- United States

- /

- Hospitality

- /

- NYSE:FLUT

Do Shifting Shareholders and Regulatory Hurdles Signal a Turning Point for Flutter (FLUT)?

Reviewed by Sasha Jovanovic

- In recent weeks, Flutter Entertainment plc was the subject of an analyst downgrade citing concerns about regulatory and tax risks alongside a review of its equity incentive schemes and buyback activities. A significant increase in shareholding by Candle Lake Limited and board committee appointments also highlight shifting dynamics in both governance and ownership structure.

- This combination of regulatory caution among analysts and evolving shareholder interests reveals underlying uncertainty about Flutter's future risk profile and growth prospects.

- With analysts citing regulatory and tax headwinds, we'll examine how these concerns may affect Flutter's long-term investment narrative.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Flutter Entertainment Investment Narrative Recap

Flutter Entertainment’s investment case turns on continued growth in regulated online gaming, margin expansion via integration synergies, and disciplined capital returns, while absorbing unpredictable regulatory and tax shifts, particularly in core US markets. The latest analyst downgrades signal increased caution around these external risks, but the announced governance and shareholder changes have little direct bearing on near-term profit catalysts, which remain most sensitive to ongoing US regulatory outcomes and cost control.

Among recent developments, the disclosure that Candle Lake Limited has raised its ownership stake to over 10% stands out. This move points to heightened shareholder engagement at a time when the share buyback program is underway and management is focused on operational efficiency, both key to supporting short-term value amid period market uncertainty.

Yet, in contrast to buyback activity and block listings, investors should pay close attention to emerging regulatory and tax risks that could shape...

Read the full narrative on Flutter Entertainment (it's free!)

Flutter Entertainment's outlook anticipates $23.5 billion in revenue and $2.5 billion in earnings by 2028. This scenario assumes 16.4% annual revenue growth and an earnings increase of $2.13 billion from current earnings of $366 million.

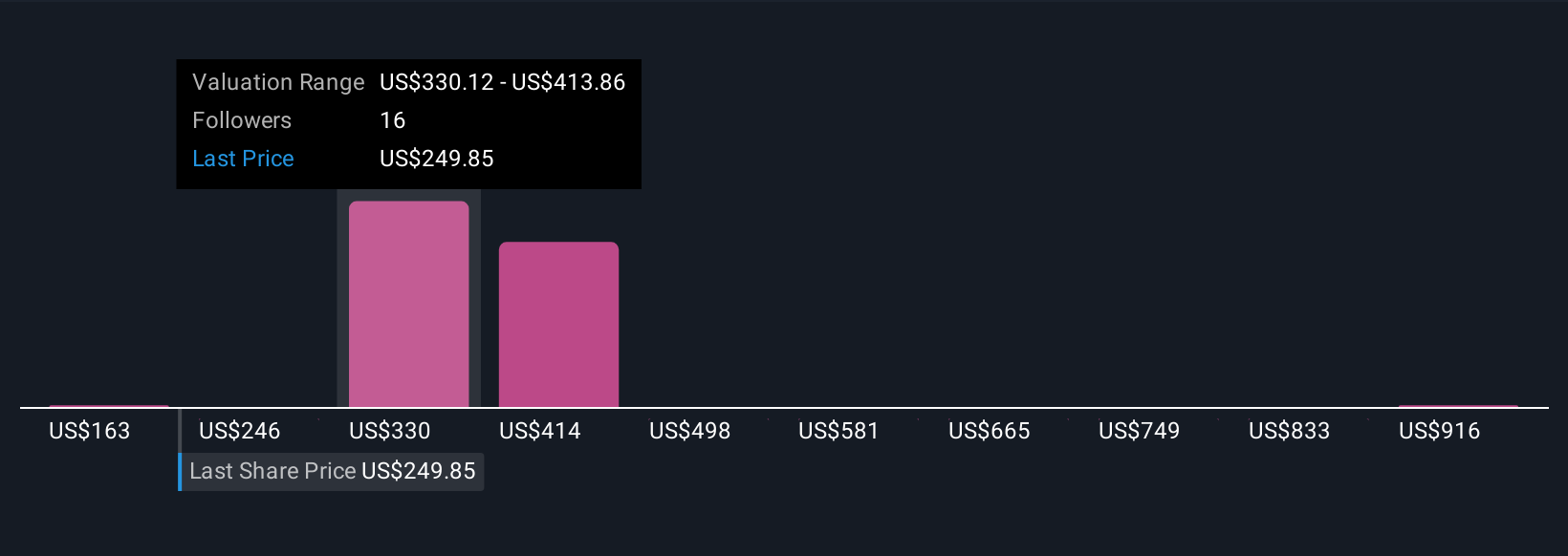

Uncover how Flutter Entertainment's forecasts yield a $330.80 fair value, a 43% upside to its current price.

Exploring Other Perspectives

Seven distinct fair value estimates on Flutter Entertainment from the Simply Wall St Community range widely from US$162.65 to US$1,000 per share. With regulatory headwinds front of mind for many, these views underline how differently investors may weigh long-term growth potential versus present-day risks.

Explore 7 other fair value estimates on Flutter Entertainment - why the stock might be worth 30% less than the current price!

Build Your Own Flutter Entertainment Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Flutter Entertainment research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Flutter Entertainment research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Flutter Entertainment's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 38 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FLUT

Flutter Entertainment

Operates as a sports betting and gaming company in the United States, the United Kingdom, Ireland, Australia, Italy, and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives