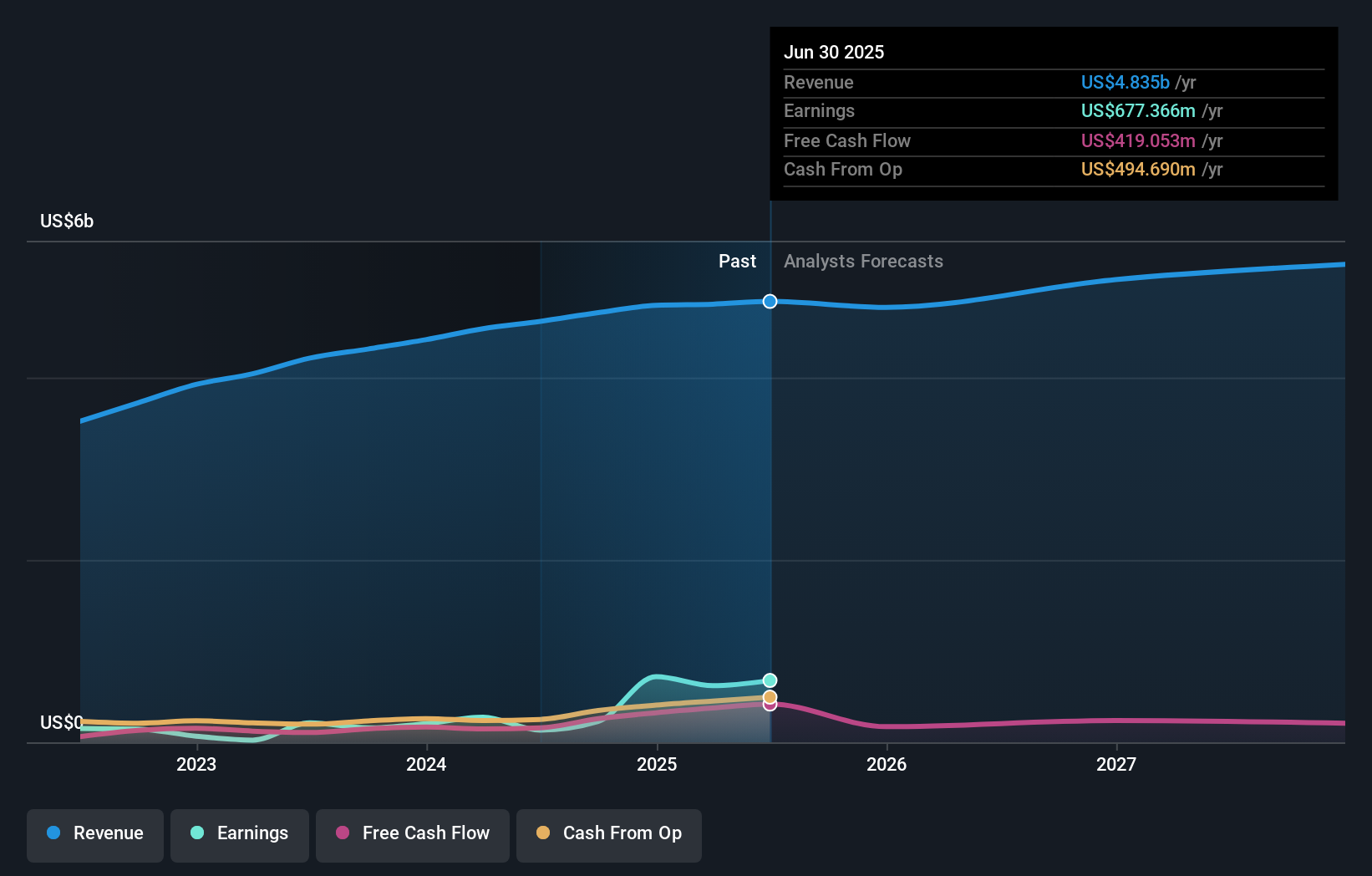

Being a shareholder in Graham Holdings means believing in the company's ability to manage a complex portfolio across media, education, and services with an eye on prudent capital allocation and financial strength. The recently announced US$400 million revolving credit facility and US$500 million in senior notes mark a significant upgrade in liquidity and debt management, and could influence near-term catalysts by providing extra buffer during periods of operational or macro uncertainty. Previously, refinancing risk and balance sheet constraints were seen as key risks to the investment case, these steps largely address those, potentially reducing pressure related to upcoming maturities while giving management more flexibility for organic or acquisitive growth. However, the business still faces familiar risks like potential impairments, market volatility in core segments, and variable free cash generation. The new financing adds stability, but profit sustainability and operational efficiency are still crucial drivers for shareholder value. On the other hand, Graham Holdings’ exposure to impairment charges remains a risk worth paying close attention to.

Graham Holdings' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 2 other fair value estimates on Graham Holdings - why the stock might be worth 13% less than the current price!

Build Your Own Graham Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Graham Holdings research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Graham Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Graham Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GHC

Graham Holdings

Through its subsidiaries, operates as a diversified holding company in the United States and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.