- United States

- /

- Hospitality

- /

- NYSE:GENI

A Fresh Look at Genius Sports (GENI) Valuation Following Raised Revenue Outlook and Strong Q3 Growth

Reviewed by Simply Wall St

Genius Sports (NYSE:GENI) announced a jump in third quarter revenue and at the same time increased its full year outlook, now targeting group revenue of around $655 million. This means 28% growth over last year.

See our latest analysis for Genius Sports.

Despite Genius Sports posting a quarterly net loss, the combination of robust revenue growth and a newly raised guidance has kept the narrative positive. Recent weeks have seen some short-term volatility, with a 1-day share price return of -7.27% and a 7-day return of -8.84%. However, the bigger picture points to traction building. The shares are up 20.12% year-to-date, and the total shareholder return stands at an impressive 31.91% for the past year and 125.39% over three years. Momentum appears to be shifting in response to the company’s sustained revenue gains and improving longer-term outlook.

If you're looking to spot the next movers in the tech and sports data world, it's a great moment to check out See the full list for free.

With shares still trading at a discount to analyst price targets and revenue momentum continuing, the key question becomes whether Genius Sports is genuinely undervalued or if the market now fully reflects its future growth prospects.

Most Popular Narrative: 30.8% Undervalued

The most widely followed narrative indicates that Genius Sports could be valued much higher than yesterday’s $10.21 close, with a fair value pegged at $14.76. Investors are watching to see if robust commercial wins and future margin expansion unlock this significant upside.

Ongoing expansion of global sports betting legalization and regulation, particularly in large markets like the U.S., Europe, Brazil and other emerging regions, is increasing the addressable market for official sports data and media platforms. This positions Genius Sports for durable multi-year revenue growth and geographic diversification.

Want to know what’s fueling this bold target? The real story comes from blockbuster growth forecasts and standout profit margins. These are numbers that would surprise even seasoned market watchers. Curious which projections set Genius Sports apart from its peers? Unlock the full narrative to see the blueprints behind this valuation.

Result: Fair Value of $14.76 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on exclusive sports data rights and increasing competition from established tech firms could present challenges to Genius Sports’ future growth trajectory.

Find out about the key risks to this Genius Sports narrative.

Another View: What Do the Multiples Say?

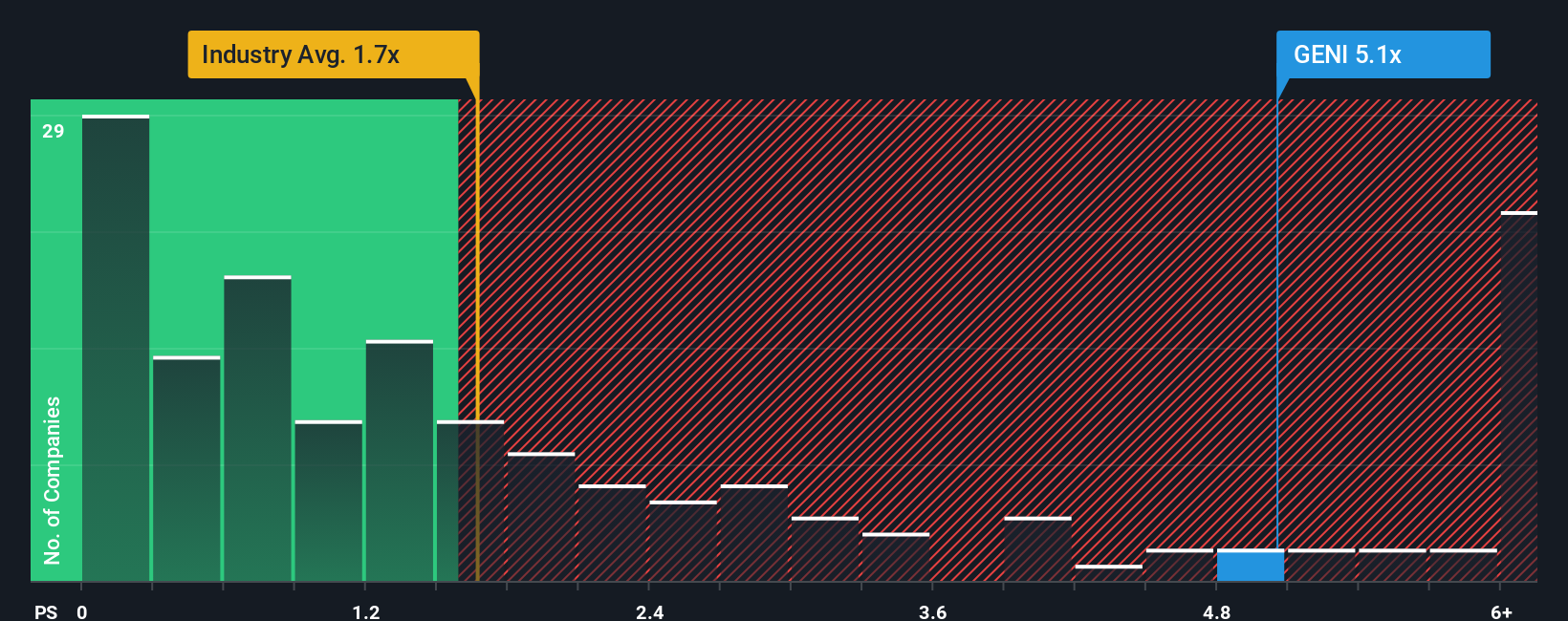

While fair value estimates suggest Genius Sports may be undervalued, looking at pricing multiples paints a different picture. The company trades at a price-to-sales ratio of 4x, which is much higher than both the US Hospitality industry average of 1.6x and its peer group average of 1.2x. That means the market is already pricing in strong growth and optimism. However, this premium could either signal greater risk if expectations are missed or reflect a sign of deserved leadership.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Genius Sports Narrative

If you see the story differently or want a fresh perspective, you have the tools to dive into the numbers and build your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Genius Sports.

Looking for More Investment Opportunities?

Take charge of your financial future by targeting stocks with breakout potential, high-yield payouts, or next-generation technology. You're missing out if you stick to the usual names. Let these tailored picks show you what else is out there.

- Capitalize on strong income streams when you check out these 17 dividend stocks with yields > 3% offering yields above 3% and a track record of dependable returns.

- Find trailblazers in artificial intelligence by sizing up these 25 AI penny stocks transforming industries with innovative applications and sector-leading growth.

- Jump on overlooked value with these 849 undervalued stocks based on cash flows based on solid cash flows and proven fundamentals in today’s rapidly shifting market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GENI

Genius Sports

Engages in the development and sale of technology-led products and services to the sports, sports betting, and sports media industries.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives