- United States

- /

- Consumer Services

- /

- NYSE:GHC

Did Graham Holdings’ (GHC) $500 Million Debt Move Just Reshape Its Investment Outlook?

Reviewed by Sasha Jovanovic

- Graham Holdings Company recently announced its intention to offer US$500 million in senior unsecured notes due 2033, with plans to concurrently amend and increase its revolving credit facility to US$400 million.

- This initiative is aimed at refinancing existing debt and demonstrates the company’s focus on actively managing its capital structure for potential flexibility and efficiency improvements.

- We’ll explore how Graham Holdings’ capital restructuring, particularly the new notes offering, shapes the company’s broader investment outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Graham Holdings' Investment Narrative?

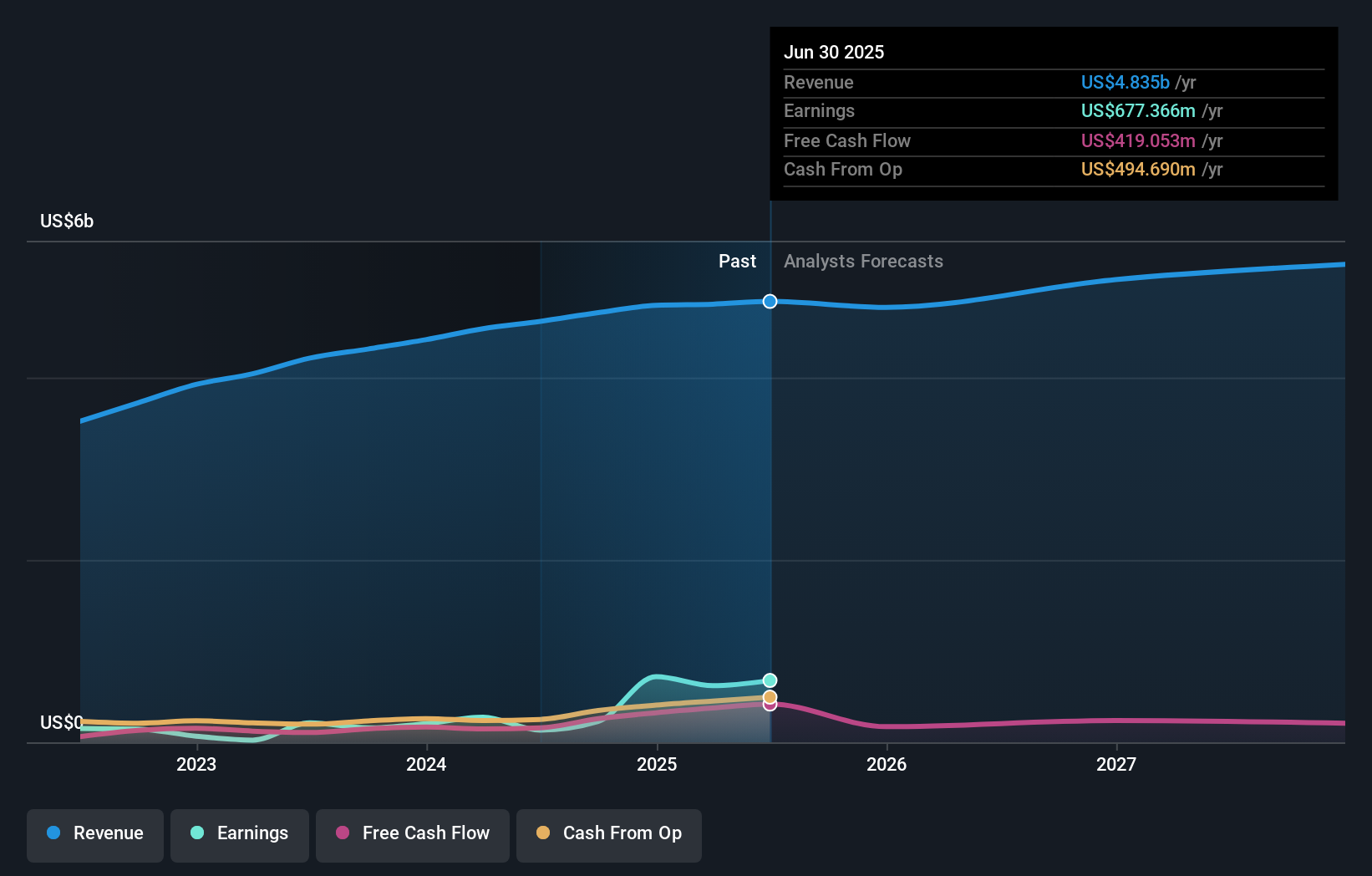

To be a shareholder in Graham Holdings, you need to be comfortable with a company that is both actively managing its capital structure and consistently rewarding shareholders with significant dividends. The recent announcement to issue US$500 million in new notes and increase the revolving credit facility to US$400 million signals a shift to longer-term, potentially lower-cost debt, directly addressing short-term refinancing needs and supporting ongoing operational flexibility. This refinancing could reduce near-term interest costs and free up capital for future M&A activities, which management has previously signaled is a focus for expansion. However, while the move enhances balance sheet resilience, it also exposes the company to execution risks around integrating acquisitions and maintaining profitability if macroeconomic conditions shift. Overall, this financing doesn’t materially alter the primary catalysts, but it does reduce immediate refinancing risk. Yet, debt restructuring introduces pressures that could affect future growth strategies, something investors need to watch closely.

Graham Holdings' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 2 other fair value estimates on Graham Holdings - why the stock might be worth as much as $1071!

Build Your Own Graham Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Graham Holdings research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Graham Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Graham Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GHC

Graham Holdings

Through its subsidiaries, operates as a diversified holding company in the United States and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives